General Instructions Use This Form to Request an Extension 2023-2026

Overview of the 2023 Louisiana CIFT 620 Form

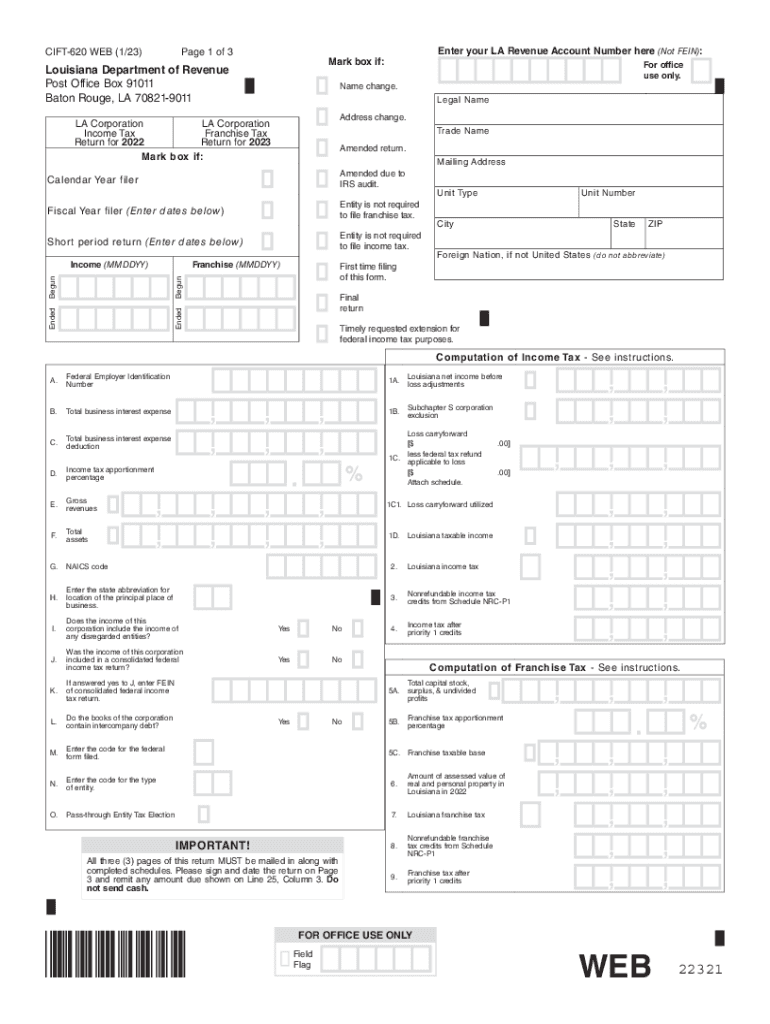

The 2023 Louisiana CIFT 620 form is a crucial document for corporations operating within the state, specifically for filing income tax returns. This form is utilized by corporations to report their income, calculate their tax liability, and ensure compliance with Louisiana tax laws. It is essential for businesses to accurately complete this form to avoid penalties and ensure proper tax assessment.

Steps to Complete the 2023 Louisiana CIFT 620 Form

Completing the 2023 Louisiana CIFT 620 form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (FEIN).

- Report total income, including gross receipts and other income sources.

- Deduct allowable expenses to determine net income.

- Calculate the tax liability based on the applicable tax rates.

- Sign and date the form, ensuring all information is accurate and complete.

Filing Deadlines for the 2023 Louisiana CIFT 620 Form

Corporations must adhere to specific filing deadlines for the 2023 Louisiana CIFT 620 form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is typically due by May 15, 2024. It is important to file on time to avoid late fees and interest charges.

Required Documents for Filing the 2023 Louisiana CIFT 620 Form

To successfully file the 2023 Louisiana CIFT 620 form, corporations should prepare the following documents:

- Financial statements, including balance sheets and income statements.

- Supporting documentation for deductions and credits claimed.

- Previous year's tax return for reference.

- Any additional forms required for specific credits or deductions.

Form Submission Methods for the 2023 Louisiana CIFT 620 Form

The 2023 Louisiana CIFT 620 form can be submitted through various methods. Corporations may choose to file online using the Louisiana Department of Revenue's e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, the form can be mailed to the appropriate tax office or delivered in person. It is advisable to keep copies of all submitted documents for record-keeping purposes.

Penalties for Non-Compliance with the 2023 Louisiana CIFT 620 Form

Failure to file the 2023 Louisiana CIFT 620 form on time or inaccuracies in reporting can result in significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential audits. Corporations are encouraged to review their submissions carefully and seek assistance if needed to ensure compliance with Louisiana tax regulations.

Quick guide on how to complete general instructions use this form to request an extension

Complete General Instructions Use This Form To Request An Extension effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage General Instructions Use This Form To Request An Extension on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign General Instructions Use This Form To Request An Extension with ease

- Find General Instructions Use This Form To Request An Extension and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign General Instructions Use This Form To Request An Extension and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general instructions use this form to request an extension

Create this form in 5 minutes!

How to create an eSignature for the general instructions use this form to request an extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Louisiana CIFT 620 form used for?

The 2023 Louisiana CIFT 620 form is a critical document for corporate income and franchise tax reporting in Louisiana. It helps businesses properly calculate their tax liabilities and ensures compliance with state regulations. Utilizing tools like airSlate SignNow can help streamline the signing and submission process for this essential form.

-

How can airSlate SignNow assist with the 2023 Louisiana CIFT 620 form?

airSlate SignNow provides businesses with an efficient way to send, sign, and manage the 2023 Louisiana CIFT 620 form electronically. With its intuitive interface and robust features, organizations can quickly gather signatures and securely store completed documents. This saves time and reduces the risk of errors in tax submissions.

-

What are the pricing options for using airSlate SignNow with the 2023 Louisiana CIFT 620?

Pricing for airSlate SignNow varies based on the specific features and number of users needed for optimal use with the 2023 Louisiana CIFT 620. Plans are designed to be cost-effective, ensuring that businesses of all sizes can afford the tools necessary for document management. Detailed pricing can be found on the airSlate SignNow website.

-

What features should I look for in a platform for the 2023 Louisiana CIFT 620?

When selecting a platform for the 2023 Louisiana CIFT 620, key features to consider include eSignature capabilities, document templates, secure storage, and integration options. airSlate SignNow offers all of these features, making it easier for businesses to handle their tax documentation efficiently. Additionally, its user-friendly design ensures quick adoption by teams.

-

How does airSlate SignNow ensure the security of the 2023 Louisiana CIFT 620 submission?

airSlate SignNow prioritizes security by implementing robust encryption and secure access controls to protect the 2023 Louisiana CIFT 620 form submissions. All data is stored in secure environments, ensuring compliance with industry standards and regulations. This gives businesses peace of mind knowing that their sensitive information is safe.

-

Can airSlate SignNow integrate with my existing accounting software for the 2023 Louisiana CIFT 620?

Yes, airSlate SignNow offers seamless integration with various accounting software, enabling a smoother workflow for the 2023 Louisiana CIFT 620 form. This integration ensures that data can flow easily between systems, reducing manual input and potential errors. It enhances efficiency for businesses managing their tax filings.

-

What benefits does using airSlate SignNow provide for filing the 2023 Louisiana CIFT 620?

Using airSlate SignNow for filing the 2023 Louisiana CIFT 620 offers numerous benefits, including time savings, reduced paperwork, and the ability to track document status in real-time. The electronic signature feature speeds up the process, allowing businesses to meet filing deadlines efficiently. Overall, it enhances productivity and helps ensure accurate submissions.

Get more for General Instructions Use This Form To Request An Extension

- Info sheet bps docx form

- Application for licensure and examination in state bbs form

- Application to license a vehicle form vl17 application to license a vehicle form vl17

- How to correctly fill the online pmp application form

- Crew member training record da form 7122 apr

- Va form 21 4142 vba va

- Va form 10 2850a online application for nursespdf

- 21p 534a application for dependency and indemnity compensation by a surviving spouse or child in service death only form

Find out other General Instructions Use This Form To Request An Extension

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now