Arkansas Corporation Estimated Tax Declaration Vouchers 2022

What is the Arkansas Corporation Estimated Tax Declaration Vouchers

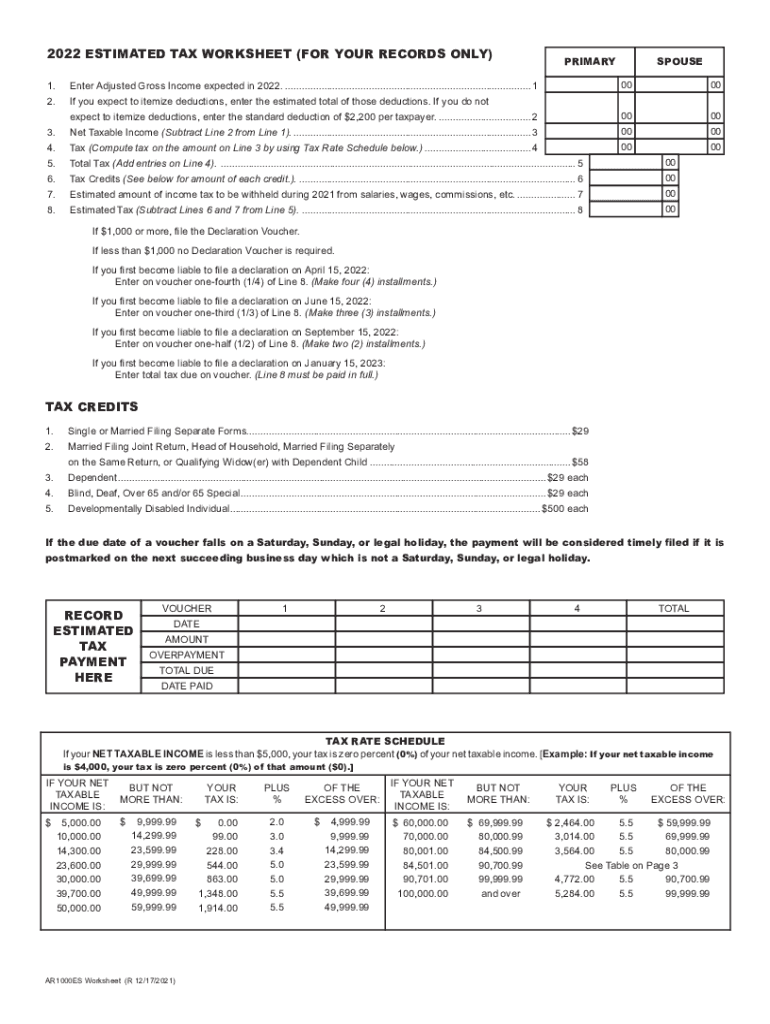

The Arkansas Corporation Estimated Tax Declaration Vouchers are official forms used by corporations to report and pay their estimated tax liabilities to the state of Arkansas. These vouchers, often referred to as the AR1000ES, are essential for businesses to ensure compliance with state tax regulations. By submitting these vouchers, corporations can estimate their tax obligations based on expected income, allowing for timely payments throughout the tax year.

How to use the Arkansas Corporation Estimated Tax Declaration Vouchers

To utilize the Arkansas Corporation Estimated Tax Declaration Vouchers, businesses must first calculate their expected taxable income for the year. Based on this estimate, they can determine the appropriate amount of tax to pay. The completed voucher must then be submitted along with the payment to the Arkansas Department of Finance and Administration (DFA). It is crucial to keep a copy of the submitted voucher for record-keeping and future reference.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when submitting their Arkansas Corporation Estimated Tax Declaration Vouchers. Typically, these vouchers are due quarterly, with deadlines falling on the 15th day of the month following the end of each quarter. For example, the first quarter payment is due on April 15, the second on June 15, the third on September 15, and the fourth on January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Steps to complete the Arkansas Corporation Estimated Tax Declaration Vouchers

Completing the Arkansas Corporation Estimated Tax Declaration Vouchers involves several steps:

- Gather financial records to estimate expected income for the year.

- Calculate the estimated tax liability based on the projected income.

- Fill out the AR1000ES form with the required information, including the estimated tax amount.

- Submit the completed voucher along with the payment to the Arkansas DFA.

- Retain a copy of the voucher and payment confirmation for your records.

Key elements of the Arkansas Corporation Estimated Tax Declaration Vouchers

The key elements of the Arkansas Corporation Estimated Tax Declaration Vouchers include the corporation's name, address, and federal employer identification number (EIN). Additionally, the form requires the estimated tax amount, payment details, and the period for which the payment is being made. Accurate completion of these elements is crucial for ensuring the validity of the submission.

Penalties for Non-Compliance

Failure to comply with the requirements for the Arkansas Corporation Estimated Tax Declaration Vouchers can lead to significant penalties. Corporations that do not submit their vouchers on time may incur late fees and interest on the unpaid tax amount. Additionally, repeated non-compliance can result in further legal action by the state, including the potential for audits or additional fines.

Quick guide on how to complete arkansas corporation estimated tax declaration vouchers

Effortlessly prepare Arkansas Corporation Estimated Tax Declaration Vouchers on any device

Digital document management has become favored by businesses and individuals alike. It serves as an outstanding eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Arkansas Corporation Estimated Tax Declaration Vouchers on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Arkansas Corporation Estimated Tax Declaration Vouchers with minimal effort

- Obtain Arkansas Corporation Estimated Tax Declaration Vouchers and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your edits.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Modify and eSign Arkansas Corporation Estimated Tax Declaration Vouchers and ensure superior communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas corporation estimated tax declaration vouchers

Create this form in 5 minutes!

People also ask

-

What is Arkansas estimated tax and how does it work?

Arkansas estimated tax refers to the tax payments that self-employed individuals, business owners, or those with signNow income not subject to withholding must make throughout the year. This helps ensure that taxpayers do not owe a large sum when they file their annual returns. It's crucial to calculate these estimates accurately to avoid penalties.

-

How do I calculate my Arkansas estimated tax payments?

To calculate your Arkansas estimated tax payments, you'll need to estimate your total income for the year, subtract any deductions, and apply the appropriate tax rate. The Arkansas Department of Finance and Administration provides guidelines and worksheets for accurate calculations. Consulting a tax professional can also help ensure your estimates are correct.

-

What are the deadlines for Arkansas estimated tax payments?

Arkansas estimated tax payments are generally due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It’s essential to adhere to these deadlines to avoid penalties or interest on unpaid taxes. Make sure to check any updates from the Arkansas Department of Finance and Administration for specific dates.

-

Can airSlate SignNow help with managing my Arkansas estimated tax documents?

Yes, airSlate SignNow can simplify the management of your Arkansas estimated tax documents by allowing you to easily create, send, and eSign tax forms. This helps keep your paperwork organized and ensures that you meet all submission deadlines. Our platform is designed for ease of use, making tax preparation less stressful.

-

What features does airSlate SignNow offer for businesses concerned about Arkansas estimated tax?

airSlate SignNow offers features such as eSigning, document templates, and automated workflows that streamline the process of handling Arkansas estimated tax documents. With our cloud-based solution, you can manage your tax-related documents from anywhere, which is particularly beneficial for busy professionals. Enhanced security features also protect sensitive financial information.

-

Is there a cost associated with using airSlate SignNow for Arkansas estimated tax documents?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans to cater to different business needs. Our plans are designed to be cost-effective, making it easier for you to manage your Arkansas estimated tax documents without straining your budget. Each plan comes with robust features to enhance your document management capabilities.

-

How can I integrate airSlate SignNow with my existing software for Arkansas estimated tax?

airSlate SignNow offers integration capabilities with popular software applications, allowing you to connect your existing systems for seamless document management related to Arkansas estimated tax. Whether you're using accounting software or customer relationship management tools, our integrations can help streamline your workflow. Check our integration list to find compatible applications.

Get more for Arkansas Corporation Estimated Tax Declaration Vouchers

- Motion and affidavit to proceed in forma pauperis montana

- Montana sample petition form

- Montana notice form

- Certificate of service montana form

- Petition for reinstatement to active status montana form

- Attorneys mediation evaluation form montana

- Mediator background information form montana

- Montana mediator form

Find out other Arkansas Corporation Estimated Tax Declaration Vouchers

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online