Nj Inheritance Waiver Tax Form 01 PDF 2008

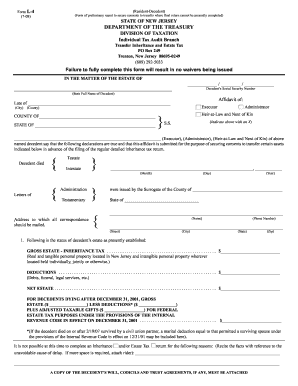

What is the NJ inheritance waiver tax form 01?

The NJ inheritance waiver tax form 01 is an official document used in New Jersey to claim a waiver of inheritance tax. This form is essential for beneficiaries who are seeking to exempt certain assets from inheritance tax obligations. The form serves as a declaration that the estate meets the criteria for tax exemption under New Jersey law. It is crucial for ensuring that the transfer of assets occurs smoothly without incurring unnecessary tax liabilities.

Steps to complete the NJ inheritance waiver tax form 01

Completing the NJ inheritance waiver tax form 01 involves several key steps:

- Gather necessary information about the deceased, including their full name, date of death, and estate details.

- Provide your information as the beneficiary, including your name, address, and relationship to the deceased.

- Detail the assets you are claiming the waiver for, ensuring you include accurate valuations and descriptions.

- Review the form for completeness and accuracy to avoid delays in processing.

- Sign and date the form, ensuring that all required signatures are included.

How to obtain the NJ inheritance waiver tax form 01

The NJ inheritance waiver tax form 01 can be obtained through several methods:

- Visit the New Jersey Division of Taxation website, where the form is available for download in PDF format.

- Request a physical copy by contacting the New Jersey Division of Taxation directly.

- Consult with an estate attorney or tax professional who can provide the form and assist with its completion.

Legal use of the NJ inheritance waiver tax form 01

The legal use of the NJ inheritance waiver tax form 01 is governed by New Jersey tax laws. This form must be filled out accurately and submitted to the appropriate tax authority to ensure compliance. Failure to properly complete and submit the form can result in penalties or delays in the transfer of assets. It is important to understand the legal implications of the waiver, as it affects the tax responsibilities of the estate and beneficiaries.

Required documents for the NJ inheritance waiver tax form 01

When submitting the NJ inheritance waiver tax form 01, certain documents are typically required to support your claim:

- A copy of the death certificate of the deceased.

- Documentation of the assets being claimed for the waiver, such as appraisals or bank statements.

- Proof of your relationship to the deceased, which may include birth certificates or marriage licenses.

Form submission methods for the NJ inheritance waiver tax form 01

The NJ inheritance waiver tax form 01 can be submitted through various methods:

- Online submission via the New Jersey Division of Taxation's electronic filing system, if available.

- Mailing the completed form and supporting documents to the appropriate tax office.

- In-person submission at designated tax offices, where assistance may be available.

Quick guide on how to complete nj inheritance waiver tax form 01 pdf

Easily Prepare Nj Inheritance Waiver Tax Form 01 Pdf on Any Device

Online document management has become prevalent among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools essential to create, modify, and eSign your documents swiftly without delays. Manage Nj Inheritance Waiver Tax Form 01 Pdf on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Simplest Way to Modify and eSign Nj Inheritance Waiver Tax Form 01 Pdf Effortlessly

- Find Nj Inheritance Waiver Tax Form 01 Pdf and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to record your changes.

- Choose your method of submitting the form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Nj Inheritance Waiver Tax Form 01 Pdf to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj inheritance waiver tax form 01 pdf

Create this form in 5 minutes!

How to create an eSignature for the nj inheritance waiver tax form 01 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inheritance tax waiver form NJ?

The inheritance tax waiver form NJ is a document used to request an exemption from inheritance tax in the state of New Jersey. It is crucial for beneficiaries to complete this form to ensure a smooth transfer of assets without incurring unexpected tax liabilities.

-

How do I obtain the inheritance tax waiver form NJ?

To obtain the inheritance tax waiver form NJ, you can visit the New Jersey Division of Taxation's official website or utilize airSlate SignNow to securely access and fill out the required documentation. Our platform simplifies the process, allowing you to effortlessly handle eSigning in one place.

-

Can airSlate SignNow help expedite the completion of the inheritance tax waiver form NJ?

Yes, airSlate SignNow streamlines the process of completing the inheritance tax waiver form NJ by providing easy-to-use templates and fast eSigning capabilities. This ensures that your documentation is completed accurately and submitted promptly.

-

What features does airSlate SignNow offer for managing the inheritance tax waiver form NJ?

airSlate SignNow offers features such as customizable templates, advanced collaboration tools, and secure cloud storage to manage the inheritance tax waiver form NJ effectively. These tools help create a seamless experience for both senders and recipients.

-

Is there a cost associated with using airSlate SignNow for the inheritance tax waiver form NJ?

airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for managing the inheritance tax waiver form NJ. You can choose from different subscription levels depending on your needs, enjoying all the platform's features at an affordable rate.

-

How can I track the status of my inheritance tax waiver form NJ with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your inheritance tax waiver form NJ through our user-friendly dashboard. This feature keeps you updated on whether the document has been viewed, signed, or completed by the necessary parties.

-

Does airSlate SignNow offer integrations for filing the inheritance tax waiver form NJ?

Yes, airSlate SignNow offers numerous integrations with popular applications and software, enabling you to file the inheritance tax waiver form NJ seamlessly. Whether you use accounting software or document management systems, airSlate SignNow can easily connect with your existing tools.

Get more for Nj Inheritance Waiver Tax Form 01 Pdf

Find out other Nj Inheritance Waiver Tax Form 01 Pdf

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form