1a Calendar Year Taxable Year Determination Period Beginning 2024-2026

Understanding the Alabama Business Privilege Tax

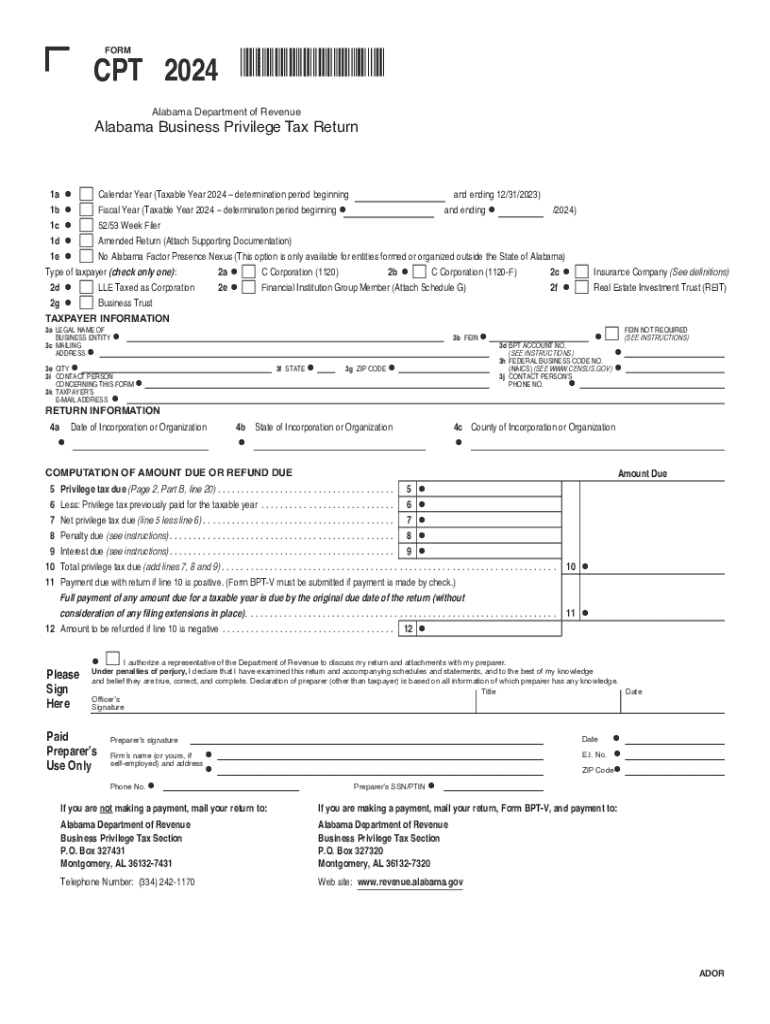

The Alabama business privilege tax is a tax imposed on businesses operating within the state. This tax applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. The tax is calculated based on the net worth of the business, with specific rates and minimums established by state law. Understanding the nuances of this tax is essential for compliance and financial planning.

Filing Deadlines and Important Dates

When it comes to the Alabama business privilege tax, timely filing is crucial. The tax return is generally due on the fifteenth day of the third month following the end of the business's tax year. For businesses operating on a calendar year, this means the return is due by March 15. It's important to mark your calendar to avoid late fees or penalties.

Required Documents for Filing

To file the Alabama business privilege tax return, businesses must gather several key documents. These typically include:

- Financial statements reflecting the business's net worth.

- The completed Alabama business privilege tax form (Form CPT).

- Any supporting documentation that verifies income and expenses.

Having these documents ready can streamline the filing process and help ensure accuracy.

Form Submission Methods

Businesses can submit their Alabama business privilege tax return through various methods. The options include:

- Online submission via the Alabama Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate state office.

- In-person submission at designated state revenue offices.

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Penalties for Non-Compliance

Failure to comply with Alabama's business privilege tax requirements can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action from the state for continued non-compliance.

Understanding these penalties can motivate businesses to stay compliant and avoid unnecessary financial burdens.

Eligibility Criteria for the Alabama Business Privilege Tax

Not all businesses are subject to the Alabama business privilege tax. Eligibility typically depends on factors such as:

- The type of business entity (e.g., corporation, LLC).

- The business's net worth, which must meet certain thresholds.

- The location of the business operations within Alabama.

It's important for business owners to assess their eligibility to ensure compliance with state tax laws.

Quick guide on how to complete 1a calendar year taxable year determination period beginning 769873071

Complete 1a Calendar Year Taxable Year Determination Period Beginning effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage 1a Calendar Year Taxable Year Determination Period Beginning on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based tasks today.

The easiest way to modify and eSign 1a Calendar Year Taxable Year Determination Period Beginning without hassle

- Locate 1a Calendar Year Taxable Year Determination Period Beginning and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Modify and eSign 1a Calendar Year Taxable Year Determination Period Beginning and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1a calendar year taxable year determination period beginning 769873071

Create this form in 5 minutes!

How to create an eSignature for the 1a calendar year taxable year determination period beginning 769873071

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama business privilege tax?

The Alabama business privilege tax is a tax imposed on businesses operating in Alabama, based on their net worth. It is essential for businesses to understand this tax to ensure compliance and avoid penalties. airSlate SignNow can help streamline the documentation process related to this tax.

-

How does airSlate SignNow assist with Alabama business privilege tax documentation?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign documents related to the Alabama business privilege tax. This simplifies the process of filing and managing necessary paperwork, ensuring that businesses stay compliant with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for managing Alabama business privilege tax documents. Each plan includes features that enhance document management and eSigning capabilities, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing taxes?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing Alabama business privilege tax documents. These features help businesses streamline their tax-related processes and maintain accurate records.

-

Can airSlate SignNow integrate with other accounting software for tax management?

Yes, airSlate SignNow can integrate with various accounting software, making it easier to manage Alabama business privilege tax filings. This integration allows for seamless data transfer and ensures that all financial documents are in sync, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Alabama business privilege tax?

Using airSlate SignNow for Alabama business privilege tax offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform's user-friendly interface allows businesses to focus on their core operations while efficiently managing tax-related documentation.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption methods to protect sensitive documents, including those related to the Alabama business privilege tax. Businesses can trust that their information is safe while using the platform for eSigning and document management.

Get more for 1a Calendar Year Taxable Year Determination Period Beginning

- Notice that use of website is subject to guidelines form

- Letter notifying 497328916 form

- Disclaimer providing instructions in the event a website contains materials that may infringe a copyright form

- Theft table form

- Services agreement form

- Marketing representative agreement for software 497328920 form

- Letter announcement sample form

- Payment letter form

Find out other 1a Calendar Year Taxable Year Determination Period Beginning

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure