Payroll Correction Review Form G4S DRMC Security Training

Understanding the Payroll Correction Review Form

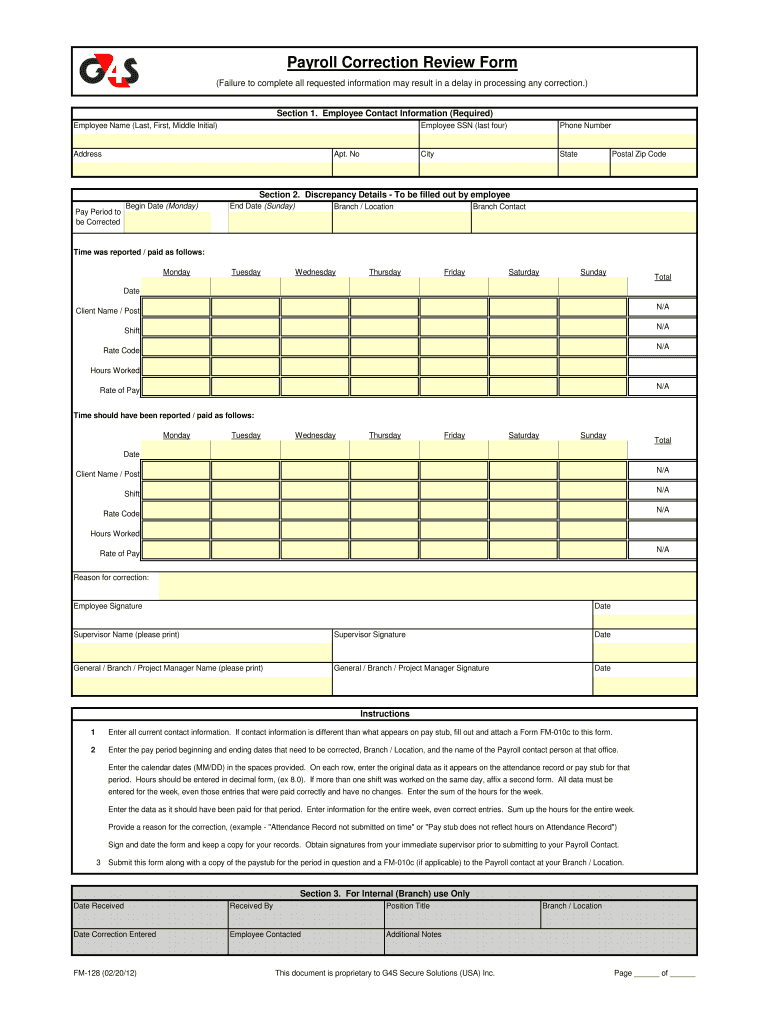

The Payroll Correction Review Form is essential for addressing any discrepancies in employee payroll records. This form allows employees to formally request corrections to their payroll information, ensuring that all records are accurate and up-to-date. It is crucial for maintaining compliance with employment regulations and ensuring that employees receive the correct compensation for their work. The form typically includes sections for employee details, the nature of the correction, and supporting documentation to validate the request.

Steps to Complete the Payroll Correction Review Form

Completing the Payroll Correction Review Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents that support your correction request, such as pay stubs or time sheets. Next, fill out your personal information accurately, including your name, employee ID, and contact details. Clearly specify the error in your payroll records and provide a detailed explanation of the correction needed. Attach any supporting documentation to substantiate your request. Finally, review the form for completeness and accuracy before submission.

Legal Use of the Payroll Correction Review Form

The Payroll Correction Review Form is legally recognized as a formal request for payroll adjustments. To be valid, the form must be completed accurately and submitted within the appropriate timeframe as dictated by company policy or state regulations. It is important to understand that submitting this form does not guarantee immediate correction; it initiates a review process that must comply with internal protocols and legal standards. Proper use of this form helps protect both the employee's rights and the employer's obligations under labor laws.

Obtaining the Payroll Correction Review Form

Employees can typically obtain the Payroll Correction Review Form through their company's human resources department or payroll office. Many organizations provide this form electronically on their internal websites or employee portals. If the form is not readily available online, employees should request a copy directly from HR or payroll personnel. Ensuring that you have the correct and most current version of the form is crucial for a smooth correction process.

Key Elements of the Payroll Correction Review Form

Several key elements are essential for the Payroll Correction Review Form to be effective. These include the employee's full name, employee ID, department, and contact information. The form should clearly outline the specific payroll error, whether it pertains to hours worked, pay rate, or deductions. Additionally, it should include a section for the employee to provide a detailed explanation of the correction being requested, along with any relevant dates and supporting documents. A signature line is also necessary to authenticate the request.

Examples of Using the Payroll Correction Review Form

There are various scenarios in which an employee might need to use the Payroll Correction Review Form. For instance, if an employee notices that their paycheck reflects incorrect hours worked due to a timekeeping error, they can submit this form to request a correction. Another example is when an employee's tax withholding is incorrect, leading to an unexpected deduction. In both cases, the form serves as a formal mechanism to address and rectify payroll discrepancies, ensuring that employees are compensated accurately.

Quick guide on how to complete payroll correction review form g4s drmc security training

Effortlessly Prepare Payroll Correction Review Form G4S DRMC Security Training on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Payroll Correction Review Form G4S DRMC Security Training on any device using the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

How to Modify and Electronically Sign Payroll Correction Review Form G4S DRMC Security Training with Ease

- Find Payroll Correction Review Form G4S DRMC Security Training and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Payroll Correction Review Form G4S DRMC Security Training and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is G4S Payroll and how does it work with airSlate SignNow?

G4S Payroll is a comprehensive payroll processing solution designed to streamline payment management for businesses. When integrated with airSlate SignNow, companies can securely send, sign, and store payroll documents, ensuring compliance and efficiency throughout the process.

-

What are the pricing options for G4S Payroll through airSlate SignNow?

Pricing for G4S Payroll when using airSlate SignNow varies based on the number of employees and the features required. Our flexible pricing plans provide cost-effective solutions tailored to businesses of all sizes, making payroll management more affordable and efficient.

-

What features does G4S Payroll offer with airSlate SignNow?

G4S Payroll includes several robust features such as automated tax calculations, direct deposits, and customizable payroll reports. By utilizing airSlate SignNow, users can also take advantage of eSignature capabilities, reducing the time it takes to get payroll documents signed and approved.

-

How can G4S Payroll benefit small businesses using airSlate SignNow?

Small businesses using G4S Payroll with airSlate SignNow can enhance their operational efficiency by automating payroll processes and ensuring timely payments to employees. Additionally, the user-friendly interface simplifies onboarding and compliance, allowing small businesses to focus on growth.

-

Can I integrate G4S Payroll with other software applications using airSlate SignNow?

Yes, G4S Payroll is designed to integrate seamlessly with various HR and accounting software applications when used with airSlate SignNow. This versatility helps streamline workflows and reduce data entry errors, making overall payroll management more effective.

-

What are the security features of G4S Payroll with airSlate SignNow?

The integration of G4S Payroll and airSlate SignNow prioritizes security with encrypted data transmission and secure storage of sensitive employee information. Compliance with industry standards ensures that payroll data is protected, giving businesses peace of mind during document management.

-

Is support available for G4S Payroll users of airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support for all users of G4S Payroll. Our support team is available to assist with any questions or issues, ensuring that payroll processes run smoothly and efficiently.

Get more for Payroll Correction Review Form G4S DRMC Security Training

Find out other Payroll Correction Review Form G4S DRMC Security Training

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple