Claim Residence Nil Rate Band Form

What is the Claim Residence Nil Rate Band

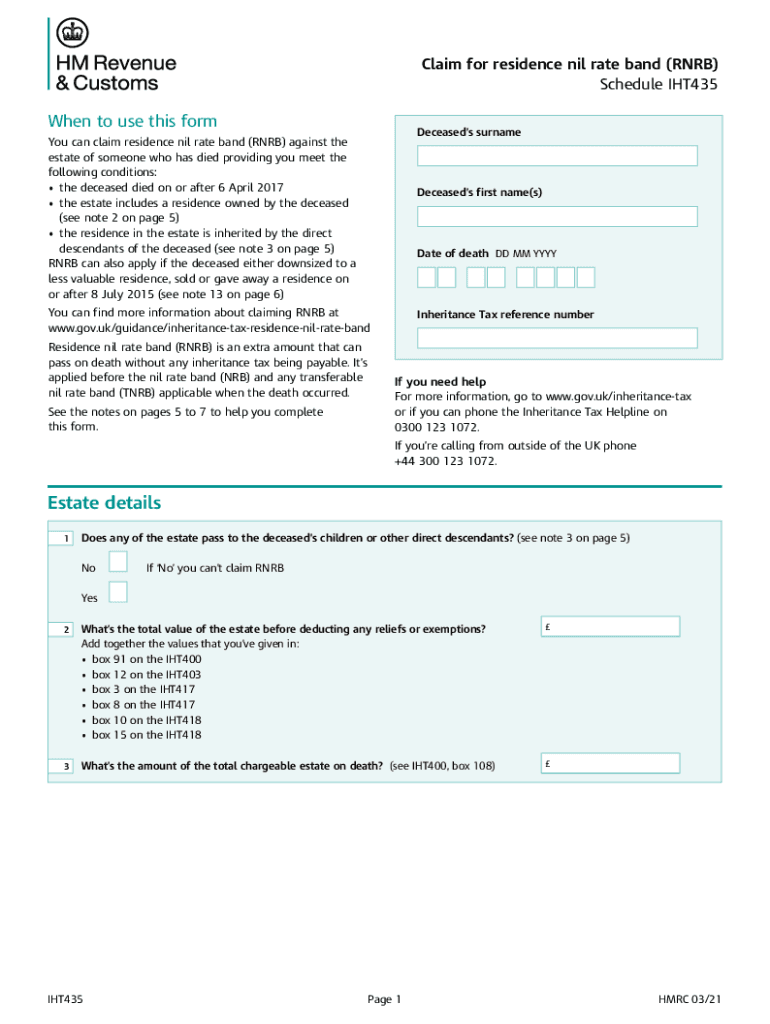

The Claim Residence Nil Rate Band (RNRB) is a tax relief available in the United Kingdom that allows individuals to pass on a certain amount of their estate to their heirs without incurring inheritance tax. The RNRB is designed to help families keep their homes and ensure that they do not face significant tax burdens when transferring property. This relief is particularly beneficial for those who own a family home and wish to pass it on to direct descendants, such as children or grandchildren.

How to Use the Claim Residence Nil Rate Band

To effectively utilize the Claim Residence Nil Rate Band, individuals must first determine their eligibility based on the value of their estate and the property being passed on. The RNRB can be claimed in conjunction with the standard nil rate band, allowing for a higher threshold before inheritance tax is applied. When completing the necessary forms, it is essential to include details about the property and the beneficiaries to ensure that the claim is processed accurately.

Steps to Complete the Claim Residence Nil Rate Band

Completing the Claim Residence Nil Rate Band involves several key steps:

- Assess the value of your estate, including all assets and liabilities.

- Determine if the property qualifies for the RNRB, ensuring it is passed to direct descendants.

- Gather necessary documentation, such as the will and property deeds.

- Complete the relevant forms, including the IHT435 form, to claim the RNRB.

- Submit the forms to HM Revenue and Customs (HMRC) within the specified deadlines.

Required Documents

When claiming the Residence Nil Rate Band, specific documents are required to support the application. These typically include:

- The deceased's will, which outlines the distribution of the estate.

- Property deeds to confirm ownership and details of the property being passed on.

- The IHT435 form, which must be filled out accurately to claim the RNRB.

- Any additional documents that may prove the relationship between the deceased and the beneficiaries.

Eligibility Criteria

To be eligible for the Claim Residence Nil Rate Band, certain criteria must be met:

- The estate must include a residential property that qualifies.

- The property must be passed on to direct descendants, such as children or grandchildren.

- The overall value of the estate must fall within the specified thresholds set by HMRC.

- Claims must be made within the appropriate timeframe following the death of the individual.

Legal Use of the Claim Residence Nil Rate Band

The legal framework surrounding the Claim Residence Nil Rate Band is governed by UK inheritance tax laws. It is essential to comply with these regulations to ensure that the claim is valid and recognized by HMRC. Utilizing digital tools for form completion can enhance accuracy and efficiency, as long as the eSignature regulations are followed. Compliance with legal standards ensures that the claim is processed smoothly and that beneficiaries receive the intended benefits without unnecessary delays.

Quick guide on how to complete claim residence nil rate band

Complete Claim Residence Nil Rate Band seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Claim Residence Nil Rate Band on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Claim Residence Nil Rate Band effortlessly

- Find Claim Residence Nil Rate Band and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow satisfies all your document management needs in a few clicks from any device you prefer. Edit and eSign Claim Residence Nil Rate Band and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the UK residence nil rate band?

The UK residence nil rate band is an additional inheritance tax allowance available when passing on a family home to direct descendants. It helps reduce the inheritance tax burden, allowing families to inherit more value from properties without incurring tax liabilities. Understanding this band is essential for effective estate planning.

-

How does the UK residence nil rate band affect my estate planning?

Incorporating the UK residence nil rate band into your estate planning can signNowly enhance the value passed to heirs. By utilizing this band effectively, you can ensure that more of your property’s value is exempt from inheritance tax, resulting in savings for your heirs. It's advisable to consult a professional for personalized strategies.

-

Is airSlate SignNow beneficial for managing important documents related to the UK residence nil rate band?

Yes, airSlate SignNow is an excellent tool for managing documents related to the UK residence nil rate band. With its eSigning features, you can easily sign and send documents such as wills and estate plans from anywhere. This ensures that your important paperwork is handled quickly and securely.

-

What pricing plans does airSlate SignNow offer for businesses managing estate planning?

airSlate SignNow offers competitive pricing plans that suit businesses of all sizes, especially those involved in estate planning. By using SignNow, companies can seamlessly manage and eSign documents like those related to the UK residence nil rate band. Our cost-effective solutions provide great value for efficient document handling.

-

Can I integrate airSlate SignNow with other systems for managing my UK residence nil rate band documents?

Absolutely, airSlate SignNow integrates easily with various software and tools, making it ideal for managing your UK residence nil rate band documents. This integration ensures that you can sync your workflows and keep all your important documents organized and easily accessible. Streamlining your operations has never been easier.

-

What are the benefits of using airSlate SignNow for eSigning documents related to the UK residence nil rate band?

Using airSlate SignNow for eSigning documents provides multiple benefits, including speed and security. With airSlate SignNow, you can quickly execute necessary documents related to the UK residence nil rate band, reducing processing time signNowly. The platform also ensures compliance and offers data protection, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my documents concerning the UK residence nil rate band?

airSlate SignNow prioritizes the security of all documents, including those related to the UK residence nil rate band. We utilize industry-standard encryption protocols and offer robust authentication options to protect your sensitive information. You can trust that your estate planning documents are handled with the utmost security.

Get more for Claim Residence Nil Rate Band

Find out other Claim Residence Nil Rate Band

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors