D 40ES Office of Tax and Revenue 2024-2026

What is the AR1000ES Form?

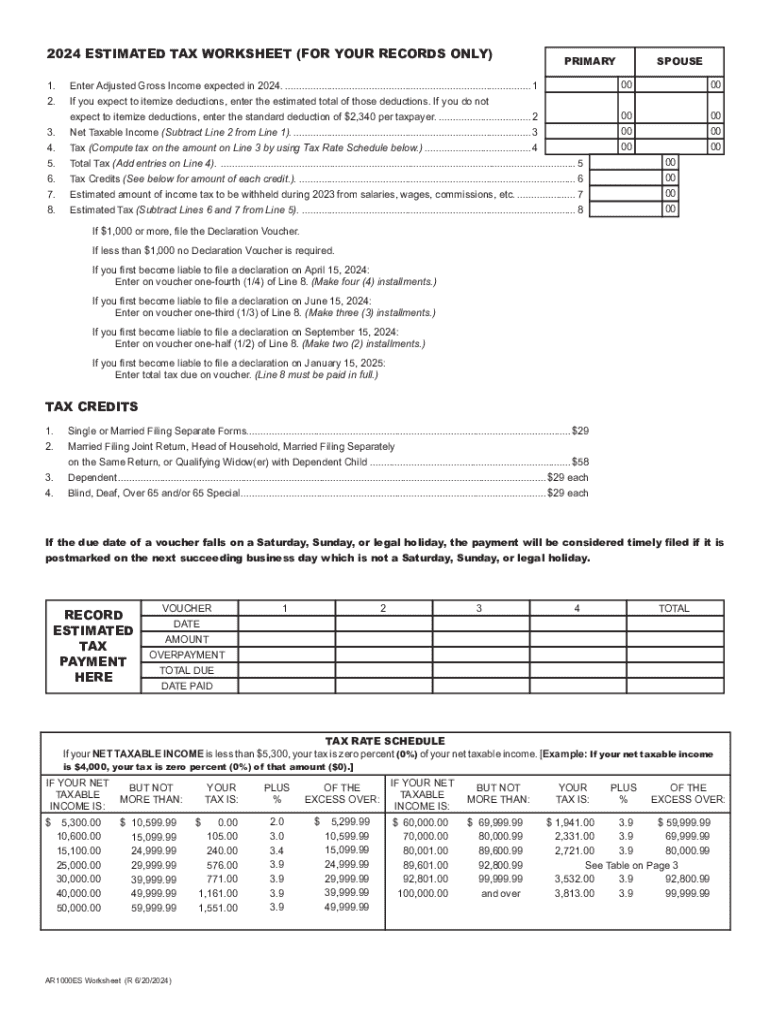

The AR1000ES form is a crucial document used by taxpayers in the United States for estimated tax payments. This form is specifically designed for individuals and businesses to report and pay estimated income taxes to the appropriate state revenue department. It is particularly relevant for those who may not have taxes withheld from their income, such as self-employed individuals, freelancers, or business owners. By submitting the AR1000ES, taxpayers can ensure they meet their tax obligations and avoid penalties for underpayment.

Steps to Complete the AR1000ES Form

Completing the AR1000ES form involves several straightforward steps:

- Gather Financial Information: Collect your income details, including wages, dividends, and any other sources of income.

- Calculate Estimated Tax: Use the previous year's tax return as a reference to estimate your current tax liability.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number, along with your estimated tax amount.

- Review Your Entries: Double-check all information for accuracy to prevent errors that could lead to penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the AR1000ES form is essential to avoid penalties. Generally, the deadlines for submitting estimated tax payments are:

- April 15 for the first quarter payment

- June 15 for the second quarter payment

- September 15 for the third quarter payment

- January 15 of the following year for the fourth quarter payment

It is advisable to mark these dates on your calendar to ensure timely submissions.

Required Documents for the AR1000ES Form

When preparing to fill out the AR1000ES form, certain documents are necessary to ensure accurate reporting:

- Previous year's tax return for reference

- Documentation of all income sources, including W-2s and 1099s

- Records of any deductions or credits you plan to claim

Having these documents on hand will streamline the process and help in accurately estimating your tax obligations.

Form Submission Methods

The AR1000ES form can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many state revenue departments offer online portals for easy submission.

- Mail: You can send the completed form to the designated address provided by your state’s tax authority.

- In-Person: Some taxpayers may prefer to submit their forms directly at local tax offices.

Choosing the right method can depend on personal preference and urgency.

Penalties for Non-Compliance

Failing to submit the AR1000ES form or underpaying estimated taxes can lead to significant penalties. Taxpayers may face:

- Interest on unpaid taxes

- Late payment penalties

- Potential legal action for continued non-compliance

It is essential to stay informed and meet all tax obligations to avoid these consequences.

Quick guide on how to complete d 40es office of tax and revenue

Complete D 40ES Office Of Tax And Revenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage D 40ES Office Of Tax And Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

How to modify and eSign D 40ES Office Of Tax And Revenue with ease

- Find D 40ES Office Of Tax And Revenue and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign D 40ES Office Of Tax And Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 40es office of tax and revenue

Create this form in 5 minutes!

How to create an eSignature for the d 40es office of tax and revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000es and how does it work?

The ar1000es is a powerful tool within the airSlate SignNow platform that allows users to easily send and eSign documents. It streamlines the signing process, making it efficient and user-friendly. With the ar1000es, businesses can enhance their document workflows and improve overall productivity.

-

What are the key features of the ar1000es?

The ar1000es offers a variety of features including customizable templates, real-time tracking, and secure cloud storage. These features ensure that users can manage their documents effectively while maintaining compliance and security. The ar1000es is designed to meet the diverse needs of businesses looking for an efficient eSigning solution.

-

How much does the ar1000es cost?

Pricing for the ar1000es varies based on the plan selected, with options for businesses of all sizes. airSlate SignNow provides flexible pricing models to accommodate different budgets and needs. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What are the benefits of using the ar1000es for my business?

Using the ar1000es can signNowly reduce the time spent on document management and signing processes. It enhances collaboration among team members and clients, leading to faster turnaround times. Additionally, the ar1000es helps in reducing paper usage, contributing to a more sustainable business practice.

-

Can the ar1000es integrate with other software?

Yes, the ar1000es seamlessly integrates with various third-party applications, enhancing its functionality. This allows businesses to connect their existing tools and workflows with the airSlate SignNow platform. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is the ar1000es secure for sensitive documents?

Absolutely, the ar1000es prioritizes security with advanced encryption and compliance with industry standards. It ensures that all documents are protected during transmission and storage. Businesses can confidently use the ar1000es for sensitive information without compromising security.

-

How can I get started with the ar1000es?

Getting started with the ar1000es is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, you can choose a subscription plan that fits your business needs and start sending and eSigning documents immediately.

Get more for D 40ES Office Of Tax And Revenue

- Letter sending order form

- Form bill sale 497330704

- Corporate establishing form

- Lease rental agreement 497330706 form

- Equipment option form

- Business trust template form

- Agreement to maintain and service medical equipment form

- Agreement and declaration of an unincorporated real estate business trust form

Find out other D 40ES Office Of Tax And Revenue

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure