1a Calendar Year Taxable Year Determination Period Beginning 2023

Filing Deadlines and Important Dates

For the 2023 Alabama tax return, it is crucial to be aware of the filing deadlines to avoid penalties. The standard due date for filing individual income tax returns is April 15, 2024. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, Alabama allows for an automatic six-month extension to file, but any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents

When preparing your 2023 Alabama tax return, several documents are essential for accurate filing. These include:

- W-2 forms from employers, showing income earned and taxes withheld

- 1099 forms for other income sources, such as freelance work or interest

- Receipts for deductible expenses, including medical, educational, and charitable contributions

- Records of any tax credits you plan to claim

- Last year's tax return for reference

Having these documents organized can streamline the filing process and ensure compliance with state requirements.

Form Submission Methods

Alabama offers several methods for submitting your 2023 tax return. You can choose to file electronically through approved software, which is often the quickest method and can expedite your refund. Alternatively, you can mail a paper return to the appropriate address based on your county of residence. In-person filing is also an option at designated state tax offices, though this may require an appointment.

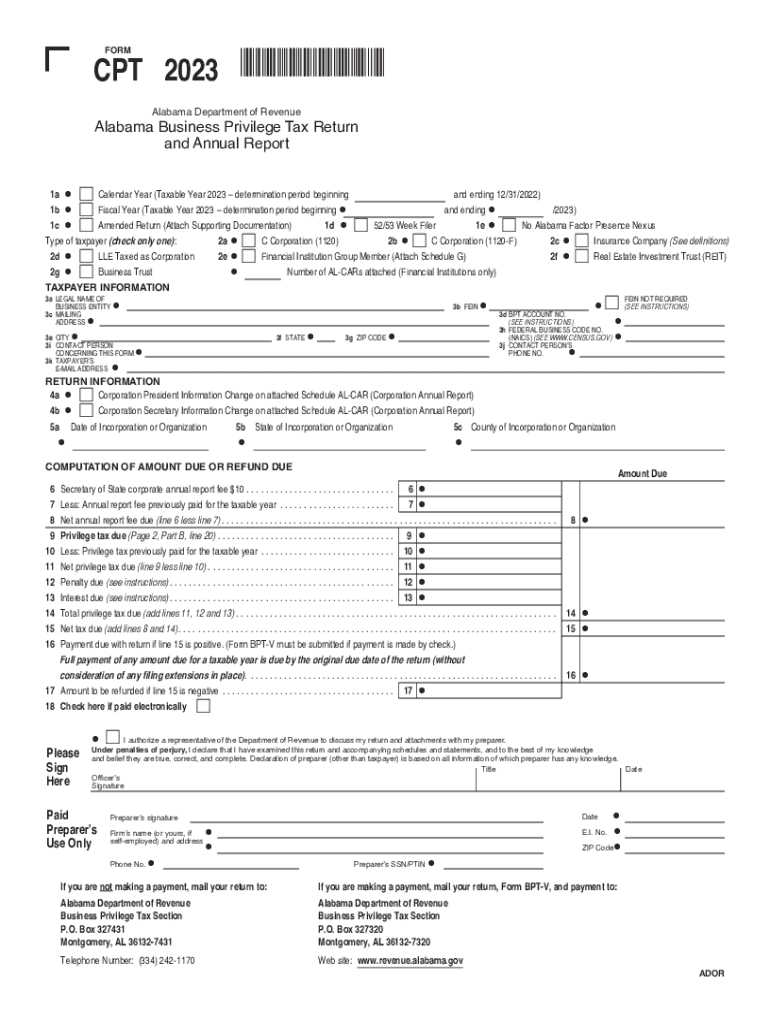

Key Elements of the 2023 Alabama Tax Return

The 2023 Alabama tax return form includes several key elements that taxpayers need to complete accurately. These elements consist of personal information such as your name, address, and Social Security number, as well as details about your income, deductions, and credits. Additionally, you must indicate your filing status, which can affect your tax rate and eligibility for certain credits. Understanding these components is vital for ensuring a smooth filing process.

Penalties for Non-Compliance

Failure to file your 2023 Alabama tax return on time or accurately can result in significant penalties. The state imposes a late filing penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid tax from the due date until it is paid in full. Being aware of these penalties can motivate timely and accurate filing.

Taxpayer Scenarios

Different taxpayer scenarios can affect how you file your 2023 Alabama tax return. For instance, self-employed individuals may need to report additional income and expenses, while retirees may have different sources of income that require specific forms. Students may qualify for education-related tax credits. Understanding your unique situation can help you navigate the filing process more effectively and take advantage of any applicable deductions or credits.

Quick guide on how to complete 1a calendar year taxable year determination period beginning

Complete 1a Calendar Year Taxable Year Determination Period Beginning effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 1a Calendar Year Taxable Year Determination Period Beginning across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign 1a Calendar Year Taxable Year Determination Period Beginning with ease

- Find 1a Calendar Year Taxable Year Determination Period Beginning and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your files or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign 1a Calendar Year Taxable Year Determination Period Beginning and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1a calendar year taxable year determination period beginning

Create this form in 5 minutes!

How to create an eSignature for the 1a calendar year taxable year determination period beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Alabama tax return process?

The 2023 Alabama tax return process involves gathering your financial documents, completing the necessary forms, and filing your return with the Alabama Department of Revenue. Using airSlate SignNow, you can easily eSign your tax documents digitally, streamlining the submission process while ensuring compliance with state regulations.

-

How can airSlate SignNow help with my 2023 Alabama tax return?

airSlate SignNow simplifies the 2023 Alabama tax return process by providing a user-friendly platform to sign and manage documents online. Our solution ensures that you can send, track, and eSign your tax return documents securely, minimizing the need for printing and mailing.

-

Is there any cost associated with using airSlate SignNow for my 2023 Alabama tax return?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly. The pricing is competitive, allowing small businesses and individuals to benefit from our effective solution for their 2023 Alabama tax return without breaking the bank.

-

What features does airSlate SignNow offer for the 2023 Alabama tax return?

airSlate SignNow offers features like document templates, in-person signing, and secure cloud storage that are particularly useful for preparing your 2023 Alabama tax return. These features enhance efficiency and ensure that your documents are always organized and accessible.

-

Can I integrate airSlate SignNow with other tools for my 2023 Alabama tax return?

Absolutely! airSlate SignNow can integrate with various platforms such as Google Drive and Microsoft Office, providing a seamless experience as you prepare your 2023 Alabama tax return. This integration allows you to access and manage your tax documents even more efficiently.

-

What are the benefits of using airSlate SignNow for eSigning my 2023 Alabama tax return?

The primary benefits of using airSlate SignNow for eSigning your 2023 Alabama tax return include enhanced security, reduced turnaround times, and ease of use. With electronic signatures, you can sign documents anytime, anywhere, ensuring that your tax return is submitted promptly.

-

Is airSlate SignNow secure for my 2023 Alabama tax return documents?

Yes, airSlate SignNow prioritizes data security and ensures that your 2023 Alabama tax return documents are protected through encryption and secure servers. You can confidently store and send sensitive information, knowing it is safeguarded against unauthorized access.

Get more for 1a Calendar Year Taxable Year Determination Period Beginning

- Raar form

- Petition form 1 tax court help

- Domanda di attribuzione del numero di codice fiscale o form

- Sample interview feedback report form

- Princeton financial aid application 49323744 form

- English olympic contest practice test form

- Please write any symptoms you are having on the following lines form

- Release of liability contract template form

Find out other 1a Calendar Year Taxable Year Determination Period Beginning

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast