Idaho St 133 2018-2026

What is the Idaho St 133?

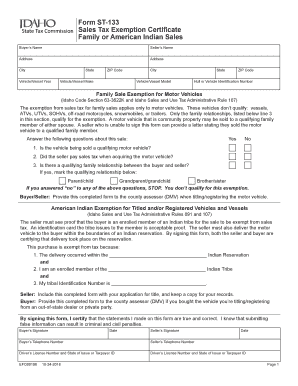

The Idaho St 133 is a sales tax exemption certificate used by businesses and individuals in Idaho to claim exemption from sales tax on qualifying purchases. This form is crucial for entities that meet specific criteria, allowing them to avoid paying sales tax on goods and services that are exempt under Idaho law. The St 133 is particularly relevant for non-profit organizations, government agencies, and certain types of businesses that engage in tax-exempt activities.

How to use the Idaho St 133

To utilize the Idaho St 133, the user must complete the form accurately and provide it to the seller at the time of purchase. The seller must retain the certificate for their records to validate the tax-exempt status of the transaction. It is important to ensure that the purchases made with this certificate align with the exemptions outlined in Idaho state tax regulations. Misuse of the form can result in penalties and tax liabilities.

Steps to complete the Idaho St 133

Completing the Idaho St 133 involves several key steps:

- Obtain the form from an official source or download it from the Idaho State Tax Commission website.

- Fill in the required information, including the name and address of the purchaser, the reason for exemption, and the type of goods or services being purchased.

- Review the completed form for accuracy to ensure compliance with Idaho tax laws.

- Sign and date the form before presenting it to the seller.

Legal use of the Idaho St 133

The legal use of the Idaho St 133 is governed by state tax laws. To be valid, the form must be completed correctly and used for eligible purchases only. It is essential for users to understand the specific exemptions that apply to their situation, as improper use can lead to legal repercussions, including fines or back taxes owed. The form must be kept on file by the seller to substantiate the exemption claim during audits.

Key elements of the Idaho St 133

Key elements of the Idaho St 133 include:

- Purchaser Information: Name, address, and contact details of the entity claiming the exemption.

- Reason for Exemption: A clear statement indicating the basis for the tax-exempt status.

- Type of Purchase: Description of the goods or services being exempted from sales tax.

- Signature: The form must be signed by an authorized representative of the purchaser.

Eligibility Criteria

Eligibility for using the Idaho St 133 typically includes non-profit organizations, government entities, and certain businesses engaged in exempt activities. Each category has specific requirements that must be met to qualify for sales tax exemption. It is advisable for users to review the Idaho State Tax Commission guidelines to confirm their eligibility before submitting the form.

Quick guide on how to complete idaho st 133

Effortlessly prepare Idaho St 133 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Idaho St 133 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Idaho St 133 without stress

- Obtain Idaho St 133 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Alter and eSign Idaho St 133 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idaho st 133

Create this form in 5 minutes!

People also ask

-

What is st 133 and how does airSlate SignNow utilize it?

St 133 refers to a specific form used in certain transactions. AirSlate SignNow can streamline the process of sending and eSigning st 133 documents, making it efficient and compliant for your business needs.

-

How much does airSlate SignNow cost for st 133 document management?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost of managing st 133 documents starts at an affordable monthly fee, providing excellent value for effective document signing.

-

What features does airSlate SignNow offer for handling st 133 forms?

AirSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking specifically designed to manage st 133 forms. These tools enhance efficiency and ensure compliance during the signing process.

-

What are the benefits of using airSlate SignNow for st 133 forms?

Using airSlate SignNow for st 133 forms simplifies document handling, speeds up transaction times, and reduces paper waste. This results in a more streamlined workflow and increased productivity for your team.

-

Can airSlate SignNow integrate with other platforms for st 133 management?

Yes, airSlate SignNow seamlessly integrates with popular business applications like Google Drive, Salesforce, and more. This integration enhances how you manage st 133 documents across various platforms, ensuring a smooth workflow.

-

Is airSlate SignNow secure for signing st 133 documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance measures for signing st 133 documents. This ensures that your data is safe and compliant with industry regulations.

-

How does airSlate SignNow enhance the user experience for st 133 forms?

AirSlate SignNow is designed with user-friendliness in mind, providing a simple interface that allows for quick navigation when handling st 133 forms. This ease of use minimizes the learning curve, allowing teams to adopt the system swiftly.

Get more for Idaho St 133

- Science project rubric 5th grade form

- Water temperature record sheet templates form

- Daily hourly schedule template form

- Kuta software infinite geometry form

- Integral table pdf form

- Advent crossword puzzle form

- Christ hospital financial assistance form

- Patient referral universal occupational medicine form

Find out other Idaho St 133

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online