Alaska Corporation Net Income Tax Return Short Form 60200101

What is the Alaska Corporation Net Income Tax Return – Short Form 60200101

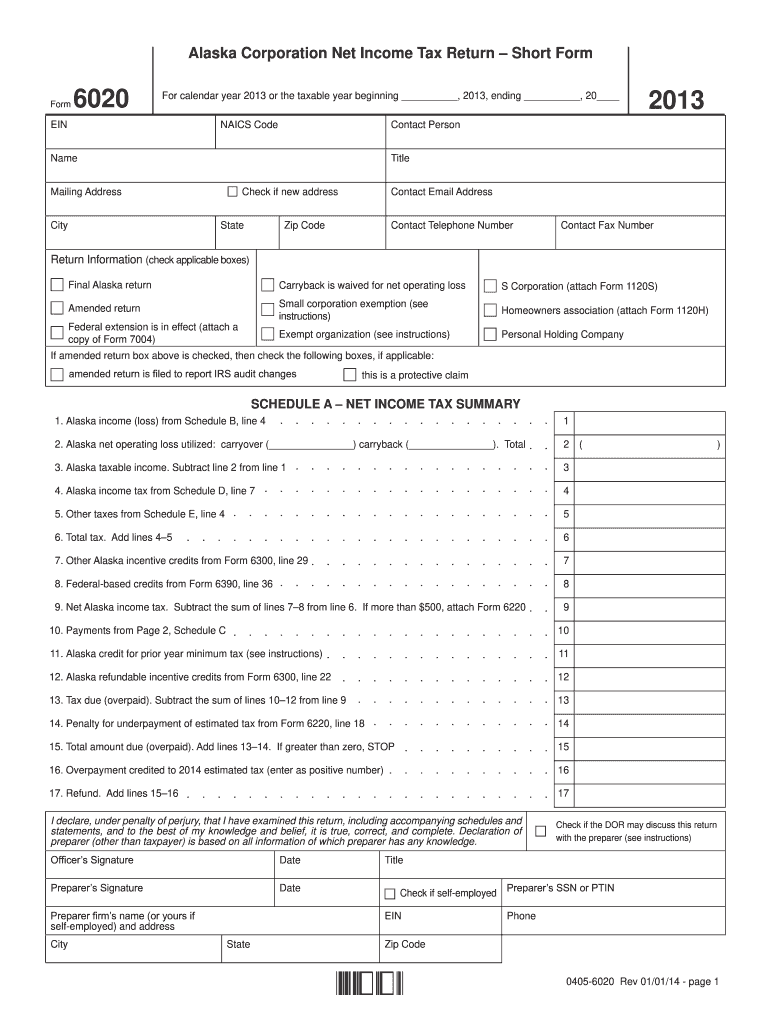

The Alaska Corporation Net Income Tax Return – Short Form 60200101 is a tax document specifically designed for corporations operating in Alaska. This form allows eligible corporations to report their net income to the state of Alaska. It simplifies the filing process for smaller corporations or those with less complex financial situations, ensuring compliance with state tax regulations. By using this short form, corporations can efficiently fulfill their tax obligations while minimizing the administrative burden associated with more extensive tax returns.

Steps to complete the Alaska Corporation Net Income Tax Return – Short Form 60200101

Completing the Alaska Corporation Net Income Tax Return – Short Form 60200101 involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Calculate the total net income for the tax year, ensuring all income and allowable deductions are accurately reported.

- Fill out the form, ensuring all sections are completed, including the identification of the corporation and financial details.

- Review the form for accuracy and completeness to avoid potential penalties.

- Sign and date the form, confirming that the information provided is true and correct.

Legal use of the Alaska Corporation Net Income Tax Return – Short Form 60200101

The legal use of the Alaska Corporation Net Income Tax Return – Short Form 60200101 is crucial for ensuring compliance with state tax laws. This form must be submitted by the designated deadline to avoid penalties. When completed correctly, it serves as a legally binding document that reflects the corporation's financial status. The signatures on the form must comply with eSignature regulations to ensure that the submission is valid and enforceable. Utilizing a reliable digital platform can enhance the legal standing of the completed form.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Corporation Net Income Tax Return – Short Form 60200101 are typically aligned with the end of the corporation's fiscal year. Corporations must file their returns by the 15th day of the fourth month following the end of their tax year. It is essential for corporations to be aware of these dates to ensure timely submission and avoid late fees. Additionally, extensions may be available, but they require proper filing to be considered valid.

Required Documents

To successfully complete the Alaska Corporation Net Income Tax Return – Short Form 60200101, corporations need to gather several required documents:

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits claimed.

- Previous tax returns, if applicable, for reference.

- Identification details of the corporation, including the federal Employer Identification Number (EIN).

Form Submission Methods (Online / Mail / In-Person)

The Alaska Corporation Net Income Tax Return – Short Form 60200101 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many corporations opt to file electronically through approved platforms, which can streamline the process and reduce processing times.

- Mail Submission: Corporations can print the completed form and send it via postal service to the appropriate state tax authority.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at designated tax offices is also an option.

Quick guide on how to complete alaska corporation net income tax return short form 60200101

Effortlessly prepare Alaska Corporation Net Income Tax Return Short Form 60200101 on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, since you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without delays. Handle Alaska Corporation Net Income Tax Return Short Form 60200101 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and electronically sign Alaska Corporation Net Income Tax Return Short Form 60200101 with ease

- Obtain Alaska Corporation Net Income Tax Return Short Form 60200101 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Alaska Corporation Net Income Tax Return Short Form 60200101 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Alaska Corporation Net Income Tax Return – Short Form 60200101?

The Alaska Corporation Net Income Tax Return – Short Form 60200101 is a simplified tax return form designed for small corporations in Alaska. It allows businesses to report their income and calculate their tax liability efficiently. This form is specifically tailored to meet the needs of eligible corporations, streamlining the filing process.

-

Who should use the Alaska Corporation Net Income Tax Return – Short Form 60200101?

The Alaska Corporation Net Income Tax Return – Short Form 60200101 should be used by small corporations operating in Alaska that meet specific criteria set by the state. It is ideal for businesses with a straightforward income structure, allowing them to file their taxes without unnecessary complexity. Reviewing the eligibility requirements is crucial to ensure compliance.

-

How can airSlate SignNow help with the Alaska Corporation Net Income Tax Return – Short Form 60200101?

AirSlate SignNow provides a cost-effective digital solution to manage, send, and eSign the Alaska Corporation Net Income Tax Return – Short Form 60200101 documents effortlessly. With its intuitive interface, businesses can complete and submit tax forms securely and efficiently. This helps save time and reduce paperwork, ensuring a smooth filing process.

-

What are the key features of airSlate SignNow for tax document management?

AirSlate SignNow offers features such as customizable templates, secure eSigning, real-time document tracking, and integrations with various applications. These functionalities allow businesses to easily manage the Alaska Corporation Net Income Tax Return – Short Form 60200101 and other important documents. The platform enhances productivity, ensuring that all tax-related paperwork is organized and easily accessible.

-

What does it cost to use airSlate SignNow for filing my corporate taxes?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, which can help save on costs when filing the Alaska Corporation Net Income Tax Return – Short Form 60200101. Depending on the features required, businesses can choose from various subscription options, ensuring they only pay for what they need. Additionally, utilizing this platform may reduce other indirect costs such as paper and postage.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow ensures high-level security for handling sensitive documents, including the Alaska Corporation Net Income Tax Return – Short Form 60200101. The platform employs encryption, secure access controls, and compliance with industry standards to protect your data. Users can confidently send and sign their tax documents without compromising security.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers integrations with various accounting software solutions, streamlining the process of managing your Alaska Corporation Net Income Tax Return – Short Form 60200101 and other financial documents. This seamless integration allows for easier data transfer and improved efficiency. Check the list of available integrations on the website to find compatible options.

Get more for Alaska Corporation Net Income Tax Return Short Form 60200101

Find out other Alaska Corporation Net Income Tax Return Short Form 60200101

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast