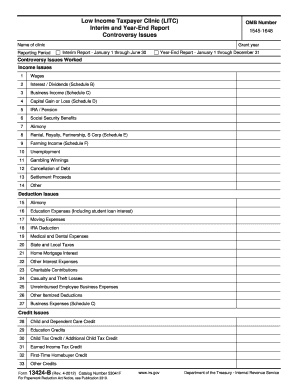

Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim and Year End Report Controversy Issues Irs 2012

Understanding the Form 13424 B Rev 4 for Low Income Taxpayer Clinics

The Form 13424 B Rev 4 is essential for Low Income Taxpayer Clinics (LITCs) in the United States. This form serves as an interim and year-end report that addresses various controversy issues related to the IRS. It is designed to help clinics document their activities, funding, and the services they provide to low-income taxpayers. By accurately completing this form, clinics can ensure they meet the IRS requirements and continue to receive funding and support.

Steps to Complete the Form 13424 B Rev 4

Completing the Form 13424 B Rev 4 involves several key steps:

- Gather necessary information, including clinic activities, client demographics, and financial data.

- Carefully fill out each section of the form, ensuring all data is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to ensure compliance with IRS regulations.

Legal Use of the Form 13424 B Rev 4

The legal validity of the Form 13424 B Rev 4 hinges on adherence to IRS guidelines. This form must be filled out truthfully and accurately to reflect the operations of the LITC. Compliance with federal regulations is crucial, as inaccuracies may lead to penalties or loss of funding. Utilizing electronic signature solutions can enhance the legitimacy of the form, ensuring that all signatures meet legal standards.

Obtaining the Form 13424 B Rev 4

The Form 13424 B Rev 4 can be obtained directly from the IRS website or through authorized tax assistance organizations. Clinics should ensure they are using the most current version of the form to avoid any compliance issues. It is advisable to regularly check for updates or revisions to the form to stay informed about any changes in reporting requirements.

IRS Guidelines for Form 13424 B Rev 4

The IRS provides specific guidelines for completing and submitting the Form 13424 B Rev 4. These guidelines outline the information required, the format for submission, and the deadlines for reporting. It is essential for LITCs to familiarize themselves with these guidelines to ensure proper compliance and to avoid any potential issues with the IRS.

Filing Deadlines for Form 13424 B Rev 4

Filing deadlines for the Form 13424 B Rev 4 are critical for maintaining compliance with IRS requirements. Typically, the interim report is due mid-year, while the year-end report must be submitted by a specified date at the end of the fiscal year. Clinics should mark these deadlines on their calendars to ensure timely submission and avoid penalties.

Quick guide on how to complete form 13424 b rev 4 2012 low income taxpayer clinic litc interim and year end report controversy issues irs

Effortlessly prepare Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs on any device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs seamlessly

- Obtain Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13424 b rev 4 2012 low income taxpayer clinic litc interim and year end report controversy issues irs

Create this form in 5 minutes!

People also ask

-

What is the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs?

The Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs is a crucial document required by the IRS for reporting activities and issues related to low-income taxpayer assistance. This form helps clinics outline their efforts and challenges faced in providing guidance to taxpayers, ensuring transparency and accountability.

-

How can airSlate SignNow assist with the completion of the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report?

airSlate SignNow provides a streamlined process to complete and eSign the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs. Our platform allows users to fill out the form electronically, ensuring accuracy and saving time in the submission process.

-

What are the pricing options for using airSlate SignNow for Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC reporting?

airSlate SignNow offers competitive pricing plans that cater to different needs, ranging from basic features for individual use to comprehensive packages for organizations. Users can choose a plan that fits their budget while ensuring they have the necessary tools to manage their Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs efficiently.

-

What features does airSlate SignNow offer to help with the Form 13424 B Rev 4 submission process?

Key features of airSlate SignNow include document templates, eSigning capabilities, and cloud storage, making it easy to manage the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs. These tools are designed to enhance workflow and ensure that your reports are submitted accurately and on time.

-

What benefits can users expect when using airSlate SignNow for IRS-related documents like Form 13424 B Rev 4?

By using airSlate SignNow for documents such as the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs, users can experience faster processing times, reduced paperwork, and improved organization of important files. Our solution simplifies the signing process while maintaining compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for managing Form 13424 B Rev 4?

Yes, airSlate SignNow offers integrations with various business applications, which enables users to manage the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs seamlessly alongside their existing workflows. This flexibility helps users enhance productivity and maintain a structured approach to handling IRS documentation.

-

How secure is the information shared while preparing Form 13424 B Rev 4 through airSlate SignNow?

airSlate SignNow prioritizes the security of user data, employing advanced encryption and security protocols to protect information related to the Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs. Users can trust that their sensitive information remains confidential throughout the entire process.

Get more for Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs

- Vendor form belize

- Fo1 form sindh pdf

- Alabama power bill template form

- Weiss functional impairment rating scale online form

- Networks worksheet answer key form

- Iee checklist sworn statement form

- Security deposit disposition form 39663145

- Cost plus agreement greater atlanta home builders association form

Find out other Form 13424 B Rev 4 Low Income Taxpayer Clinic LITC Interim And Year End Report Controversy Issues Irs

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement