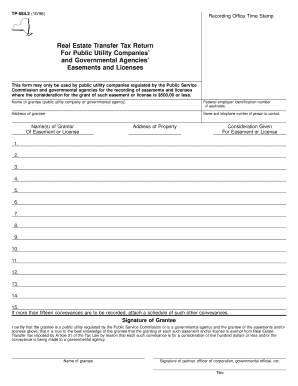

Form TP 584 21096Real Estate Transfer Tax Return for

What is the Form TP6 Real Estate Transfer Tax Return For

The Form TP6 Real Estate Transfer Tax Return is a crucial document used in the United States for reporting the transfer of real estate property. This form is typically required when a property is sold, transferred, or conveyed, and it helps ensure that the appropriate real estate transfer taxes are calculated and paid. The information collected on this form assists local government authorities in tracking property transfers and assessing tax liabilities associated with these transactions.

How to use the Form TP6 Real Estate Transfer Tax Return For

Using the Form TP6 involves several steps to ensure accurate and compliant completion. First, gather all necessary information regarding the property being transferred, including the property address, the names of the parties involved, and the sale price. Once you have this information, you can fill out the form, ensuring that each section is completed accurately. After filling out the form, it must be submitted to the appropriate local tax authority, along with any required payment for transfer taxes.

Steps to complete the Form TP6 Real Estate Transfer Tax Return For

Completing the Form TP6 involves a systematic approach:

- Begin by entering the property details, including the full address and legal description.

- Provide the names and contact information of the grantor (seller) and grantee (buyer).

- Indicate the sale price or consideration for the property transfer.

- Complete any additional sections that may apply, such as exemptions or special circumstances.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Form TP6 Real Estate Transfer Tax Return For

The Form TP6 contains several key elements that are essential for its validity:

- Property Identification: Accurate details about the property being transferred.

- Parties Involved: Full names and addresses of both the seller and buyer.

- Consideration Amount: The sale price or other valuable consideration for the property.

- Signature: The form must be signed by the appropriate parties to validate the transaction.

Legal use of the Form TP6 Real Estate Transfer Tax Return For

The legal use of the Form TP6 is governed by state and local laws regarding real estate transactions. This form must be completed accurately to comply with tax regulations and to ensure that the transfer is recognized legally. Failure to properly file this form can result in penalties, including fines or delays in the transfer process. It is important to consult local regulations to understand specific requirements and implications related to the form.

Form Submission Methods (Online / Mail / In-Person)

The Form TP6 can typically be submitted through various methods, depending on the local jurisdiction:

- Online Submission: Many jurisdictions offer electronic filing options for convenience.

- Mail: The completed form can often be mailed to the local tax authority.

- In-Person: Submitting the form in person may be required in some areas, allowing for immediate confirmation of receipt.

Quick guide on how to complete form tp 58421096real estate transfer tax return for

Prepare Form TP 584 21096Real Estate Transfer Tax Return For seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form TP 584 21096Real Estate Transfer Tax Return For on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form TP 584 21096Real Estate Transfer Tax Return For effortlessly

- Locate Form TP 584 21096Real Estate Transfer Tax Return For and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form TP 584 21096Real Estate Transfer Tax Return For while ensuring exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form TP 584 21096Real Estate Transfer Tax Return For?

Form TP 584 21096Real Estate Transfer Tax Return For is a necessary document used in real estate transactions to report the transfer of property and related tax obligations. It ensures compliance with state regulations and helps both buyers and sellers understand their tax liabilities. Filling this form accurately is crucial for a smooth property transfer process.

-

How can airSlate SignNow help with Form TP 584 21096Real Estate Transfer Tax Return For?

airSlate SignNow streamlines the process of completing and signing Form TP 584 21096Real Estate Transfer Tax Return For. Our platform allows you to fill out the form electronically, obtain signatures, and securely store your documents. This simplifies the filing process and ensures that all necessary information is included, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form TP 584 21096Real Estate Transfer Tax Return For?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling Form TP 584 21096Real Estate Transfer Tax Return For. Our plans are designed to be cost-effective, allowing you to choose the features you need without paying for unnecessary extras. You can review our pricing page to select the best option for your requirements.

-

What are the key features of airSlate SignNow for handling real estate documents?

Key features of airSlate SignNow when dealing with Form TP 584 21096Real Estate Transfer Tax Return For include customizable templates, secure eSigning, and easy document sharing. These features enhance efficiency, ensuring that all parties can collaborate seamlessly. Additionally, our platform supports real-time updates so you can track changes instantly.

-

Can I integrate airSlate SignNow with other software to manage Form TP 584 21096Real Estate Transfer Tax Return For?

Absolutely! airSlate SignNow offers integrations with various software platforms, enabling you to manage Form TP 584 21096Real Estate Transfer Tax Return For efficiently. Whether you’re using CRMs or document management systems, our integrations ensure a smooth workflow, allowing you to synchronize data effortlessly.

-

Is it safe to use airSlate SignNow for sensitive documents like Form TP 584 21096Real Estate Transfer Tax Return For?

Yes, airSlate SignNow prioritizes security, ensuring that your Form TP 584 21096Real Estate Transfer Tax Return For and other sensitive documents are protected. We utilize advanced encryption technology and comply with industry standards for data protection. You can trust that your information is secure throughout the signing process.

-

How long does it take to complete Form TP 584 21096Real Estate Transfer Tax Return For using airSlate SignNow?

Completing Form TP 584 21096Real Estate Transfer Tax Return For using airSlate SignNow is quick and efficient, often taking just a few minutes. Our user-friendly interface allows you to fill out the form and gather signatures without delay. The platform is designed to minimize paperwork and maximize speed in your real estate dealings.

Get more for Form TP 584 21096Real Estate Transfer Tax Return For

Find out other Form TP 584 21096Real Estate Transfer Tax Return For

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement