Form IRS 1041 Schedule K 1 Fill Online, Printable 2021

What is the IRS Form 1041 Schedule K-1?

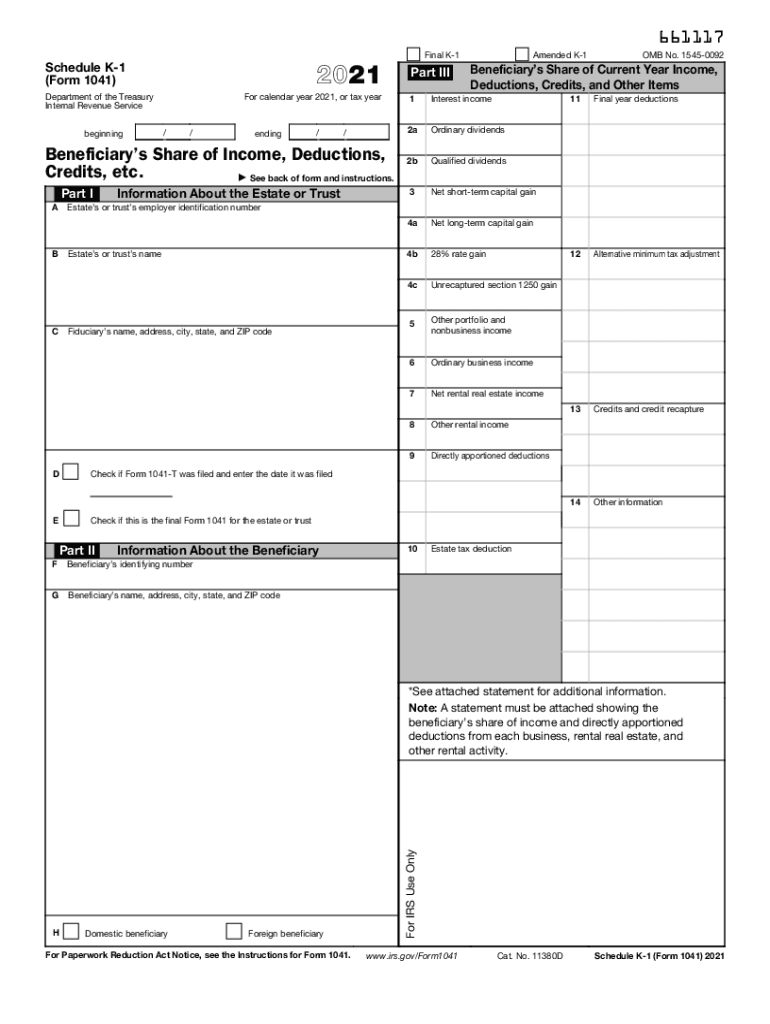

The IRS Form 1041 Schedule K-1 is a tax document used to report income, deductions, and credits from a partnership, estate, or trust. This form is essential for beneficiaries and partners as it provides detailed information regarding their share of the entity's income, which must be reported on their individual tax returns. The K-1 form is part of the IRS Form 1041, which is filed by estates and trusts to report income and expenses. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the IRS Form 1041 Schedule K-1

Completing the IRS Form 1041 Schedule K-1 involves several key steps:

- Gather necessary documentation, including financial statements from the partnership, estate, or trust.

- Fill out the basic information section, which includes the name, address, and taxpayer identification number of the entity and the recipient.

- Report the income, deductions, and credits allocated to the recipient. This includes ordinary business income, rental income, and capital gains.

- Review the completed form for accuracy to ensure all figures are correct and comply with IRS guidelines.

- Provide a copy of the completed Schedule K-1 to the recipient and retain a copy for your records.

Legal Use of the IRS Form 1041 Schedule K-1

The IRS Form 1041 Schedule K-1 is legally binding when completed accurately and submitted according to IRS guidelines. It serves as a formal declaration of income distribution from partnerships, estates, or trusts to their beneficiaries or partners. Proper use of this form is vital for compliance with tax laws, as it ensures that all parties report their income correctly. Failure to accurately report income from a K-1 can lead to penalties and interest on unpaid taxes.

Filing Deadlines for the IRS Form 1041 Schedule K-1

Filing deadlines for the IRS Form 1041 Schedule K-1 typically align with the deadlines for Form 1041. Generally, Form 1041 is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the form is due by April 15. It is important for beneficiaries to receive their K-1 in a timely manner to ensure they can report the income on their personal tax returns by the April 15 deadline.

Who Issues the IRS Form 1041 Schedule K-1?

The IRS Form 1041 Schedule K-1 is issued by partnerships, estates, or trusts. The entity responsible for filing Form 1041 must prepare and distribute Schedule K-1 to each beneficiary or partner who received income during the tax year. This form provides the necessary information for recipients to accurately report their share of income on their personal tax returns. It is essential for the issuing entity to ensure that the K-1 is completed correctly and sent out promptly to avoid any delays in tax filing for recipients.

Key Elements of the IRS Form 1041 Schedule K-1

Several key elements are included in the IRS Form 1041 Schedule K-1:

- Entity Information: Name, address, and taxpayer identification number of the estate, trust, or partnership.

- Recipient Information: Name, address, and taxpayer identification number of the beneficiary or partner.

- Income Reporting: Detailed breakdown of income types, including ordinary income, capital gains, and deductions.

- Tax Credits: Any credits that can be claimed by the recipient based on their share of the entity's income.

Quick guide on how to complete 2013 form irs 1041 schedule k 1 fill online printable

Effortlessly prepare Form IRS 1041 Schedule K 1 Fill Online, Printable on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents since you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Form IRS 1041 Schedule K 1 Fill Online, Printable on any device utilizing airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to edit and eSign Form IRS 1041 Schedule K 1 Fill Online, Printable with ease

- Find Form IRS 1041 Schedule K 1 Fill Online, Printable and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IRS 1041 Schedule K 1 Fill Online, Printable and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form irs 1041 schedule k 1 fill online printable

Create this form in 5 minutes!

How to create an eSignature for the 2013 form irs 1041 schedule k 1 fill online printable

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is tax form K-1?

Tax form K-1 is a document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information to individual taxpayers, helping them accurately report their share of the entity's income on their tax returns.

-

How do I access my tax form K-1?

You typically receive your tax form K-1 from the partnership or corporation in which you have an investment. If you use document management solutions like airSlate SignNow, you can electronically request and securely receive your K-1 to streamline your tax preparation.

-

What information is included in tax form K-1?

Tax form K-1 includes essential information such as the entity's income, losses, and other tax-related data pertinent to each partner or shareholder. This information is crucial for filing accurate individual tax returns and is best accessed through reliable document platforms like airSlate SignNow.

-

Are there any fees associated with obtaining a tax form K-1?

Typically, there are no direct fees associated with obtaining your tax form K-1, as it is provided by the business entity. However, if you utilize document management services like airSlate SignNow for eSigning or retrieving the form, you may incur service fees depending on your subscription plan.

-

Can I eSign my tax form K-1 using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign your tax form K-1 securely and efficiently. This feature helps meet tax deadlines, all while providing a legally binding signature and ensuring your documents are stored safely in the cloud.

-

How does airSlate SignNow enhance the process of handling tax form K-1?

airSlate SignNow streamlines the process of handling tax form K-1 by allowing businesses to easily prepare, send, and eSign documents electronically. This means faster turnaround times and improved tracking of your important tax documents, making tax season less stressful.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including tax form K-1, offers benefits like easy access, secure eSigning, and integrated document storage. This centralized approach simplifies collaboration, especially during the busy tax season, ensuring no documents are overlooked.

Get more for Form IRS 1041 Schedule K 1 Fill Online, Printable

Find out other Form IRS 1041 Schedule K 1 Fill Online, Printable

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval