L 8 This Form is a Self Executing Waiver Affidavit for Resident 2019-2026

Understanding the NJ L-4 Form

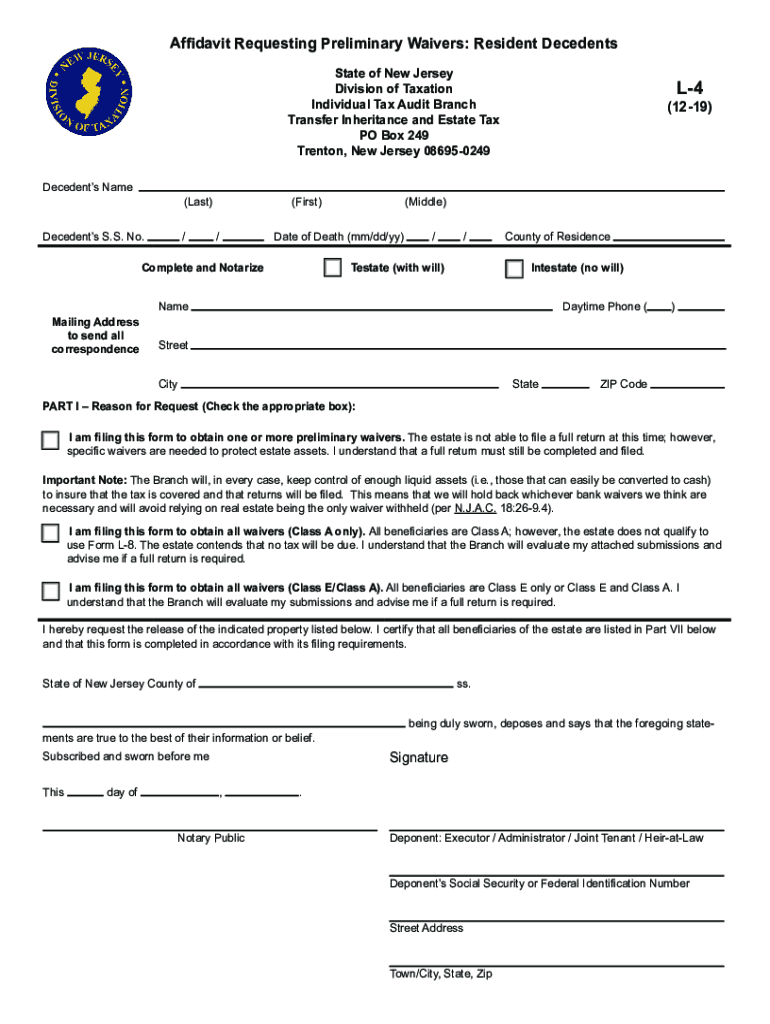

The NJ L-4 form is a tax waiver form used in New Jersey, specifically designed for individuals who are residents and wish to execute a self-executing waiver affidavit. This form is essential in the context of inheritance tax, allowing individuals to waive certain tax liabilities under specified conditions. Understanding its purpose is crucial for residents who may be dealing with estate matters.

Steps to Complete the NJ L-4 Form

Completing the NJ L-4 form involves several important steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary information, including details about the estate, the decedent, and the beneficiaries. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form as per the instructions provided, either online or by mail.

Eligibility Criteria for the NJ L-4 Form

To be eligible to use the NJ L-4 form, individuals must meet certain criteria. Primarily, the applicant must be a resident of New Jersey and must be involved in the estate of a decedent who has passed away. Additionally, the form is applicable only in cases where the waiver of inheritance tax is being sought. It is important to ensure that all eligibility requirements are met before proceeding with the application.

Required Documents for the NJ L-4 Form

When submitting the NJ L-4 form, certain documents are required to support the application. These typically include a copy of the decedent's death certificate, documentation proving the relationship to the decedent, and any relevant financial records that may pertain to the estate. Having these documents ready will facilitate a smoother application process and ensure compliance with state requirements.

Filing Deadlines for the NJ L-4 Form

Timely submission of the NJ L-4 form is crucial. The form must be filed within a specific timeframe following the decedent's passing. Generally, it is advisable to file the form as soon as possible to avoid any potential penalties or complications. Keeping track of important dates related to the estate will help ensure compliance with state regulations.

Digital vs. Paper Version of the NJ L-4 Form

Residents have the option to complete the NJ L-4 form digitally or in paper format. The digital version often provides a more streamlined process, allowing for easier submission and tracking. However, some individuals may prefer the traditional paper method for various reasons, including personal comfort or lack of access to technology. Both formats are acceptable, but it is essential to follow the specific submission guidelines for each method.

Common Scenarios for Using the NJ L-4 Form

The NJ L-4 form is commonly used in various scenarios involving estate management. For instance, it may be utilized by heirs seeking to waive their inheritance tax responsibilities when the estate's value falls below a certain threshold. Understanding these scenarios can help residents determine if the NJ L-4 form is applicable to their situation and how to proceed effectively.

Quick guide on how to complete l 8 this form is a self executing waiver affidavit for resident

Complete L 8 This Form Is A Self executing Waiver Affidavit For Resident effortlessly on any device

Online document management has become widely adopted by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage L 8 This Form Is A Self executing Waiver Affidavit For Resident on any device using airSlate SignNow Android or iOS applications and streamline your document-driven processes today.

How to modify and electronically sign L 8 This Form Is A Self executing Waiver Affidavit For Resident effortlessly

- Obtain L 8 This Form Is A Self executing Waiver Affidavit For Resident and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign L 8 This Form Is A Self executing Waiver Affidavit For Resident to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct l 8 this form is a self executing waiver affidavit for resident

Create this form in 5 minutes!

People also ask

-

What is the nj l 4 form and why is it important?

The nj l 4 form is essential for New Jersey residents as it allows for the reporting of income and tax deductions. Completing this form accurately can result in a more favorable tax outcome. Using airSlate SignNow makes it easier to eSign and submit your nj l 4 form securely and efficiently.

-

How does airSlate SignNow help with the nj l 4 form?

airSlate SignNow simplifies the process of preparing and signing the nj l 4 form. Our platform allows users to seamlessly fill out, eSign, and share the form, ensuring compliance and reducing the risk of errors. Additionally, our solution provides secure storage for all your tax documents.

-

Is airSlate SignNow suitable for businesses handling nj l 4 forms?

Yes, airSlate SignNow is an excellent choice for businesses that frequently handle the nj l 4 form. Our solution streamlines document management and provides bulk sending features, which save time and increase productivity when managing multiple forms. Plus, it ensures your documents are eSigned quickly.

-

What are the pricing options for airSlate SignNow when using the nj l 4 form?

airSlate SignNow offers flexible pricing plans designed to accommodate various needs, including individuals and businesses involved in processing the nj l 4 form. With competitive pricing, you receive a feature-rich platform that includes unlimited eSignatures and document management tools, making it cost-effective.

-

Can I integrate airSlate SignNow with other tools for the nj l 4 form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, allowing you to link your workflow related to the nj l 4 form with other tools you may already be using. This integration enhances productivity and ensures a smooth process from document preparation to signing.

-

What are the key benefits of using airSlate SignNow for the nj l 4 form?

Using airSlate SignNow for the nj l 4 form offers numerous benefits such as increased efficiency and enhanced security. Our electronic signing process eliminates the need for physical documents, reducing paper waste. Additionally, we provide a comprehensive audit trail for tracking all actions taken on your documents.

-

Is electronic signing of the nj l 4 form legally valid?

Yes, electronic signing of the nj l 4 form is legally valid in New Jersey and most other states under the Electronic Signatures in Global and National Commerce (ESIGN) Act. By using airSlate SignNow, you can ensure that your eSigning process adheres to all legal standards, making your signed documents enforceable.

Get more for L 8 This Form Is A Self executing Waiver Affidavit For Resident

Find out other L 8 This Form Is A Self executing Waiver Affidavit For Resident

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer