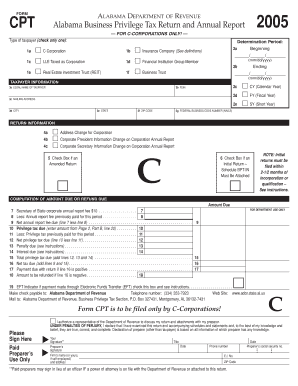

Alabama Form Cpt 2005

What is the Alabama business privilege tax return?

The Alabama business privilege tax return is a tax form that businesses operating in Alabama must file annually. This tax is based on the net worth of the business and applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. The purpose of this tax is to generate revenue for the state and support local services. Understanding the specific requirements and calculations involved in the Alabama business privilege tax return is essential for compliance and accurate reporting.

Steps to complete the Alabama business privilege tax return

Completing the Alabama business privilege tax return involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Determine the net worth of your business, as this will influence your tax calculation.

- Access the Alabama business privilege tax return form, which can be obtained online or through the state’s Department of Revenue.

- Fill out the form, ensuring all required information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Filing deadlines and important dates

It is crucial for businesses to be aware of the filing deadlines associated with the Alabama business privilege tax return. Typically, the return is due on the fifteenth day of the third month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the return is due by March 15. Late submissions may result in penalties, so timely filing is essential to avoid additional charges.

Required documents for the Alabama business privilege tax return

When preparing to file the Alabama business privilege tax return, businesses need to collect specific documents to ensure accurate reporting. These documents typically include:

- Balance sheets detailing the assets and liabilities of the business.

- Income statements reflecting revenue and expenses.

- Any previous tax returns for reference and consistency.

- Documentation of any exemptions or deductions that may apply.

Penalties for non-compliance

Failure to comply with the requirements of the Alabama business privilege tax return can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to familiarize themselves with the rules and ensure timely and accurate filing to avoid these consequences. Understanding the implications of non-compliance can help businesses maintain good standing with state authorities.

Digital vs. paper version of the Alabama business privilege tax return

Businesses have the option to file the Alabama business privilege tax return either digitally or using a paper version. Filing online can streamline the process, reduce the risk of errors, and provide immediate confirmation of submission. Conversely, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is important to ensure that all information is complete and accurate to avoid complications.

Quick guide on how to complete alabama form cpt 2014

Complete Alabama Form Cpt effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Alabama Form Cpt on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Alabama Form Cpt without hassle

- Find Alabama Form Cpt and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate new printed copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign Alabama Form Cpt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama form cpt 2014

Create this form in 5 minutes!

People also ask

-

What is an AL business privilege tax return?

An AL business privilege tax return is a document required by the state of Alabama that ensures businesses are compliant with state tax laws. It provides crucial information about the business's activities and revenue. Businesses must file this return annually to avoid penalties and ensure good standing.

-

How can airSlate SignNow help with AL business privilege tax return filings?

airSlate SignNow offers an easy-to-use platform for sending and eSigning documents, making it simpler to manage your AL business privilege tax return filings. Our solution streamlines the document preparation and signature process, ensuring that all necessary forms are completed efficiently. This reduces the time spent on filing taxes and increases compliance.

-

What is the pricing structure for using airSlate SignNow for tax return documents?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when handling AL business privilege tax returns. Our plans are cost-effective, designed for small and medium-sized businesses looking for budget-friendly solutions. You can choose from various tiers based on your requirements, such as document templates and user access.

-

Are there any additional features that support AL business privilege tax return preparation?

Yes, airSlate SignNow includes features that simplify your AL business privilege tax return preparation, such as customizable document templates and automated workflows. These tools not only save you time but also ensure accuracy. Additionally, the platform allows for real-time collaboration, making it easy for multiple stakeholders to review and approve documents.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a priority at airSlate SignNow, especially when dealing with sensitive tax documents like the AL business privilege tax return. We implement robust encryption protocols and strict compliance measures to protect your data. You can trust that your information is safe when using our eSigning and document management solutions.

-

Can airSlate SignNow integrate with other financial software for tax purposes?

Absolutely! airSlate SignNow supports integrations with various financial software tools, making it easy to manage your AL business privilege tax return alongside your accounting systems. This integration helps streamline the workflow and ensures all information is accurate and readily available. Users can connect their accounts with popular platforms to maintain seamless operations.

-

What benefits does using airSlate SignNow provide for AL business privilege tax return processing?

Using airSlate SignNow for AL business privilege tax return processing offers signNow benefits like time savings and improved accuracy. The platform simplifies document management and streamlines the signing process, reducing the burden of paperwork. Additionally, users gain access to audit trails and tracking features, ensuring complete transparency throughout the tax filing procedure.

Get more for Alabama Form Cpt

- Fedex signature release form 63327251

- Taguig business permit application form 2022

- Mtn sponsorship application form

- Documento cesion de armas form

- English plus 3 second edition tests form

- Trade test certificate form

- Amendment of foreign registration statement llc foreign form

- Sample wage verification form the paralegal mentor

Find out other Alabama Form Cpt

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed