Revolving Credit Mortgage Forms for Florida

What is the Revolving Credit Mortgage Forms For Florida

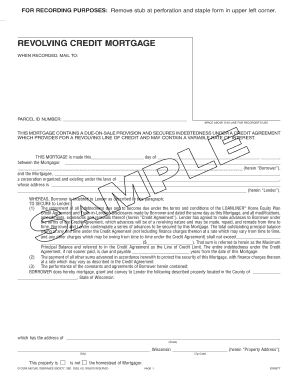

The revolving credit mortgage forms for Florida are essential documents used in the process of securing a revolving credit mortgage. This type of mortgage allows homeowners to borrow against the equity in their property, providing them with flexible access to funds as needed. The forms typically include details about the property, the borrower, and the terms of the credit agreement. Understanding these forms is crucial for anyone looking to utilize their home equity effectively.

How to Use the Revolving Credit Mortgage Forms For Florida

Using the revolving credit mortgage forms for Florida involves several key steps. First, gather all necessary information, including personal identification, property details, and financial history. Next, complete the forms accurately, ensuring that all fields are filled out correctly. Once completed, these forms can be submitted electronically or printed for physical submission. It is important to review the forms for accuracy before submission to avoid delays in processing.

Steps to Complete the Revolving Credit Mortgage Forms For Florida

Completing the revolving credit mortgage forms for Florida requires careful attention to detail. Follow these steps:

- Gather required documents, such as proof of income, credit history, and property appraisal.

- Fill out the forms, ensuring all personal and property information is accurate.

- Review the forms for completeness and accuracy.

- Submit the forms electronically through a secure platform or print and mail them to the appropriate lender.

Key Elements of the Revolving Credit Mortgage Forms For Florida

Key elements of the revolving credit mortgage forms for Florida include borrower information, property details, loan amount, interest rates, and repayment terms. Additionally, the forms may require disclosures about fees, penalties, and the rights of the borrower. Understanding these elements helps borrowers make informed decisions about their mortgage options.

Legal Use of the Revolving Credit Mortgage Forms For Florida

The legal use of the revolving credit mortgage forms for Florida is governed by state and federal laws. To be legally binding, these forms must be completed and signed according to the regulations set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Ensuring compliance with these laws protects both the lender and the borrower.

State-Specific Rules for the Revolving Credit Mortgage Forms For Florida

Florida has specific rules regarding the use of revolving credit mortgage forms. These include requirements for disclosures, interest rate limits, and consumer protection laws. It is important for borrowers to be aware of these state-specific regulations to ensure that their mortgage agreements are valid and enforceable.

Quick guide on how to complete revolving credit mortgage forms for florida

Complete Revolving Credit Mortgage Forms For Florida effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly replacement for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Revolving Credit Mortgage Forms For Florida on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Revolving Credit Mortgage Forms For Florida with ease

- Locate Revolving Credit Mortgage Forms For Florida and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Revolving Credit Mortgage Forms For Florida and ensure remarkable communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revolving credit mortgage forms for florida

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are revolving credit mortgage forms for Florida?

Revolving credit mortgage forms for Florida are specialized documents used in securing a revolving line of credit against your property. They allow homeowners in Florida to access funds as needed, making it easier to manage expenses. By understanding these forms, you can better leverage your property's equity.

-

How can airSlate SignNow help with revolving credit mortgage forms for Florida?

airSlate SignNow simplifies the process of handling revolving credit mortgage forms for Florida by providing a user-friendly platform for eSigning and document management. With our solution, you can easily fill out, send, and store your forms securely online. This streamlines your workflow and ensures that your important documents are always accessible.

-

Are there any fees associated with using airSlate SignNow for revolving credit mortgage forms for Florida?

Yes, airSlate SignNow offers competitive pricing plans that cater to different needs, including those requiring revolving credit mortgage forms for Florida. We provide transparent pricing with no hidden fees, allowing you to choose a plan that fits your budget and document management needs. You can review our pricing details on our website.

-

What features does airSlate SignNow offer for managing revolving credit mortgage forms for Florida?

airSlate SignNow includes features such as customizable templates, an intuitive drag-and-drop interface, and robust security measures for your revolving credit mortgage forms for Florida. Additionally, our platform allows multiple signers, making it easier for all parties involved to manage and complete the documentation efficiently.

-

Can I integrate airSlate SignNow with other applications when using revolving credit mortgage forms for Florida?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM tools, enhancing your experience with revolving credit mortgage forms for Florida. These integrations allow for easy document transfers and improved productivity across your business tools.

-

How secure are my revolving credit mortgage forms for Florida in airSlate SignNow?

The security of your revolving credit mortgage forms for Florida is our top priority at airSlate SignNow. We implement industry-leading encryption and compliance measures to ensure your documents remain confidential and protected from unauthorized access. You can sign and store your documents with peace of mind.

-

Can I track the status of my revolving credit mortgage forms for Florida?

Yes, airSlate SignNow provides real-time tracking for all your revolving credit mortgage forms for Florida. This feature allows you to see when documents are sent, viewed, and signed, keeping you informed throughout the entire process. It enhances transparency and helps you manage deadlines effectively.

Get more for Revolving Credit Mortgage Forms For Florida

- Box 12076 austin texas 78711 800 835 5832 512 463 7476 form

- Wreckersalvage processor monthly report form

- This application should be filed only by charitable educational or religious institutions disregarded resident single member form

- Disability recreational hunting and fishing license sc dnr form

- Fillable lifetime recreational hunting and fishing license form

- Kcc license application kansas corporation commission form

- A seller may not accept a certificate of exemption for an entity based exemption on a form

- License application for corporate afc crs fads afccrs alternate overnight supervision technology family systems license form

Find out other Revolving Credit Mortgage Forms For Florida

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy