Tax Claim Single Person Credit 2021

What is the Tax Claim Single Person Credit

The Tax Claim Single Person Credit is a tax benefit designed to provide financial relief to eligible individuals who file their taxes as single. This credit can reduce the amount of tax owed, making it an important aspect of tax planning for single filers. Understanding the eligibility criteria and how this credit works can help taxpayers maximize their potential refunds.

Eligibility Criteria

To qualify for the Tax Claim Single Person Credit, individuals must meet specific requirements, including:

- Filing status as single on the federal tax return.

- Meeting income thresholds set by the IRS.

- Being a U.S. citizen or resident alien.

- Not being claimed as a dependent on someone else's tax return.

These criteria ensure that the credit is available to those who genuinely need financial assistance during tax season.

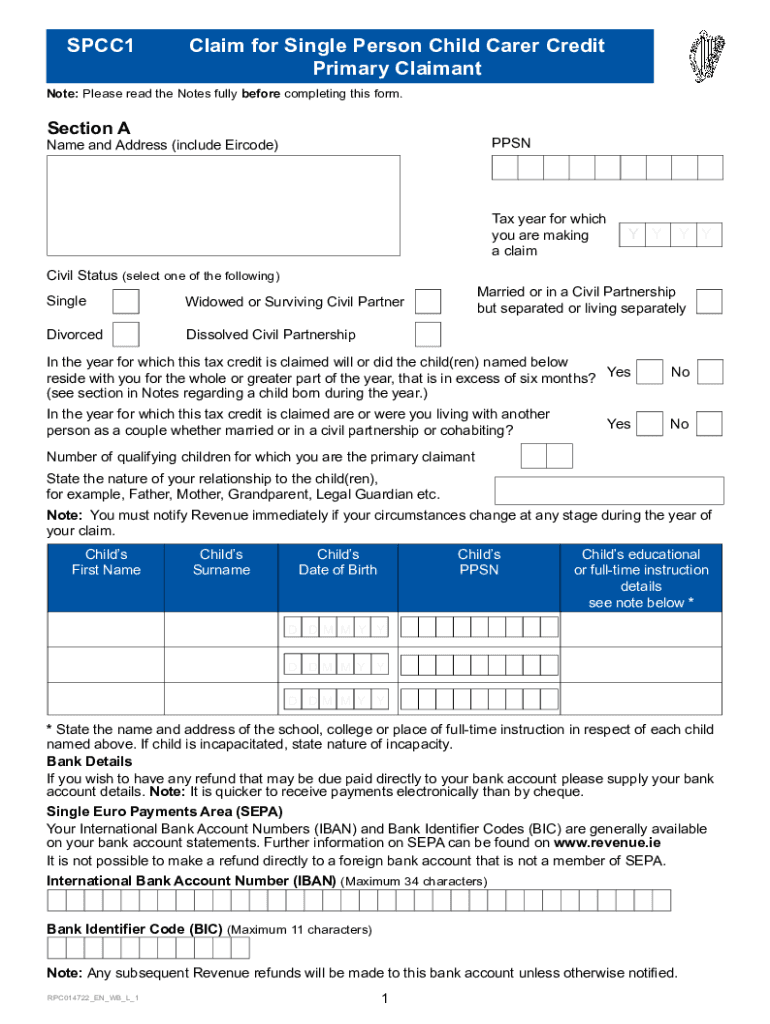

Steps to Complete the Tax Claim Single Person Credit

Completing the Tax Claim Single Person Credit involves several straightforward steps:

- Gather necessary documentation, including your W-2 forms and any other income statements.

- Determine your eligibility based on the criteria mentioned above.

- Fill out the relevant sections of the spcc1 form accurately.

- Calculate the amount of credit you are eligible for based on your income and filing status.

- Submit the completed spcc1 form along with your tax return.

Following these steps can help ensure that you claim the credit correctly and avoid delays in processing your return.

Legal Use of the Tax Claim Single Person Credit

The Tax Claim Single Person Credit is governed by federal tax laws, which outline the legal framework for its use. Taxpayers must ensure compliance with IRS regulations to avoid penalties. Proper documentation and adherence to filing guidelines are essential for the credit to be recognized as valid. Engaging with a tax professional can provide additional assurance of compliance.

Form Submission Methods

The spcc1 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through e-filing platforms.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can streamline the process and ensure timely processing of your tax return.

Required Documents

To successfully complete the Tax Claim Single Person Credit, certain documents are necessary. These typically include:

- Your most recent tax return.

- W-2 forms from employers.

- Documentation of any additional income.

- Proof of eligibility for the credit, if applicable.

Having these documents ready can facilitate a smoother filing experience and help ensure that all necessary information is included.

Quick guide on how to complete tax claim single person credit

Effortlessly prepare Tax Claim Single Person Credit on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your files promptly without delays. Manage Tax Claim Single Person Credit on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign Tax Claim Single Person Credit effortlessly

- Find Tax Claim Single Person Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Claim Single Person Credit and ensure exceptional communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax claim single person credit

Create this form in 5 minutes!

People also ask

-

What is an spcc1 form and why is it important?

The spcc1 form is a document used for regulatory compliance regarding oil spills and environmental protection. It outlines a company's spill prevention control measures and is crucial for avoiding potential legal issues and fines. Understanding the spcc1 form helps businesses maintain compliance and protect natural resources.

-

How does airSlate SignNow simplify the spcc1 form process?

airSlate SignNow streamlines the completion and signing of the spcc1 form with its user-friendly interface. Document templates make it easy to fill out essential information and capture electronic signatures securely. This not only saves time but also enhances accuracy in compliance documentation.

-

Are there any pricing plans available for using airSlate SignNow for the spcc1 form?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you need basic features for small teams or advanced options for larger organizations, you can find a plan that enables efficient management of documents like the spcc1 form. Check our pricing page for details and choose the right plan for your company.

-

Can I integrate airSlate SignNow with other software while using the spcc1 form?

Absolutely, airSlate SignNow provides seamless integrations with popular productivity tools and applications. This allows users to easily manage the spcc1 form alongside other documents and workflows within their existing systems. Enhanced integration capabilities help improve overall efficiency and document handling.

-

What security features does airSlate SignNow offer for the spcc1 form?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like the spcc1 form. Our platform includes features such as advanced encryption, secure cloud storage, and access controls to ensure that your documents are protected against unauthorized access and bsignNowes.

-

How can airSlate SignNow help improve the efficiency of spcc1 form management?

With airSlate SignNow, businesses can signNowly increase the efficiency of managing the spcc1 form through automation and digital workflows. Fast document sharing, eSignature capabilities, and easy tracking of updates streamline processes that traditionally took more time. This results in quicker turnaround times and improved productivity.

-

What customer support options are available for users of the spcc1 form on airSlate SignNow?

airSlate SignNow offers robust customer support to ensure you have assistance while using the spcc1 form. Our support options include live chat, email support, and an extensive help center with guides and tutorials. We're dedicated to helping you navigate any questions or challenges that arise.

Get more for Tax Claim Single Person Credit

- Social security affidavit form sample

- Bikini bottom genetics answer key form

- Tpg change of ownership form

- Verklaring gedeeld autogebruik form

- Annexure x form

- Indian river county declaration of domicile form

- Form 590 withholding exemption certificate form 590 withholding exemption certificate

- Form 100 e s corporation estimated tax form 100 es corporation estimated tax

Find out other Tax Claim Single Person Credit

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word