Minnesota Ble Tax Form 2018

What is the Minnesota Ble Tax Form

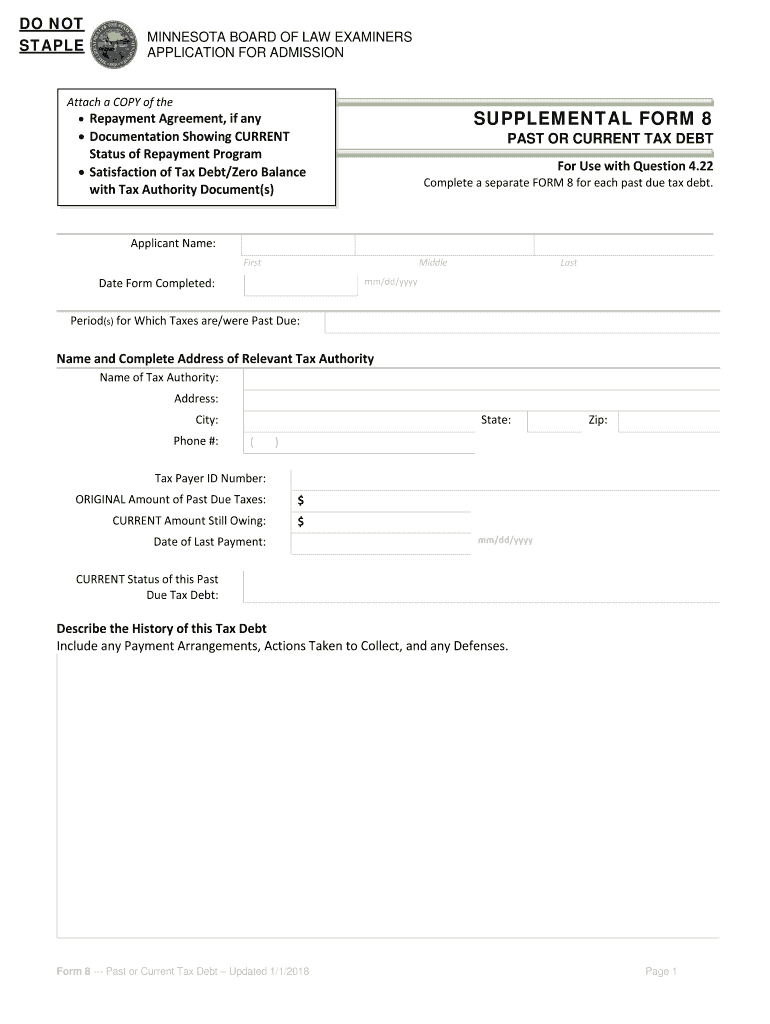

The 2018 Minnesota BLE tax form, also known as the BLE-8 tax form, is a document used by businesses and individuals to report specific tax information to the state of Minnesota. This form is particularly relevant for those involved in business activities that fall under the jurisdiction of the Minnesota Department of Revenue. It serves as a means for taxpayers to disclose their income and any applicable tax credits or deductions, ensuring compliance with state tax regulations.

How to use the Minnesota Ble Tax Form

Using the 2018 Minnesota BLE tax form requires careful attention to detail. Taxpayers should first gather all necessary financial documents, including income statements and records of any deductions. Once the form is obtained, individuals can fill it out by entering their personal information, income details, and any applicable credits. It is crucial to double-check all entries for accuracy before submission to avoid delays or penalties.

Steps to complete the Minnesota Ble Tax Form

Completing the 2018 Minnesota BLE tax form involves several key steps:

- Gather required documents, such as W-2s, 1099s, and receipts for deductions.

- Obtain the BLE-8 tax form from the Minnesota Department of Revenue website or other authorized sources.

- Fill out the form, ensuring all personal and financial information is accurate.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, following the guidelines provided by the state.

Key elements of the Minnesota Ble Tax Form

The 2018 Minnesota BLE tax form includes several important sections that taxpayers must complete. These sections typically encompass:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed breakdown of all income sources.

- Deductions and Credits: Any applicable deductions or tax credits claimed.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the 2018 Minnesota BLE tax form. Typically, the deadline for filing state tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any specific deadlines for extensions or special circumstances that may apply.

Legal use of the Minnesota Ble Tax Form

The 2018 Minnesota BLE tax form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the Minnesota Department of Revenue. This includes providing accurate information, signing the form, and submitting it by the established deadlines. Non-compliance can lead to penalties or legal repercussions.

Quick guide on how to complete 2018 minnesota ble tax form

Accomplish Minnesota Ble Tax Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Ble Tax Form seamlessly on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest method to adjust and electronically sign Minnesota Ble Tax Form with ease

- Acquire Minnesota Ble Tax Form and click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finished button to save your adjustments.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Ble Tax Form and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 minnesota ble tax form

Create this form in 5 minutes!

How to create an eSignature for the 2018 minnesota ble tax form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2018 Minnesota BLE tax form?

The 2018 Minnesota BLE tax form is specifically designed for businesses in Minnesota to report and remit any applicable Business and Local Taxes. Understanding this form is crucial for compliance with state tax regulations and helps avoid penalties. It ensures your business remains in good standing with Minnesota tax authorities.

-

How can I access the 2018 Minnesota BLE tax form?

You can access the 2018 Minnesota BLE tax form online through the official Minnesota Department of Revenue website. Additionally, airSlate SignNow provides easy access and eSigning options for any necessary documents, making it convenient to handle tax-related paperwork. You can securely download and fill out the form from our platform.

-

What features does airSlate SignNow offer for handling the 2018 Minnesota BLE tax form?

airSlate SignNow offers features such as secure eSigning, document tracking, and customizable templates to streamline the completion of the 2018 Minnesota BLE tax form. These tools enhance efficiency and ensure that your submissions are accurate and timely. Our user-friendly interface makes it easy to manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for the 2018 Minnesota BLE tax form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. We offer subscription plans that provide great value for businesses handling multiple documents, including the 2018 Minnesota BLE tax form. Investing in SignNow can save your business time and reduce the likelihood of errors.

-

Can airSlate SignNow help me stay compliant with the 2018 Minnesota BLE tax form submission deadlines?

Absolutely! airSlate SignNow can help you keep track of submission deadlines for the 2018 Minnesota BLE tax form through automatic reminders and notifications. This feature ensures that you won’t miss important deadlines, helping you stay compliant with state tax requirements. Our platform promotes efficient document management to prevent last-minute rushes.

-

Does airSlate SignNow integrate with other software for the 2018 Minnesota BLE tax form?

Yes, airSlate SignNow offers integration with various accounting and document management software that can assist with the 2018 Minnesota BLE tax form. This seamless integration allows for easy import and export of data, making your workflow more efficient. You can connect with tools you already use to enhance your tax preparation process.

-

What are the benefits of using airSlate SignNow for the 2018 Minnesota BLE tax form?

Using airSlate SignNow for the 2018 Minnesota BLE tax form provides numerous benefits, including increased efficiency and reduced paperwork. You can eSign documents from anywhere, and our platform ensures that your submissions are secure and legally binding. Additionally, it helps in maintaining an organized record of your tax filings.

Get more for Minnesota Ble Tax Form

Find out other Minnesota Ble Tax Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document