La Cift 620 2022

What is the La Cift 620

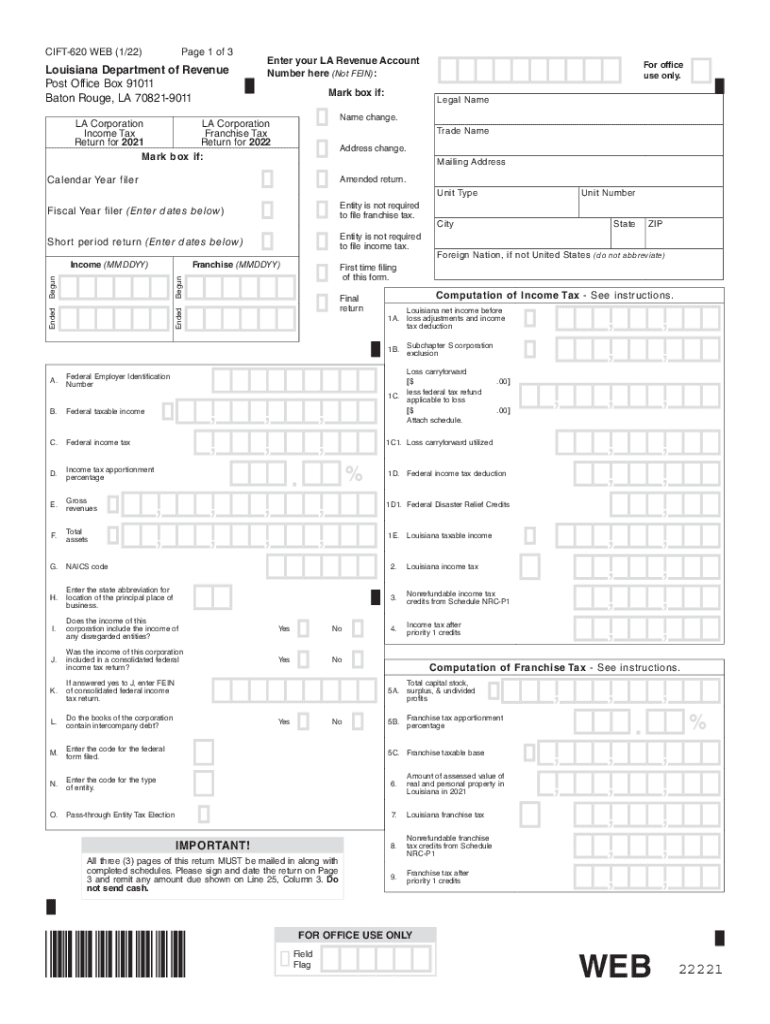

The La Cift 620, formally known as the Louisiana Corporation Income and Franchise Tax Return, is a crucial document for businesses operating in Louisiana. This form is used to report and pay the state income tax and franchise tax obligations of corporations. It is essential for ensuring compliance with Louisiana tax laws and regulations. The La Cift 620 is specifically designed for corporations, including C corporations and S corporations, and must be filed annually.

Steps to Complete the La Cift 620

Completing the La Cift 620 involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather Required Information: Collect financial statements, income records, and any relevant tax documents.

- Fill Out the Form: Input your corporation's income, deductions, and credits as required on the form.

- Calculate Tax Liability: Use the provided tax tables to determine your corporation's tax liability based on the reported income.

- Review for Accuracy: Double-check all entries for accuracy to avoid penalties or delays.

- Submit the Form: File electronically or via mail, ensuring you meet the filing deadline.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the La Cift 620 is essential for compliance. Typically, the due date for filing the form is the fifteenth day of the fourth month following the end of your corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates to avoid late fees and penalties.

Required Documents

To successfully complete the La Cift 620, several documents are necessary. These include:

- Financial statements, including balance sheets and income statements.

- Records of all income earned during the tax year.

- Documentation of any deductions or credits claimed.

- Prior year tax returns, if applicable, for reference.

Legal Use of the La Cift 620

The La Cift 620 must be used in accordance with Louisiana tax laws. It is legally binding and must be completed accurately to reflect the corporation's financial situation. Misrepresentation or errors can lead to penalties, including fines or audits. Utilizing reliable digital tools for eSigning and submitting the form can enhance compliance and security.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the La Cift 620. The form can be filed electronically through the Louisiana Department of Revenue’s online portal, which is often the most efficient method. Alternatively, corporations can mail the completed form to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices, although this method is less common.

Quick guide on how to complete la cift 620

Effortlessly Prepare La Cift 620 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle La Cift 620 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign La Cift 620 effortlessly

- Obtain La Cift 620 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Annotate important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign La Cift 620 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct la cift 620

Create this form in 5 minutes!

People also ask

-

What is the 2022 Louisiana income tax rate for individuals?

The 2022 Louisiana income tax is structured with rates ranging from 2% to 6% based on income brackets. The first $12,500 of taxable income is taxed at a lower rate, while higher income levels are taxed progressively. Understanding these rates is crucial for accurate tax filing and financial planning.

-

How can airSlate SignNow help with filing 2022 Louisiana income tax?

airSlate SignNow can streamline your document management process by allowing you to electronically sign and send necessary tax documents for the 2022 Louisiana income tax. This feature simplifies paperwork and ensures you meet filing deadlines with ease. By utilizing SignNow, businesses can reduce clerical errors and save time during tax season.

-

What documents are needed for 2022 Louisiana income tax preparation?

To prepare for the 2022 Louisiana income tax, you will typically need documents such as W-2s, 1099 forms, proof of deductions, and any relevant business income records. These documents should be organized for smooth filing. Utilizing airSlate SignNow can help you gather, sign, and send these documents efficiently.

-

Are there any deductions available for the 2022 Louisiana income tax?

Yes, for the 2022 Louisiana income tax, several deductions are available, including those for state tax paid, mortgage interest, and certain education expenses. Familiarizing yourself with these deductions can signNowly reduce your taxable income. Using airSlate SignNow can help you easily collect and distribute documents involving these deductions.

-

How does airSlate SignNow integrate with accounting software for tax purposes?

airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your financial data in relation to the 2022 Louisiana income tax. Integrations enable automatic syncing of signed documents, reducing repetitive data entry. This leads to more accurate records and simplified tax filings.

-

What are the advantages of using airSlate SignNow for tax-related documents?

The key advantages of using airSlate SignNow for tax-related documents include enhanced security, fast document turnaround, and seamless electronic signatures. By opting for airSlate SignNow, you can ensure compliance with IRS requirements while facilitating smoother transactions during the 2022 Louisiana income tax process.

-

Is airSlate SignNow cost-effective for small businesses filing 2022 Louisiana income tax?

Absolutely! airSlate SignNow offers various pricing plans that cater specifically to small businesses. The cost-effectiveness of this electronic signature solution means your business can manage the 2022 Louisiana income tax process without overspending, ensuring a valuable return on your investment.

Get more for La Cift 620

- Pogil dna structure and replication form

- Interest a lyzer form

- Financial disclosure statement will county illinois circuit form

- Antrag auf erteilung einer bescheinigung in steuersachen pdf form

- Work abroad application form

- Michigan personal protection order form

- Uct 6 form

- Download mosaic 2 reading silver edition download mosaic 2 reading silver edition form

Find out other La Cift 620

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online