California Forms 593 C, 593 L, and Instructions Form 593 C, Real Estate Withholding Certificate for Individual Sellers and Form

Understanding the California Forms 593 C and 593 L

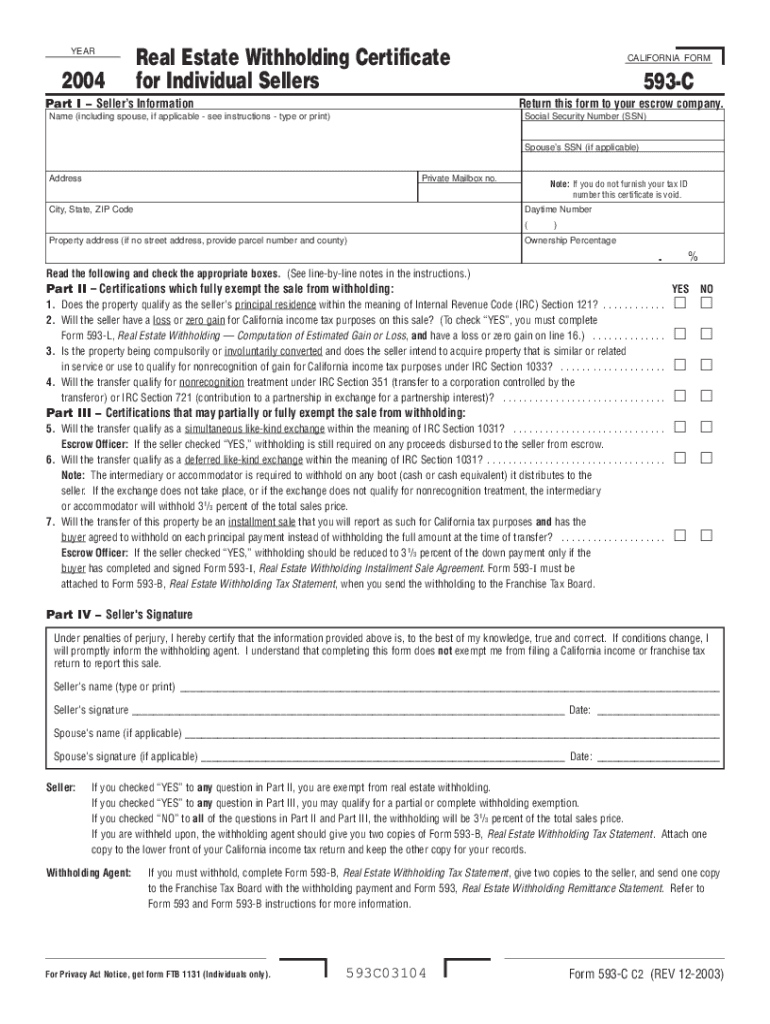

The California Forms 593 C and 593 L are essential documents for real estate transactions involving individual sellers. Form 593 C, known as the Real Estate Withholding Certificate, is used to report the withholding of a portion of the sales proceeds for tax purposes. Form 593 L, the Real Estate Withholding Computation of Estimated Gain or Loss, helps sellers calculate their potential gain or loss from the sale. Both forms are crucial for ensuring compliance with California tax regulations during real estate sales.

Steps to Complete the California Forms 593 C and 593 L

Completing the California Forms 593 C and 593 L involves several key steps:

- Gather necessary information about the property and the seller.

- Fill out Form 593 C with details such as the seller's name, address, and the sale amount.

- Use Form 593 L to calculate the estimated gain or loss from the sale.

- Ensure all information is accurate to avoid delays in processing.

- Submit both forms to the appropriate tax authority as part of the real estate transaction.

Legal Use of the California Forms 593 C and 593 L

The legal use of Forms 593 C and 593 L is governed by California tax laws. These forms must be accurately completed and submitted to ensure that the withholding tax is properly calculated and remitted. Failure to comply with these requirements can lead to penalties, making it essential for sellers to understand their obligations under California law.

Filing Deadlines for the California Forms 593 C and 593 L

It is important to be aware of the filing deadlines associated with Forms 593 C and 593 L. Typically, these forms must be submitted at the time of the property sale or shortly thereafter. Missing these deadlines can result in additional penalties or complications with tax filings. Sellers should consult the California Franchise Tax Board for specific dates relevant to their transactions.

Required Documents for Completing the California Forms 593 C and 593 L

To complete the California Forms 593 C and 593 L, sellers need to gather several documents, including:

- Property sale agreement or contract.

- Proof of ownership, such as a deed.

- Tax identification numbers for both the seller and the buyer.

- Any prior tax documents related to the property.

Examples of Using the California Forms 593 C and 593 L

Consider a scenario where an individual sells a residential property in California. The seller must complete Form 593 C to report the withholding tax on the sale proceeds. They will also use Form 593 L to determine their estimated gain or loss, which will inform their overall tax liability. Accurate completion of these forms ensures compliance and helps avoid potential tax issues.

Quick guide on how to complete 2004 california forms 593 c 593 l and instructions form 593 c real estate withholding certificate for individual sellers and

Complete California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form effortlessly on any device

Web-based document administration has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without holdups. Manage California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form effortlessly

- Find California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the real estate withholding form CA and why is it important?

The real estate withholding form CA is a document required by the California Franchise Tax Board to ensure that non-residents comply with state tax regulations when selling property. It helps streamline tax withholding and ensures that sellers meet their tax obligations. Understanding this form is crucial for any real estate transaction in California.

-

How can airSlate SignNow assist with the real estate withholding form CA?

airSlate SignNow simplifies the process of completing and eSigning the real estate withholding form CA by providing an easy-to-use platform. You can fill out the form digitally, reducing the chances of errors and ensuring all necessary information is included. This efficient process saves time and enhances compliance.

-

Are there any costs associated with using airSlate SignNow for the real estate withholding form CA?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans include features for managing the real estate withholding form CA along with other document management tools. You can choose a plan that fits your budget while gaining access to an efficient eSignature solution.

-

What are the key features of airSlate SignNow related to the real estate withholding form CA?

airSlate SignNow provides robust features such as document templates, eSigning, and secure storage that are ideal for managing the real estate withholding form CA. Users can easily create, send, and track documents, ensuring a seamless experience throughout the transaction process. The platform also supports multiple document formats.

-

Can I integrate airSlate SignNow with other software for managing the real estate withholding form CA?

Yes, airSlate SignNow offers integrations with various applications commonly used in real estate transactions. This ensures that you can seamlessly manage the real estate withholding form CA alongside your existing tools, enhancing workflow efficiency. Popular integrations include CRM, file storage, and project management software.

-

Is airSlate SignNow secure for handling sensitive documents like the real estate withholding form CA?

Absolutely. airSlate SignNow implements advanced security measures to protect sensitive documents, including the real estate withholding form CA. Features like encryption, secure access, and compliance with industry-standard regulations ensure that your information is safe and confidential.

-

What are the benefits of using airSlate SignNow for real estate professionals dealing with the withholding form CA?

For real estate professionals, airSlate SignNow streamlines the management of the real estate withholding form CA, saving time and reducing paperwork. The platform enhances collaboration with clients through easy eSigning and provides tracking features to monitor document status. This leads to increased efficiency and improved client satisfaction.

Get more for California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form

Find out other California Forms 593 C, 593 L, And Instructions Form 593 C, Real Estate Withholding Certificate For Individual Sellers And Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement