Discharge Refinance Authority Form 2019-2026

What is the Discharge Refinance Authority Form

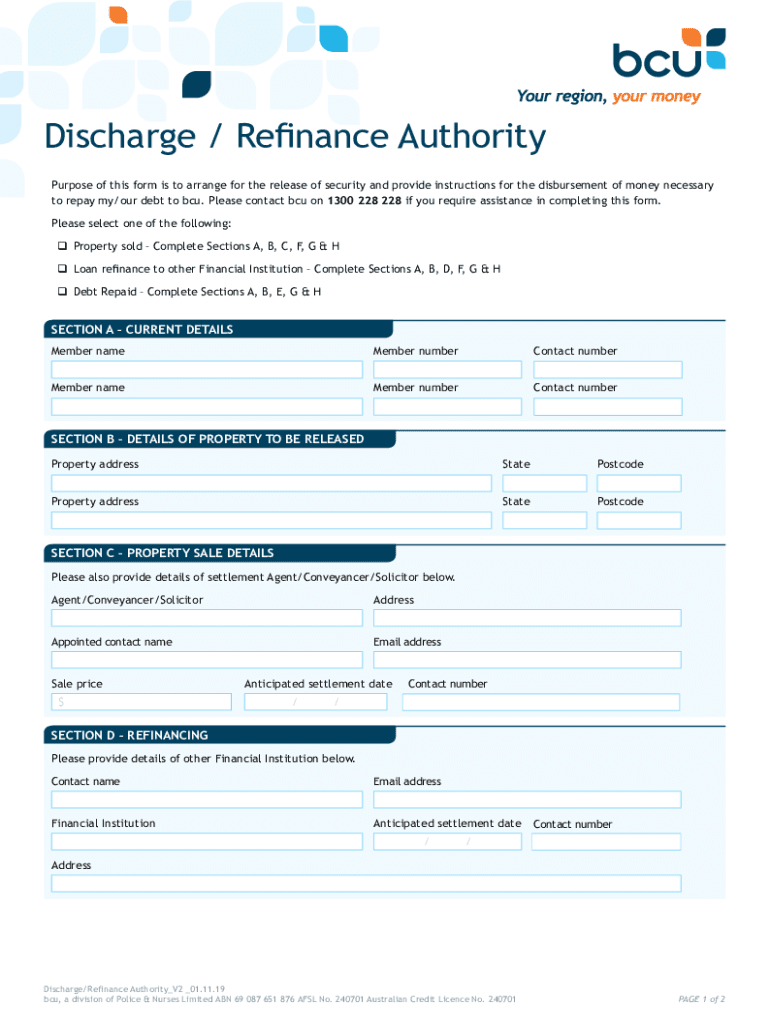

The discharge refinance authority form is a crucial document used in the refinancing process of loans, particularly in the context of mortgages. This form grants permission to a lender to discharge an existing loan and replace it with a new one under different terms. It is essential for borrowers who wish to refinance their current loans to secure better interest rates or adjust their loan terms. Understanding this form is vital for ensuring that the refinancing process proceeds smoothly and legally.

How to use the Discharge Refinance Authority Form

Using the discharge refinance authority form involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from your lender or financial institution. Next, fill out the required fields accurately, providing information such as your personal details, loan number, and the lender's information. Once completed, review the form for any errors before submitting it to your lender. This form can often be submitted electronically, enhancing the efficiency of the refinancing process.

Key elements of the Discharge Refinance Authority Form

Several key elements must be included in the discharge refinance authority form to ensure its validity. These elements typically encompass:

- Borrower's Information: Full name, address, and contact details.

- Loan Details: Current loan number and the amount being refinanced.

- Lender's Information: Name and contact details of the lender involved in the refinance.

- Signature: The borrower's signature, which validates the authority granted to the lender.

Each of these components plays a critical role in the form's acceptance and the overall refinancing process.

Steps to complete the Discharge Refinance Authority Form

Completing the discharge refinance authority form involves a series of methodical steps:

- Obtain the latest version of the form from your lender.

- Carefully read the instructions provided with the form.

- Fill in your personal information, ensuring accuracy.

- Provide details about the existing loan, including the loan number and amount.

- Include the lender's information, ensuring all contact details are correct.

- Sign and date the form to authorize the discharge of the loan.

- Submit the completed form to your lender, either electronically or via mail.

Following these steps will help ensure that your form is completed correctly and submitted in a timely manner.

Legal use of the Discharge Refinance Authority Form

The discharge refinance authority form holds legal significance in the refinancing process. It serves as a binding agreement between the borrower and the lender, outlining the borrower's consent to discharge the existing loan. To be legally valid, the form must be completed accurately and signed by the borrower. Additionally, compliance with relevant laws and regulations, such as the Electronic Signatures in Global and National Commerce Act (ESIGN), is crucial for ensuring that the form is recognized legally in the United States.

Form Submission Methods (Online / Mail / In-Person)

Submitting the discharge refinance authority form can be done through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders provide a secure online portal for submitting forms electronically, which can expedite the process.

- Mail: You can print the completed form and send it via postal mail to your lender's designated address.

- In-Person: Some borrowers may choose to deliver the form directly to their lender's office for immediate processing.

Choosing the appropriate submission method can enhance the efficiency of your refinancing process.

Quick guide on how to complete discharge refinance authority form

Effortlessly prepare Discharge Refinance Authority Form on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle Discharge Refinance Authority Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Discharge Refinance Authority Form with ease

- Locate Discharge Refinance Authority Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a customary wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Discharge Refinance Authority Form and ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct discharge refinance authority form

Create this form in 5 minutes!

People also ask

-

What is a discharge refinance authority form?

A discharge refinance authority form is a document that allows borrowers to authorize their lenders to initiate the discharge process for a refinance. This form is essential for ensuring that the previous mortgage is officially closed out, enabling a seamless transition to the new loan. By using a discharge refinance authority form, borrowers can streamline their refinancing process.

-

How do I complete a discharge refinance authority form?

Completing a discharge refinance authority form typically involves providing your personal and mortgage details. You'll need to enter information such as your loan number, lender's information, and your signature to authorize the discharge. airSlate SignNow offers templates and an easy-to-use interface to help you fill out this form quickly and accurately.

-

Is there a cost associated with the discharge refinance authority form?

Generally, the discharge refinance authority form itself is free to complete, but there may be fees associated with the refinancing process itself. airSlate SignNow provides a cost-effective solution to facilitate the signing and sharing of important documents, including refinancing paperwork. Consider all potential costs to ensure a smooth refinancing experience.

-

What are the benefits of using airSlate SignNow for my discharge refinance authority form?

Using airSlate SignNow to handle your discharge refinance authority form offers numerous benefits, such as increased efficiency and security. The platform allows you to eSign documents from anywhere, eliminating the need for physical paperwork. Additionally, SignNow provides robust tracking features, ensuring you stay informed about the document's status throughout the process.

-

Can I integrate airSlate SignNow with other financial tools for my refinance?

Yes, airSlate SignNow offers integrations with various financial tools and services. This allows you to seamlessly connect your discharge refinance authority form process with other applications, improving overall workflow. By utilizing integrations, you can manage documents and finances more effectively, making your refinancing experience smoother.

-

How does airSlate SignNow ensure my discharge refinance authority form is secure?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures. When you eSign and send your discharge refinance authority form through the platform, your data is protected against unauthorized access. This commitment to security gives you peace of mind while handling sensitive financial documents.

-

What features does airSlate SignNow offer for managing my refinancing documents?

AirSlate SignNow provides a range of features for managing refinancing documents, including easy-to-use templates, customizable workflows, and robust signing options. You can create, edit, and store your discharge refinance authority form alongside other necessary documents seamlessly. These features enable faster processing and better organization of your refinancing paperwork.

Get more for Discharge Refinance Authority Form

- Gonioscopy documentation form

- Uia 1027 form

- Asq 39 months form

- Speakout placement test instructions form

- Lcsb verification of community service performed in grades 9 12 lake k12 fl

- Fire alarm activation report 70399792 form

- Ifta 200a form

- State of california electrical power distribution cec nrci elc 01 e created 0714 california energy commission certificate of form

Find out other Discharge Refinance Authority Form

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online