Idaho Sales Tax 2014

What is the Idaho Sales Tax

The Idaho sales tax is a state-imposed tax on the sale of goods and services. It is important for businesses and individuals to understand this tax as it affects various transactions. The current sales tax rate in Idaho is six percent, but certain items may be exempt or subject to different rates. This tax is collected by sellers at the point of sale and is then remitted to the Idaho State Tax Commission. Understanding the nuances of the sales tax can help individuals and businesses ensure compliance and avoid potential penalties.

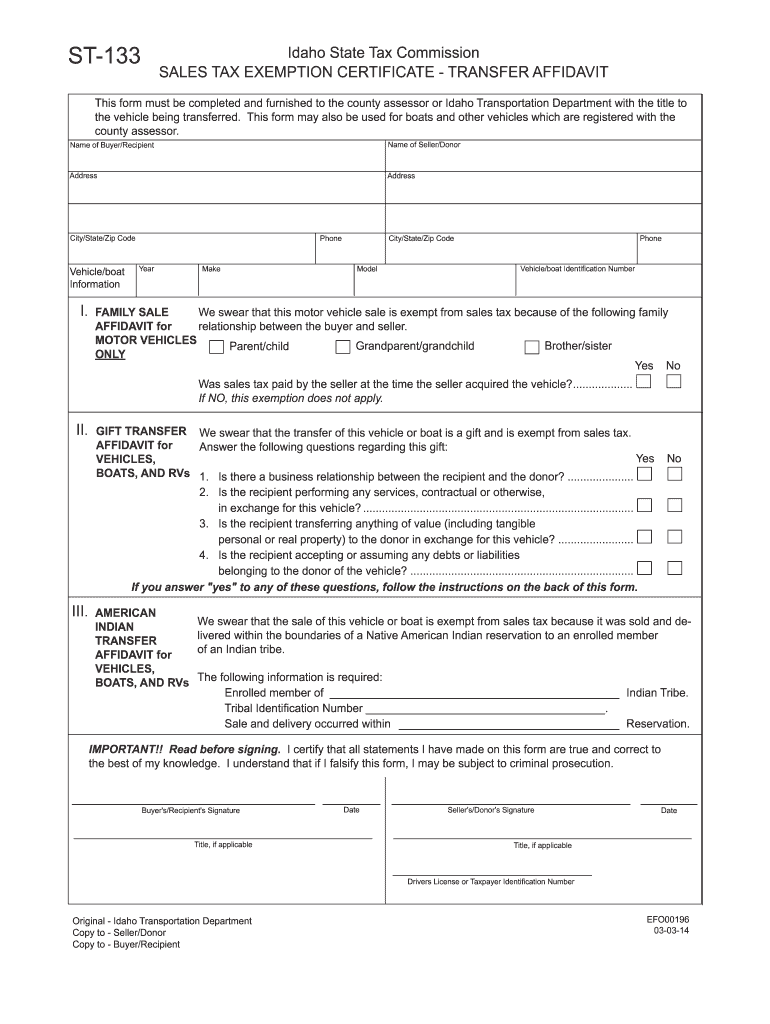

How to complete the Idaho Sales Tax Exemption Certificate (Form ST-133GT)

Completing the Idaho Sales Tax Exemption Certificate, known as Form ST-133GT, involves several steps. First, ensure you have the correct version of the form, as outdated versions may not be accepted. Begin by providing your name, address, and the reason for the exemption. Common reasons include purchases for resale or items used in manufacturing. Next, include your sales tax identification number, if applicable. After filling out the required fields, sign and date the form. It is essential to keep a copy for your records and provide the original to the seller to validate the exemption.

Legal use of the Idaho Sales Tax Exemption Certificate

The legal use of the Idaho Sales Tax Exemption Certificate is crucial for both buyers and sellers. Buyers must ensure that they qualify for the exemption to avoid tax liabilities. Sellers, on the other hand, must verify the certificate's authenticity and keep it on file. If a seller accepts a fraudulent certificate, they could be held responsible for the unpaid sales tax. Compliance with the rules surrounding the use of Form ST-133GT helps maintain the integrity of the sales tax system in Idaho.

Required Documents for Idaho Sales Tax Exemption

When applying for a sales tax exemption in Idaho, specific documents are typically required. These include a completed Form ST-133GT, which outlines the reason for the exemption, and any supporting documentation that substantiates the claim. For instance, if the exemption is for resale, a seller's permit or business license may be necessary. Keeping thorough records of these documents is essential for compliance and may be requested during audits by the Idaho State Tax Commission.

Form Submission Methods for Idaho Sales Tax Exemption

Form ST-133GT can be submitted through various methods, depending on the seller's preference. The form can be presented in person at the time of purchase, mailed directly to the seller, or submitted electronically if the seller allows for digital documentation. It is important to confirm the submission method with the seller, as some may have specific requirements for accepting exemption certificates. Proper submission ensures that the exemption is recognized and that the buyer is not charged sales tax unnecessarily.

Penalties for Non-Compliance with Idaho Sales Tax Regulations

Failure to comply with Idaho sales tax regulations can result in significant penalties. If a buyer improperly claims an exemption, they may be liable for the unpaid sales tax, along with interest and penalties. Sellers who do not adhere to the verification process for exemption certificates may also face penalties, including fines or additional tax liabilities. Understanding the importance of compliance with Form ST-133GT and related regulations can help mitigate these risks and ensure smooth transactions.

Quick guide on how to complete idaho sales tax

Complete Idaho Sales Tax effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Idaho Sales Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Idaho Sales Tax seamlessly

- Locate Idaho Sales Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to share your form, either by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Idaho Sales Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idaho sales tax

Create this form in 5 minutes!

How to create an eSignature for the idaho sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ST 133GT and how is it used?

The form ST 133GT is a governmental document required for specific tax exemption purposes. It is primarily used by businesses in certain states to signNow that a transaction is exempt from sales tax. Understanding how to properly fill out the form ST 133GT is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow streamline the process of completing form ST 133GT?

airSlate SignNow provides an easy-to-use platform for digitally completing and eSigning the form ST 133GT. With our user-friendly interface, businesses can fill out the necessary fields quickly and securely. This simplifies the submission process, allowing for efficient document management and compliance.

-

Is there a cost associated with using airSlate SignNow for form ST 133GT?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. While there is a subscription fee, the cost is typically offset by the signNow savings in time and resources when processing documents like the form ST 133GT electronically. We also offer a free trial for users to explore our features.

-

What are the key features of airSlate SignNow for handling form ST 133GT?

Key features of airSlate SignNow for handling form ST 133GT include customizable templates, secure eSigning, and document tracking. These features enhance the efficiency and security of the document signing process. Additionally, our platform supports collaboration, allowing multiple parties to review and sign the form seamlessly.

-

Can I integrate airSlate SignNow with other applications for my form ST 133GT needs?

Absolutely! airSlate SignNow integrates with a variety of applications, including CRM and document management systems. This allows users to automate workflows involving the form ST 133GT, ensuring that all necessary data is transferred and managed efficiently. Check our integration list for compatibility options.

-

What benefits does airSlate SignNow offer for businesses needing the form ST 133GT?

airSlate SignNow provides numerous benefits for businesses needing the form ST 133GT, including reduced turnaround times and enhanced compliance. By digitizing the signing process, businesses can easily manage their documents, ensure accuracy, and avoid errors. These efficiencies translate into signNow cost and time savings.

-

Is airSlate SignNow compliant with legal requirements for form ST 133GT?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that the completed form ST 133GT is legally valid. Our platform adheres to industry regulations, which means businesses can trust that their documents are secure and accepted by governing bodies. This commitment to compliance supports effective business practices.

Get more for Idaho Sales Tax

- Australia review form

- Da form 5988 e example

- Tc 95 623 form

- Lic 701 spanish form

- Portsmouth leisure card form

- 555 wright way carson city nv 89711 renosparksc form

- Standard and personalized professional fire fighter license plates may be issued for passenger vehicles light commercial form

- Certificate of inspectionaffidavit of vehicle construction form

Find out other Idaho Sales Tax

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History