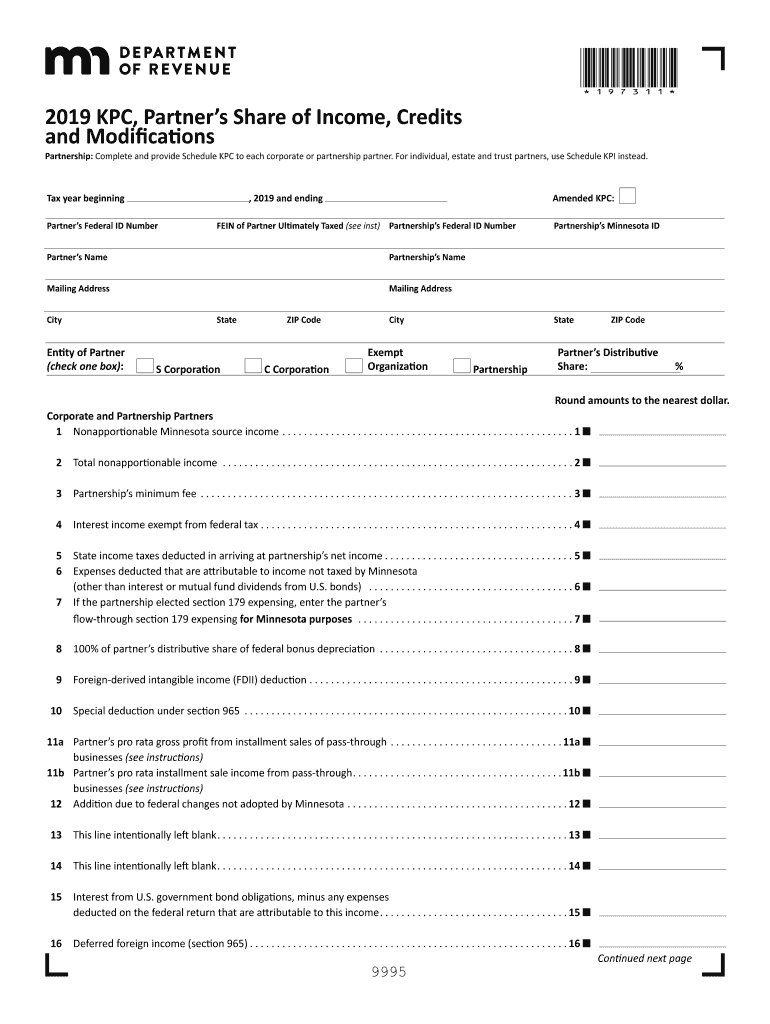

Partnership Complete and Provide Schedule KPC to Each Corporate or Partnership Partner Form

IRS Guidelines

The IRS provides specific guidelines for completing the 1040EZ form, which is designed for individuals with simple tax situations. This form is primarily for taxpayers who have a taxable income below a certain threshold, do not claim any dependents, and take the standard deduction. Familiarizing yourself with these guidelines ensures a smoother filing process. Key points include:

- Eligibility requirements, such as income limits and filing status.

- Instructions for entering income from wages, salaries, and tips.

- Details on how to report taxable interest and other income sources.

- Information on standard deductions applicable for the tax year.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1040EZ is crucial to avoid penalties. The typical deadline for filing individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of:

- Extensions for filing, which can be requested through Form 4868.

- Payment deadlines to avoid interest and penalties on owed taxes.

- Specific state deadlines that may differ from federal deadlines.

Required Documents

Before completing the 1040EZ form, gather all necessary documents to ensure accurate reporting. Essential documents include:

- W-2 forms from employers, detailing wages and withheld taxes.

- Any 1099 forms for additional income sources, such as freelance work.

- Records of any taxable interest earned from bank accounts.

- Documentation for any other income that needs to be reported.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 1040EZ form. Understanding these methods can help streamline the filing process:

- Online submission through IRS-approved e-filing software, which can expedite processing and refunds.

- Mailing a paper form to the appropriate IRS address based on your state of residence.

- In-person submission at local IRS offices, which may require an appointment.

Penalties for Non-Compliance

Failing to comply with tax filing requirements can lead to significant penalties. Common penalties associated with the 1040EZ include:

- Failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late.

- Failure-to-pay penalty, which is generally 0.5 percent of the unpaid tax for each month it remains unpaid.

- Interest on unpaid taxes that accrues from the due date until the tax is paid in full.

Digital vs. Paper Version

When choosing between the digital and paper versions of the 1040EZ, consider the benefits of each. The digital version offers advantages such as:

- Faster processing times and quicker refunds when filed electronically.

- Built-in error checking that can help prevent common mistakes.

- Convenience of filing from home without the need for postage.

Conversely, some taxpayers may prefer the traditional paper form for its tangible nature and ease of record-keeping.

Quick guide on how to complete partnership complete and provide schedule kpc to each corporate or partnership partner

Prepare Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner effortlessly

- Locate Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow that help with 1040ez instructions?

airSlate SignNow provides a user-friendly interface that simplifies the completion of 1040ez instructions. Key features include customizable templates, real-time collaboration, and the ability to upload and sign documents electronically. This ensures that users can efficiently manage their tax filings without any hassle.

-

How can airSlate SignNow assist me in understanding 1040ez instructions?

With airSlate SignNow, you can easily gather necessary documents and securely share them with tax professionals who can provide guidance on 1040ez instructions. The platform allows you to track document progress, ensuring you never miss an important step. Additionally, our customer support is available to help clarify any doubts.

-

Is there a cost associated with using airSlate SignNow for 1040ez instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs, from individual users to large businesses. Each plan provides access to essential features that streamline your document signing process, including those related to 1040ez instructions. We recommend checking our pricing page to find the best option for you.

-

Can I integrate airSlate SignNow with other accounting software for 1040ez instructions?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easy to incorporate 1040ez instructions into your existing workflow. This interoperability allows you to seamlessly manage your documents and ensure compliance with tax requirements.

-

What are the benefits of using airSlate SignNow for completing 1040ez instructions?

Using airSlate SignNow for 1040ez instructions simplifies your tax filing process by allowing for electronic signatures and document management. It minimizes the need for paper forms, reduces errors, and speeds up the overall completion time. Plus, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow when following 1040ez instructions?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols to protect your sensitive information while you follow 1040ez instructions. We also provide audit trails to ensure all actions taken on your documents are logged and accessible.

-

Are there resources available to help me with 1040ez instructions on airSlate SignNow?

Yes, airSlate SignNow provides a variety of resources, including tutorials and FAQs, to assist users with 1040ez instructions. These materials are designed to guide you through the process of signing and submitting your tax documents. Our support team is also available for further assistance.

Get more for Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner

- Maths and logic recruitment test form

- New vendor request form vendor name vendor address alexandercountync

- Netlink trust authorisation form

- Form p tem a

- Moving permit pdf lower macungie township form

- Un ashi medicare form

- Conductor licence renewal online kerala form

- Specify sex age m f below 18 40 49 18 29 50 59 30 form

Find out other Partnership Complete And Provide Schedule KPC To Each Corporate Or Partnership Partner

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online