CARES Act Self Certification and COVID Distribution Form

What is the CARES Act Self Certification And COVID Distribution Form

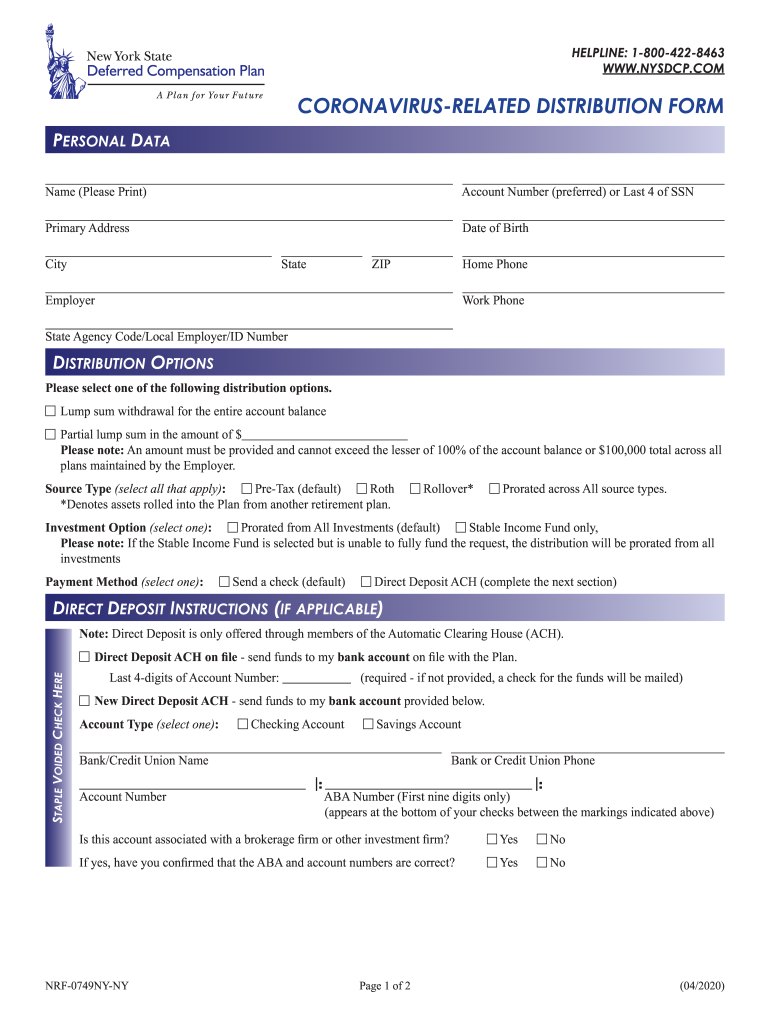

The CARES Act Self Certification and COVID Distribution Form is a document designed to facilitate access to distributions from retirement plans under the provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This form allows eligible individuals to certify their eligibility for taking a distribution due to adverse financial conditions caused by the COVID-19 pandemic. The form ensures that both the individual and the plan administrator have a clear understanding of the eligibility criteria and the distribution process.

How to use the CARES Act Self Certification And COVID Distribution Form

To effectively use the CARES Act Self Certification and COVID Distribution Form, individuals should first review the eligibility requirements outlined in the CARES Act. Once eligibility is confirmed, complete the form by providing necessary personal information, including your name, social security number, and details regarding your retirement plan. Ensure that all information is accurate to avoid delays in processing. After filling out the form, submit it to your plan administrator as per their specified submission guidelines.

Steps to complete the CARES Act Self Certification And COVID Distribution Form

Completing the CARES Act Self Certification and COVID Distribution Form involves several key steps:

- Review the eligibility criteria to confirm you qualify for a distribution.

- Gather required personal information, including your retirement account details.

- Fill out the form accurately, ensuring all fields are completed.

- Sign and date the form to validate your certification.

- Submit the form to your plan administrator via their preferred method, whether online or by mail.

Legal use of the CARES Act Self Certification And COVID Distribution Form

The legal use of the CARES Act Self Certification and COVID Distribution Form hinges on compliance with the provisions set forth in the CARES Act. This form serves as a legal declaration of eligibility for distributions, and it is essential that individuals provide truthful and accurate information. Misrepresentation or failure to meet eligibility criteria may result in penalties or the requirement to repay any distributions taken under false pretenses.

Eligibility Criteria

To qualify for the distributions outlined in the CARES Act, individuals must meet specific eligibility criteria. Generally, this includes being diagnosed with COVID-19, experiencing adverse financial consequences due to the pandemic, or having a spouse or dependent who has been diagnosed. Additionally, individuals must be participants in a qualified retirement plan, such as a 401(k) or IRA, to utilize the CARES Act Self Certification and COVID Distribution Form.

Required Documents

When completing the CARES Act Self Certification and COVID Distribution Form, individuals may need to provide supporting documentation to verify their eligibility. This could include medical records confirming a COVID-19 diagnosis, proof of income loss, or documentation of other financial hardships related to the pandemic. Having these documents ready can streamline the process and facilitate quicker approval from the plan administrator.

Form Submission Methods

The CARES Act Self Certification and COVID Distribution Form can typically be submitted through various methods, depending on the plan administrator's preferences. Common submission methods include:

- Online submission via the plan administrator's secure portal.

- Mailing a hard copy of the form to the designated address.

- In-person delivery, if permitted by the plan administrator.

It is advisable to confirm the preferred submission method with your plan administrator to ensure proper processing of your form.

Quick guide on how to complete cares act self certification and covid distribution form

Effortlessly Prepare CARES Act Self Certification And COVID Distribution Form on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed materials, allowing you to locate the necessary form and securely save it online. airSlate SignNow offers all the tools required to create, modify, and eSign your documents quickly without issues. Manage CARES Act Self Certification And COVID Distribution Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign CARES Act Self Certification And COVID Distribution Form with Ease

- Obtain CARES Act Self Certification And COVID Distribution Form and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Mark crucial sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, boring form navigation, or errors requiring new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign CARES Act Self Certification And COVID Distribution Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the CARES Act Self Certification And COVID Distribution Form?

The CARES Act Self Certification And COVID Distribution Form is a document that allows eligible individuals to signNow their qualification for a distribution from their retirement accounts under the CARES Act provisions. This form simplifies the process of accessing funds during challenging times caused by the COVID-19 pandemic.

-

How does the CARES Act Self Certification And COVID Distribution Form work?

The form guides users through the self-certification process, outlining the criteria to determine eligibility for COVID-related distributions. Once completed, it can be submitted electronically through platforms like airSlate SignNow, making it easier and faster to manage essential financial documents.

-

What are the benefits of using airSlate SignNow for the CARES Act Self Certification And COVID Distribution Form?

Using airSlate SignNow for the CARES Act Self Certification And COVID Distribution Form streamlines document management with e-signature functionality, ensuring quick turnaround times. The platform is user-friendly and cost-effective, allowing businesses to remain compliant while providing a seamless user experience.

-

Is there a cost associated with using the CARES Act Self Certification And COVID Distribution Form on airSlate SignNow?

AirSlate SignNow offers various pricing plans catered to different business needs, which include access to features like the CARES Act Self Certification And COVID Distribution Form. You can choose a plan that fits your budget and requirements, ensuring you only pay for the features you need.

-

Can I integrate the CARES Act Self Certification And COVID Distribution Form with other software?

Yes, airSlate SignNow provides integration capabilities with a wide range of applications, allowing for seamless data transfer and management alongside the CARES Act Self Certification And COVID Distribution Form. This helps streamline workflows and maintain efficiency across your business operations.

-

How secure is the airSlate SignNow platform for handling the CARES Act Self Certification And COVID Distribution Form?

AirSlate SignNow prioritizes security and compliance, employing encryption and secure access protocols to protect sensitive information such as the CARES Act Self Certification And COVID Distribution Form. Users can sign documents confidently, knowing their data is safeguarded.

-

Who can benefit from using the CARES Act Self Certification And COVID Distribution Form?

Individuals who are eligible for COVID-related distributions from their retirement plans will benefit from using the CARES Act Self Certification And COVID Distribution Form. Additionally, businesses assisting employees with this process can utilize airSlate SignNow to simplify documentation.

Get more for CARES Act Self Certification And COVID Distribution Form

Find out other CARES Act Self Certification And COVID Distribution Form

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document