Alabama Business Privilege Tax 2022

What is the Alabama Business Privilege Tax

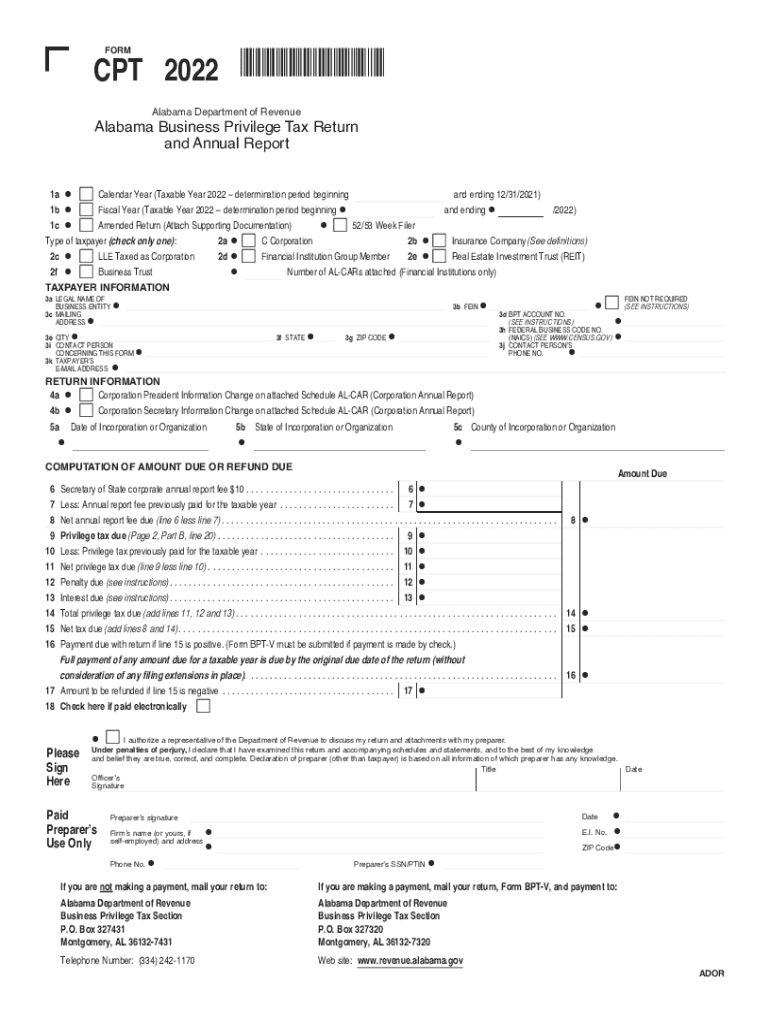

The Alabama Business Privilege Tax is a tax imposed on businesses operating within the state. This tax applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. The amount of tax owed depends on the business's net worth and is calculated based on specific criteria established by the Alabama Department of Revenue. Understanding this tax is essential for compliance and maintaining good standing with state regulations.

Steps to complete the Alabama Business Privilege Tax

Completing the Alabama Business Privilege Tax involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including balance sheets and income statements, which will provide the required information for the calculation. Next, access the Alabama Business Privilege Tax form, which can be completed online or printed for manual submission. Carefully fill out the form, ensuring that all figures are accurate and reflect your business's financial status. Once completed, review the form for any errors before submitting it to the Alabama Department of Revenue, either electronically or via mail.

Required Documents

To successfully file the Alabama Business Privilege Tax, certain documents are necessary. These typically include:

- Balance sheet

- Income statement

- Previous year’s tax return, if applicable

- Any supporting documentation that validates the figures reported

Having these documents ready will streamline the filing process and help ensure that all information is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Business Privilege Tax are crucial to avoid penalties. Typically, the tax return is due on the fifteenth day of the third month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the tax return is due by March 15. It is advisable to mark your calendar with these important dates to ensure timely submission.

Penalties for Non-Compliance

Failure to comply with the Alabama Business Privilege Tax requirements can result in significant penalties. Businesses that do not file their tax returns on time may face late fees, which can accumulate over time. Additionally, non-compliance can lead to interest charges on any unpaid taxes. In severe cases, the state may take further action, such as suspending the business's ability to operate legally until the tax obligations are met.

Legal use of the Alabama Business Privilege Tax

The legal framework surrounding the Alabama Business Privilege Tax ensures that businesses contribute fairly to state revenue. Compliance with this tax is not only a legal obligation but also a vital aspect of maintaining good standing within the state. Businesses must adhere to the guidelines set forth by the Alabama Department of Revenue to ensure that their tax filings are valid and legally recognized.

Quick guide on how to complete alabama business privilege tax

Effortlessly Prepare Alabama Business Privilege Tax on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle Alabama Business Privilege Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Alabama Business Privilege Tax Effortlessly

- Locate Alabama Business Privilege Tax and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Alabama Business Privilege Tax to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama business privilege tax

Create this form in 5 minutes!

People also ask

-

What is the Alabama business privilege tax?

The Alabama business privilege tax is a tax imposed on businesses operating within the state of Alabama, calculated based on the net worth of the business. This tax is essential for maintaining operational licenses and ensuring compliance with state regulations. Understanding this tax is vital for launching and running a business in Alabama.

-

How is the Alabama business privilege tax calculated?

The calculation of the Alabama business privilege tax depends on the net worth of your business as reported in your financial statements. Businesses are required to file a return annually, and the tax amount varies based on the asset value. Using tools like airSlate SignNow can streamline document management related to this tax.

-

What are the deadlines for filing the Alabama business privilege tax?

The annual filing deadline for the Alabama business privilege tax is typically the 15th day of the third month following the close of the business's tax year. Businesses should stay alert to these deadlines to avoid penalties and ensure compliance. Leveraging electronic solutions like airSlate SignNow can help keep track of important due dates.

-

What are the consequences of not paying the Alabama business privilege tax?

Failure to pay the Alabama business privilege tax can result in penalties, interest charges, and potential legal issues, which could jeopardize your business operations. This tax is crucial for maintaining good standing with state regulations. Ensuring timely payment can save you from unnecessary complications, and using airSlate SignNow can simplify the process of submitting your documents.

-

Are there any exemptions from the Alabama business privilege tax?

Certain non-profit organizations and small businesses with minimal revenue may qualify for exemptions or reduced rates on the Alabama business privilege tax. It's essential to check specific criteria to determine eligibility. Informative resources and efficient documentation tools like airSlate SignNow can assist in navigating these exemptions.

-

How can airSlate SignNow assist with the Alabama business privilege tax?

airSlate SignNow provides an easy-to-use platform that allows businesses to send, eSign, and manage key documents related to the Alabama business privilege tax efficiently. By digitizing processes and enhancing compliance tracking, businesses can save time and reduce errors. This can be particularly beneficial during tax filing seasons.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as electronic signatures, customizable templates, and secure cloud storage specifically designed to streamline the management of tax-related documents. These tools can signNowly enhance your workflow when dealing with the Alabama business privilege tax. Effective document management leads to better compliance and organizational efficiency.

Get more for Alabama Business Privilege Tax

- Assessable spouse election form

- Address affidavit form

- Mail handlers benefit plan reimbursement questionnaire form

- 6g welder certificate sample form

- Example letter of support for bariatric surgery form

- Navcruit 112404 form

- Itemized deduction worksheet amp small business itemized form

- Custom gift basket order form

Find out other Alabama Business Privilege Tax

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free