Note in Order for Form W 8BEN E to Be Complete, You Must Complete the Highlighted Fields and All Other

Understanding the Note In Order For Form W-8BEN-E

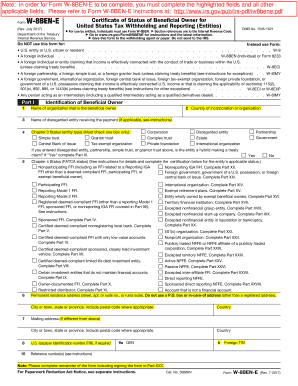

The note in order for Form W-8BEN-E to be complete, you must complete the highlighted fields and all other sections is essential for foreign entities to certify their status for U.S. tax purposes. This form is primarily used by non-U.S. entities to establish their eligibility for reduced withholding rates on certain types of income. Completing this form accurately is crucial to avoid unnecessary withholding and ensure compliance with IRS regulations.

Steps to Complete the Note In Order For Form W-8BEN-E

To effectively complete the note in order for Form W-8BEN-E to be complete, you must follow these steps:

- Identify the highlighted fields that require your attention. These fields are critical for the form's validity.

- Provide accurate information regarding the entity's name, country of incorporation, and address.

- Complete the sections regarding the entity’s classification and any applicable tax treaty benefits.

- Ensure that all required signatures are provided, as this validates the form.

Legal Use of the Note In Order For Form W-8BEN-E

The note in order for Form W-8BEN-E to be complete, you must complete the highlighted fields and all other is legally binding when filled out correctly. This means that the information provided must be true and accurate to the best of your knowledge. Misrepresentation or failure to complete the form can lead to penalties, including increased withholding taxes or legal repercussions.

IRS Guidelines for Form W-8BEN-E

The IRS has established specific guidelines for the completion of Form W-8BEN-E. These guidelines emphasize the importance of accuracy in reporting and the necessity of completing all highlighted fields. The IRS requires that the form be updated periodically, especially if there are changes in the entity's circumstances or tax status.

Required Documents for Form W-8BEN-E

When submitting the note in order for Form W-8BEN-E to be complete, you may need to provide additional documentation to support your claims. This could include:

- Proof of the entity's country of incorporation.

- Tax identification numbers from the foreign jurisdiction.

- Documentation that supports eligibility for any claimed tax treaty benefits.

Form Submission Methods for W-8BEN-E

The completed note in order for Form W-8BEN-E to be complete can be submitted through various methods. Entities may choose to submit the form electronically or via mail, depending on the requirements of the withholding agent or financial institution. It is important to confirm the preferred submission method to ensure timely processing.

Quick guide on how to complete note in order for form w 8ben e to be complete you must complete the highlighted fields and all other

Effortlessly Prepare Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Easily Modify and eSign Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other

- Locate Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other and click on Get Form to commence.

- Make use of the tools we provide to complete your paperwork.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching through forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other and ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of completing Form W 8BEN E correctly?

Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other. Completing this form accurately is crucial to avoid withholding taxes and ensure compliance with IRS regulations. It identifies beneficial owners of income and helps prevent delays in processing.

-

How does airSlate SignNow assist with filling out Form W 8BEN E?

With airSlate SignNow, filling out Form W 8BEN E is streamlined and simplified. The platform provides clear instructions and allows users to easily navigate the document. Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other to ensure all necessary information is captured.

-

Are there any costs associated with using airSlate SignNow for Form W 8BEN E?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. While there may be costs, the platform provides a cost-effective solution that saves time and reduces errors in document handling. Remember, Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features such as eSignature capabilities, document sharing, and secure storage. These features enhance the signing process and ensure legal compliance. Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other before electronically signing any document.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, including CRM systems and cloud storage. This ensures that your document workflows remain efficient. When using Form W 8BEN E, remember that Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other.

-

What benefits does airSlate SignNow provide for businesses?

Businesses benefit from increased efficiency, reduced paper usage, and enhanced security with airSlate SignNow. The platform simplifies document management and signing processes, allowing companies to focus on their core operations. Just remember, Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other.

-

Is there customer support available for airSlate SignNow users?

Yes, airSlate SignNow provides robust customer support options, including live chat, email, and extensive documentation. This support is crucial for users needing assistance with their documents, including forms like W 8BEN E. Don’t forget, Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other.

Get more for Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other

Find out other Note In Order For Form W 8BEN E To Be Complete, You Must Complete The Highlighted Fields And All Other

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed