VAT68 Transfer of a Business as a Going Concern Request for Transfer of a Registration Number 2021-2026

Understanding the VAT68 Transfer of a Business as a Going Concern

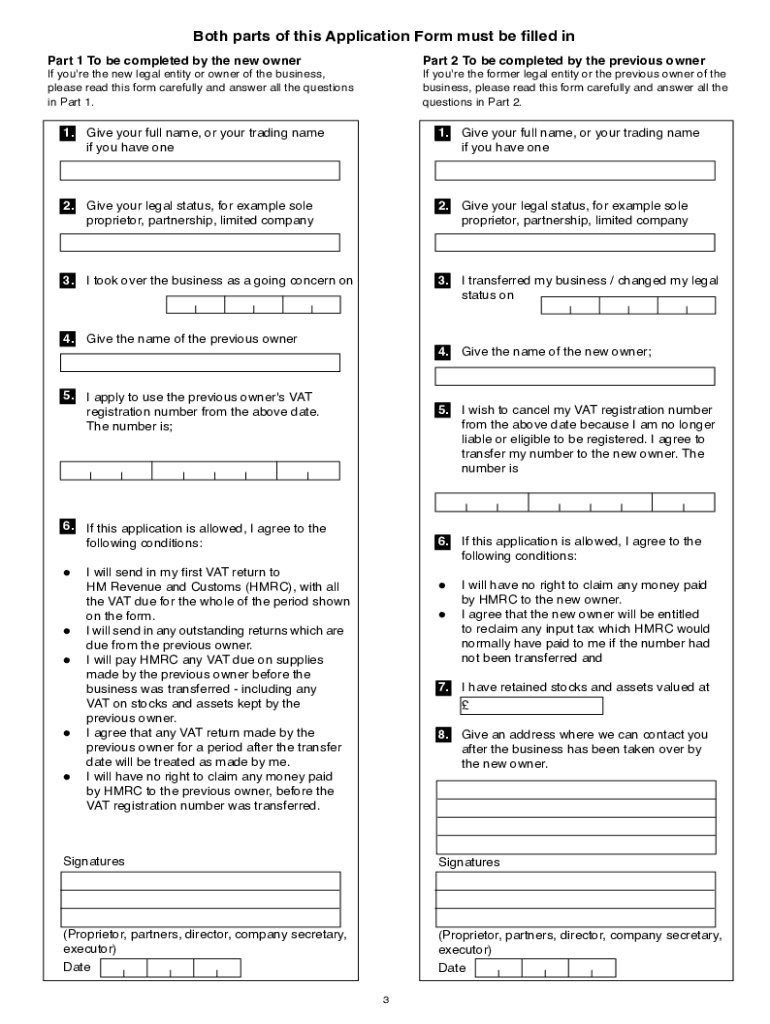

The VAT68 form is essential for businesses that are transferring their registration number during a sale or transfer of ownership. This form is specifically designed for situations where a business is sold as a going concern, meaning it continues to operate without interruption. The HMRC requires this form to ensure that the VAT registration is correctly transferred to the new owner, maintaining compliance with tax regulations. This process is crucial for both the seller and the buyer, as it helps in the seamless transition of business operations and responsibilities.

Steps to Complete the VAT68 Form

Filling out the VAT68 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the business, including the current VAT registration number and details of the new owner. The form requires specific details such as:

- The name and address of the business being transferred.

- The VAT registration number associated with the business.

- The name and address of the new owner.

- The date of transfer.

Once all information is collected, complete the form carefully, ensuring that all sections are filled out accurately. Review the completed form for any errors before submission to avoid delays in processing.

Legal Use of the VAT68 Form

The VAT68 form serves a legal purpose in the transfer of VAT responsibilities from one business entity to another. By completing and submitting this form, both parties acknowledge the transfer of ownership and the associated VAT obligations. This legal recognition is crucial for maintaining compliance with tax laws and preventing any potential disputes regarding VAT liabilities. It is advisable to retain a copy of the submitted form for your records, as it may be necessary for future reference or audits.

Obtaining the VAT68 Form

The VAT68 form can be obtained directly from the HMRC website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change. If assistance is needed, consulting with a tax advisor can provide clarity on the process and ensure that all necessary steps are followed correctly.

Form Submission Methods

The completed VAT68 form can be submitted in various ways, including online, by mail, or in person. For online submissions, ensure that you have access to the necessary digital platforms provided by HMRC. If submitting by mail, send the form to the designated HMRC address, ensuring that it is sent via a trackable method to confirm delivery. In-person submissions may be possible at certain HMRC offices; however, checking ahead for specific requirements is recommended.

Eligibility Criteria for VAT68 Submission

To be eligible to submit the VAT68 form, the business must be registered for VAT and undergoing a transfer of ownership as a going concern. Both the seller and the buyer must meet specific criteria, including being VAT registered and having a valid VAT number. Additionally, the transfer must involve the sale of the entire business, not just a portion of its assets. Understanding these eligibility criteria is essential to ensure that the form is applicable to your situation.

Quick guide on how to complete vat68 transfer of a business as a going concern request for transfer of a registration number

Effortlessly prepare VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number on any device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documentation, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number on any device through airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number with ease

- Find VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, be it through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or mistakes that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number to guarantee excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat68 transfer of a business as a going concern request for transfer of a registration number

Create this form in 5 minutes!

People also ask

-

What is the HMRC VAT 68 form?

The HMRC VAT 68 form is a document used by businesses to request a refund of VAT overpayments from HM Revenue and Customs. This form is crucial for businesses seeking to reclaim VAT that they have paid on purchases but did not owe.

-

How can airSlate SignNow help with the HMRC VAT 68 form?

AirSlate SignNow simplifies the process of completing and sending the HMRC VAT 68 form electronically. With our easy-to-use eSigning features, you can fill out and submit the form without the hassle of paper documents.

-

Is there a cost associated with using airSlate SignNow for the HMRC VAT 68 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. By opting for our service, you can streamline the submission of the HMRC VAT 68 form at a competitive price, ensuring cost-effectiveness in your operations.

-

What features does airSlate SignNow offer for processing the HMRC VAT 68 form?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking to ensure that your HMRC VAT 68 form is submitted efficiently. These functionalities enhance your experience and save time during the VAT refund process.

-

Can I integrate airSlate SignNow with other software for the HMRC VAT 68 form?

Yes, airSlate SignNow supports seamless integrations with various business applications, allowing you to connect your existing tools with our platform when working on the HMRC VAT 68 form. This integration facilitates a smoother workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the HMRC VAT 68 form?

Using airSlate SignNow for your HMRC VAT 68 form submission offers benefits such as faster processing times, improved accuracy, and the elimination of paperwork. Our platform enables quick eSigning, leading to a more efficient VAT refund process.

-

Is airSlate SignNow secure for submitting the HMRC VAT 68 form?

Absolutely, airSlate SignNow prioritizes security and compliance. When submitting the HMRC VAT 68 form through our platform, your sensitive information is protected by advanced encryption and security protocols.

Get more for VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number

Find out other VAT68 Transfer Of A Business As A Going Concern Request For Transfer Of A Registration Number

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free