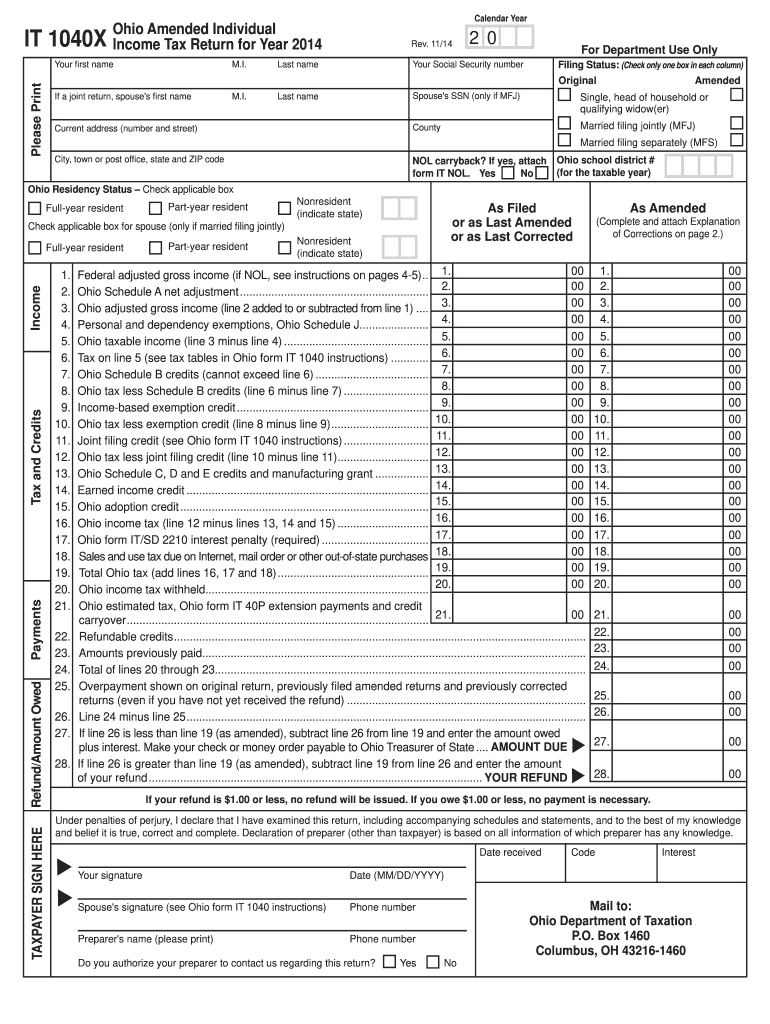

1040x Form 2014-2026

What is the 1040x Form

The 1040x form is used by taxpayers to amend their federal income tax returns. This form allows individuals to correct errors or make changes to their previously filed 1040, 1040a, or 1040ez forms. Common reasons for filing a 1040x include correcting income, claiming deductions or credits that were initially missed, or changing filing status. It is essential to ensure that all information provided on the 1040x is accurate and complete to avoid delays in processing.

Steps to complete the 1040x Form

Completing the 1040x form involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documents, including your original tax return and any supporting documents related to the changes. Next, clearly indicate the year of the return you are amending at the top of the form. Fill out the form by providing the corrected figures in the appropriate sections, explaining the changes in Part III. Finally, review the entire form for accuracy before signing and dating it, ensuring that all required information is included.

Legal use of the 1040x Form

The 1040x form is legally recognized by the IRS for amending tax returns. To be valid, it must be filed within the designated time frame, typically within three years from the original filing date or within two years of paying the tax due, whichever is later. It is crucial to follow IRS instructions when completing the form to ensure compliance with tax laws. Failure to adhere to these guidelines may result in penalties or delays in processing the amendment.

Filing Deadlines / Important Dates

When filing a 1040x form, it is important to be aware of the deadlines for submission. Generally, the form must be filed within three years from the original return's due date, including extensions. For example, if you filed your 2019 tax return on April 15, 2020, you have until April 15, 2023, to submit your 1040x. Additionally, if you are claiming a refund, it is advisable to file the amendment as soon as possible to avoid missing the deadline for receiving your refund.

Required Documents

To successfully file a 1040x form, certain documents are required. These include your original tax return, any supporting documentation that justifies the changes being made, and any additional forms or schedules that may be necessary based on the amendments. It is also beneficial to keep copies of all documents submitted for your records, as this can help resolve any potential issues with the IRS in the future.

Form Submission Methods (Online / Mail / In-Person)

The 1040x form can be submitted through various methods. As of recent updates, taxpayers can file the 1040x electronically using IRS-approved software, which simplifies the process and speeds up processing times. Alternatively, you can mail the completed form to the appropriate IRS address based on your state of residence. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete it 1040x ohio 2014 2019 form

Your assistance manual on how to prepare your 1040x Form

If you’re curious about how to finalize and dispatch your 1040x Form, here are a few brief guidelines on how to simplify tax filing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that allows you to modify, create, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to make changes as necessary. Optimize your tax handling with sophisticated PDF editing, eSigning, and user-friendly sharing.

Adhere to the instructions below to complete your 1040x Form in just a few minutes:

- Establish your account and start editing PDFs in mere moments.

- Utilize our directory to acquire any IRS tax form; browse through various versions and schedules.

- Press Get form to access your 1040x Form in our editor.

- Populate the necessary editable fields with your details (text, figures, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to additional return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

Create this form in 5 minutes!

How to create an eSignature for the it 1040x ohio 2014 2019 form

How to generate an electronic signature for the It 1040x Ohio 2014 2019 Form in the online mode

How to generate an eSignature for the It 1040x Ohio 2014 2019 Form in Google Chrome

How to make an electronic signature for putting it on the It 1040x Ohio 2014 2019 Form in Gmail

How to make an electronic signature for the It 1040x Ohio 2014 2019 Form from your smart phone

How to make an eSignature for the It 1040x Ohio 2014 2019 Form on iOS devices

How to generate an electronic signature for the It 1040x Ohio 2014 2019 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to ohio 00?

airSlate SignNow is a powerful eSignature solution that enables businesses in ohio 00 to send and sign documents efficiently. With its user-friendly interface, companies in this region can streamline their document workflows and enhance productivity.

-

What pricing options does airSlate SignNow offer for businesses in ohio 00?

The pricing for airSlate SignNow varies based on the features and number of users required. Businesses in ohio 00 can choose from flexible plans that cater to their specific needs, providing cost-effective options suitable for both small and large enterprises.

-

What features are included in airSlate SignNow's service for ohio 00 customers?

airSlate SignNow offers a range of features including customizable templates, mobile access, and fast document turnaround times. Customers in ohio 00 can benefit from these features to optimize their signing processes and improve document management.

-

How can airSlate SignNow benefit businesses operating in ohio 00?

Businesses in ohio 00 can save time and reduce errors by using airSlate SignNow's eSignature capabilities. This not only streamlines operations but also enhances compliance and security in document handling.

-

Does airSlate SignNow integrate with other software tools used by businesses in ohio 00?

Yes, airSlate SignNow integrates seamlessly with various software applications commonly used by businesses in ohio 00. This includes CRM systems, cloud storage solutions, and productivity tools, allowing for a cohesive workflow.

-

What types of documents can be signed using airSlate SignNow in ohio 00?

airSlate SignNow supports a variety of document types, including contracts, agreements, and consent forms. Businesses in ohio 00 can utilize this feature to ensure that all important documents are securely signed and stored.

-

Is airSlate SignNow compliant with legal requirements in ohio 00?

Yes, airSlate SignNow complies with all necessary legal requirements for eSignatures in ohio 00. This means businesses can trust that their electronic agreements are valid and enforceable under state and federal laws.

Get more for 1040x Form

- Health home mco and cm standards new york state department form

- Environmental health manual procedure csfp 146 form

- Nys accession number form

- Health home application to serve children new york state form

- Opwdd ddro manual for childrens waiver form

- Doh 4392 form

- Report for legal blindness ny state form

- New york state department of health infectious diseases form

Find out other 1040x Form

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself