Federal Form 13424 Low Income Taxpayer Clinic LITC Application 2016-2026

What is the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

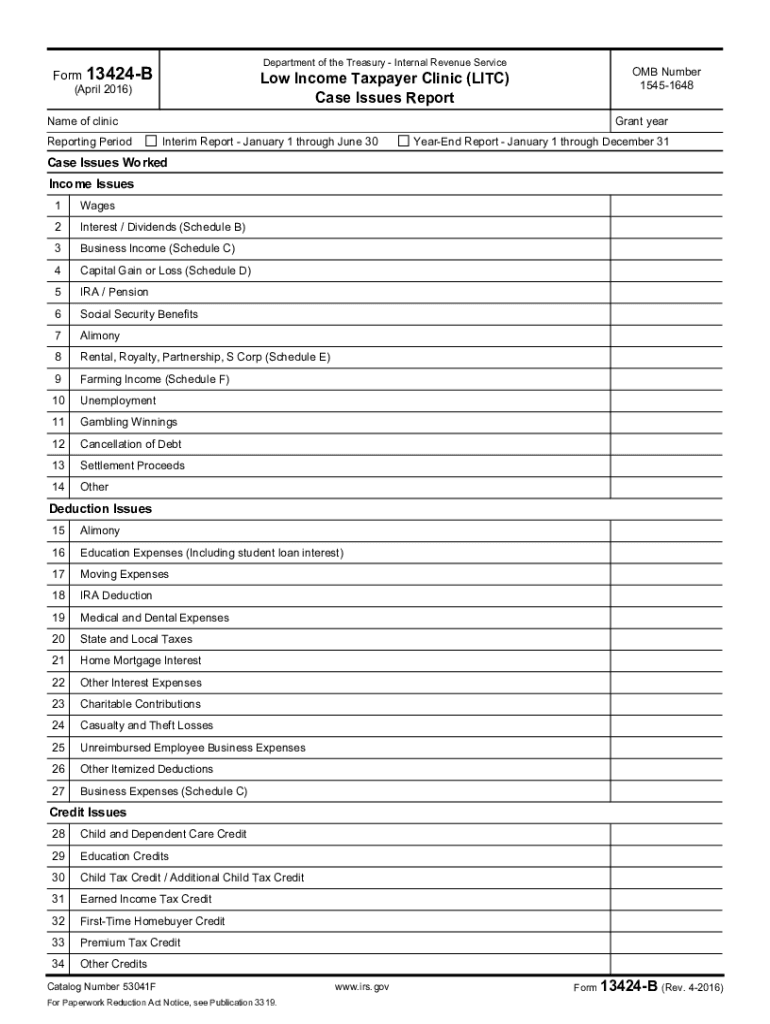

The Federal Form 13424 is an application used by organizations seeking recognition as Low Income Taxpayer Clinics (LITCs). These clinics provide assistance to low-income individuals who are facing tax issues, particularly those involving disputes with the Internal Revenue Service (IRS). The form is essential for organizations that aim to offer legal representation and education regarding taxpayer rights. By completing this application, organizations can gain the necessary approval to operate as LITCs and help vulnerable populations navigate complex tax matters.

Steps to Complete the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

Completing the Federal Form 13424 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information about your organization, including its mission, structure, and services offered.

- Provide details about the target population, including income levels and specific tax issues faced by clients.

- Outline the qualifications of staff members who will provide assistance, including any relevant legal training or experience.

- Complete all sections of the form accurately, ensuring that all required fields are filled out.

- Review the application for completeness and accuracy before submission.

Eligibility Criteria for the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

To be eligible for approval as a Low Income Taxpayer Clinic, organizations must meet certain criteria. These include:

- Providing services to individuals whose income does not exceed a specified percentage of the federal poverty level.

- Offering assistance in tax disputes with the IRS, including audits, appeals, and collections.

- Demonstrating the ability to provide education on taxpayer rights and responsibilities.

- Having qualified staff, including attorneys or certified representatives, to assist clients.

How to Obtain the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

The Federal Form 13424 can be obtained directly from the IRS website or through designated tax assistance organizations. It is important to ensure that you are using the most current version of the form. Organizations interested in applying should check the IRS resources for any updates or changes to the application process.

Legal Use of the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

The Federal Form 13424 is legally binding once submitted and approved by the IRS. Organizations must adhere to all stipulations outlined in the application, including maintaining compliance with IRS regulations regarding the operation of LITCs. Misuse of the form or failure to comply with its requirements can result in penalties or revocation of clinic status.

Form Submission Methods for the Federal Form 13424 Low Income Taxpayer Clinic LITC Application

The completed Federal Form 13424 can be submitted to the IRS through various methods. These include:

- Mailing the application to the designated IRS address provided in the form instructions.

- Submitting the form electronically if the IRS offers an online submission option for this application.

- Ensuring that all required documentation accompanies the application to avoid delays in processing.

Quick guide on how to complete federal form 13424 low income taxpayer clinic litc application

Complete Federal Form 13424 Low Income Taxpayer Clinic LITC Application effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to find the needed form and securely keep it online. airSlate SignNow provides all the features required to create, adjust, and electronically sign your documents quickly and without delays. Manage Federal Form 13424 Low Income Taxpayer Clinic LITC Application on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Federal Form 13424 Low Income Taxpayer Clinic LITC Application with ease

- Find Federal Form 13424 Low Income Taxpayer Clinic LITC Application and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Mark important parts of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Federal Form 13424 Low Income Taxpayer Clinic LITC Application to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 13424 low income taxpayer clinic litc application

Create this form in 5 minutes!

People also ask

-

What is Federal Form 13424 Low Income Taxpayer Clinic LITC Application?

The Federal Form 13424 Low Income Taxpayer Clinic LITC Application is a form used to apply for tax assistance through Low Income Taxpayer Clinics. These clinics provide free or low-cost tax help to eligible individuals, ensuring they can effectively navigate their tax obligations and rights. Understanding this form is crucial for those seeking economical tax-related support.

-

Who is eligible to apply using Federal Form 13424?

Eligibility for the Federal Form 13424 Low Income Taxpayer Clinic LITC Application generally includes individuals with incomes below a certain threshold, typically defined as a percentage of the federal poverty level. Moreover, applicants must have a tax dispute or need assistance related to a tax matter. It’s essential to review the specific eligibility criteria outlined by the IRS.

-

What are the benefits of using the Federal Form 13424 Low Income Taxpayer Clinic LITC Application?

By using the Federal Form 13424 Low Income Taxpayer Clinic LITC Application, applicants can gain access to quality legal assistance at little or no cost. This can signNowly ease the burden of tax-related issues, providing not only representation but also valuable guidance on tax laws. Additionally, it helps ensure taxpayers are treated fairly and that their rights are upheld.

-

How can airSlate SignNow simplify the application process for the Federal Form 13424?

airSlate SignNow streamlines the application process for the Federal Form 13424 Low Income Taxpayer Clinic LITC Application by offering an easy-to-use platform for document signing and submission. Users can fill out and eSign the form digitally, reducing the time and effort involved in manual processing. This efficiency ensures that applications are submitted promptly and securely.

-

What are the costs associated with filing the Federal Form 13424?

The Federal Form 13424 Low Income Taxpayer Clinic LITC Application itself does not have a filing fee, as clinics provide services at minimal or no cost to eligible individuals. However, there may be associated costs depending on required documentation or other related services. Always check with your chosen clinic for any specific charges.

-

What features does airSlate SignNow offer for managing Federal Form 13424 applications?

airSlate SignNow provides features like customizable templates, secure document storage, and real-time collaboration, which are integral for managing the Federal Form 13424 Low Income Taxpayer Clinic LITC Application. These tools ensure that users can efficiently track their application status and communicate with tax professionals. Moreover, the platform’s integration capabilities further enhance the overall experience.

-

How does airSlate SignNow ensure the security of documents related to Federal Form 13424 applications?

The security of documents submitted through the Federal Form 13424 Low Income Taxpayer Clinic LITC Application is a top priority for airSlate SignNow. The platform employs advanced encryption and secure access controls to protect sensitive taxpayer information. Users can have peace of mind knowing their applications are handled with the utmost confidentiality and security.

Get more for Federal Form 13424 Low Income Taxpayer Clinic LITC Application

Find out other Federal Form 13424 Low Income Taxpayer Clinic LITC Application

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online