Qdot Trust Sample Form

What is the Qdot Trust Sample

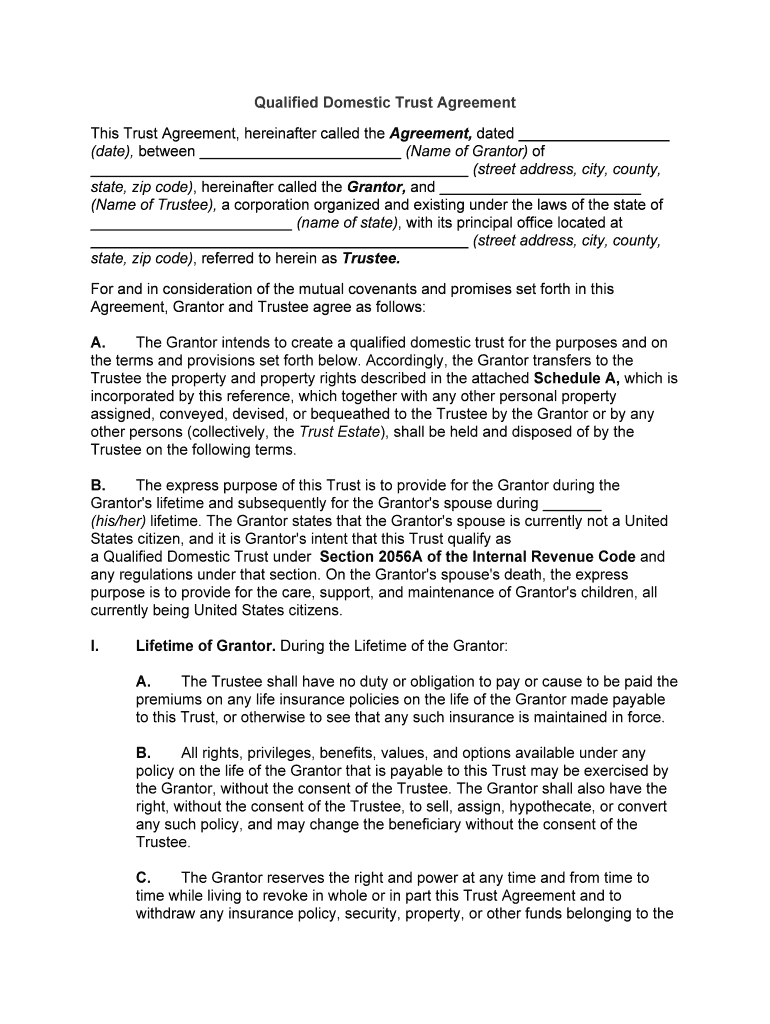

The Qdot Trust, or Qualified Domestic Trust, is a legal instrument designed to manage and protect assets for non-citizen spouses of U.S. citizens. This trust allows for the deferral of estate taxes that would typically apply upon the death of the U.S. citizen spouse. The Qdot Trust ensures that the surviving spouse can benefit from the assets while adhering to U.S. tax laws, thus providing a financial safety net for families in this unique situation. The trust must meet specific IRS requirements to qualify for tax deferral, making it essential to understand its structure and purpose.

Steps to Complete the Qdot Trust Sample

Completing a Qdot Trust Sample involves several critical steps to ensure compliance with legal requirements. Begin by gathering necessary information about both spouses, including full names, Social Security numbers, and financial details. Next, draft the trust document, ensuring it includes provisions that meet IRS guidelines. Key components should cover the trustee's powers, distribution of assets, and the rights of the surviving spouse. Once drafted, both spouses should review the document with legal counsel to confirm its validity. Finally, execute the trust by signing in the presence of a notary public, ensuring all formalities are observed to uphold its legal standing.

Legal Use of the Qdot Trust Sample

The legal use of a Qdot Trust Sample is governed by specific IRS regulations that dictate how the trust must be structured and managed. To qualify, the trust must be irrevocable, and the U.S. citizen spouse must be the only beneficiary during their lifetime. This ensures that the trust assets are not subject to estate tax until the death of the non-citizen spouse. It is crucial to adhere to these legal stipulations to avoid penalties and ensure the trust serves its intended purpose. Consulting with a legal expert in estate planning is advisable to navigate these complexities effectively.

Key Elements of the Qdot Trust Sample

Several key elements define the structure of a Qdot Trust Sample. First, it must clearly state the identity of the trustee, who will manage the trust assets. Second, the trust document should outline the specific assets included in the trust and the terms under which distributions can be made to the surviving spouse. Additionally, it should specify the conditions under which the trust will terminate, typically upon the death of the non-citizen spouse. Lastly, the document must include provisions for tax compliance, ensuring that all necessary filings are completed as required by the IRS.

State-Specific Rules for the Qdot Trust Sample

Each state may have unique regulations that affect the establishment and management of a Qdot Trust. It is essential to understand these state-specific rules, as they can influence how the trust is administered and the rights of the beneficiaries. For instance, some states may have additional requirements for notarization or witnessing the trust document. Furthermore, state tax laws may also impact the trust's operation. Consulting with a local attorney who specializes in estate planning can provide clarity on these nuances and ensure compliance with both state and federal laws.

Examples of Using the Qdot Trust Sample

Utilizing a Qdot Trust Sample can take various forms depending on individual circumstances. For example, a U.S. citizen married to a foreign national may use the trust to secure their family's financial future while minimizing estate tax liabilities. Another scenario could involve a couple planning for retirement, where the Qdot Trust ensures that the non-citizen spouse can access funds without immediate tax implications. These examples highlight the flexibility of the Qdot Trust in addressing diverse financial situations while adhering to legal requirements.

Quick guide on how to complete qdot trust sample

Effortlessly Prepare Qdot Trust Sample on Any Device

The management of online documents has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Qdot Trust Sample on any device using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to Modify and eSign Qdot Trust Sample with Ease

- Locate Qdot Trust Sample and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Qdot Trust Sample and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is qdot and how does it work with airSlate SignNow?

qdot is a unique feature within airSlate SignNow that enhances document management efficiency. By utilizing qdot, users can streamline the process of sending and signing documents, ensuring faster turnaround times and increased productivity. It's designed for businesses looking to simplify their workflows while maintaining security and compliance.

-

What are the pricing options for airSlate SignNow with qdot features?

AirSlate SignNow offers competitive pricing plans that include qdot functionalities. Customers can choose from various subscription tiers tailored to their needs, starting from a basic plan for small teams to advanced options for larger enterprises. Each plan is designed to deliver value, featuring scalability and flexibility that aligns with business growth.

-

Can qdot integrate with other business tools?

Yes, qdot seamlessly integrates with a variety of business tools and software. airSlate SignNow supports integrations with popular platforms like Salesforce, Google Workspace, and Microsoft Teams. This allows users to enhance their document workflows by connecting their existing tools effortlessly.

-

How does qdot enhance document security in airSlate SignNow?

The qdot feature in airSlate SignNow signNowly bolsters document security through advanced encryption and authentication methods. Users can rest assured that their sensitive documents are protected during the signing process. Additionally, airSlate SignNow complies with industry standards to ensure data integrity and confidentiality.

-

What benefits does qdot provide for small businesses?

For small businesses, qdot offers substantial benefits, including cost savings and increased efficiency in document handling. With airSlate SignNow's easy-to-use interface and automated workflows, small business owners can focus more on their core operations. This leads to quicker decision-making and improved customer satisfaction.

-

Is there a mobile app available for airSlate SignNow with qdot?

Yes, airSlate SignNow provides a mobile app that includes all qdot features, allowing users to manage documents on-the-go. This convenience ensures that you can send, sign, and track documents from your smartphone or tablet easily. The mobile app is designed to enhance productivity regardless of location.

-

How can I get support for using qdot in airSlate SignNow?

AirSlate SignNow offers comprehensive customer support for users leveraging the qdot feature. You can access a variety of resources including detailed documentation, tutorial videos, and live chat support. This ensures that you have the assistance needed to maximize the benefits of qdot in your document workflows.

Get more for Qdot Trust Sample

- Nm power of attorney mvd form

- 2findex form

- Ssa 4164 249607559 form

- Affidavit of shared residence form

- Solicitud de pago directo por incapacidad temporal umivale form

- Transcript request form or at wwwboswegobbedubtranscript

- State university of new york college of agricultur form

- Precision xceed pro glucose meter training and competency massgeneral form

Find out other Qdot Trust Sample

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template