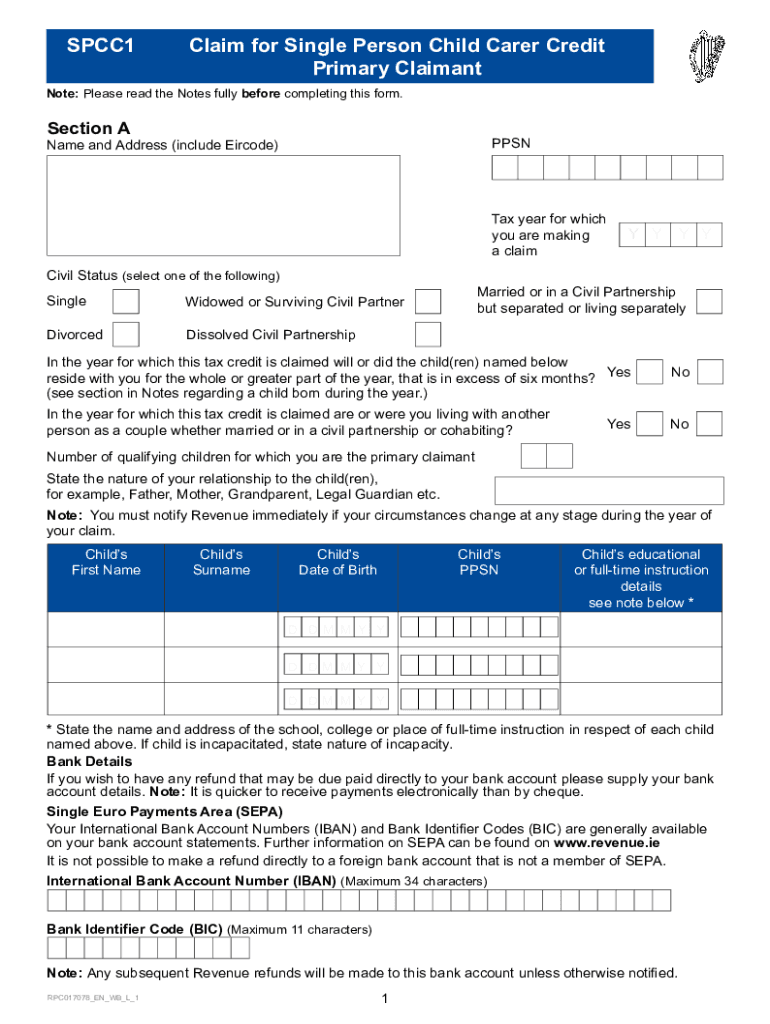

SPCC1 Claim for Single Person Child Carer Credit Primary Claimant 2022-2026

What is the SPCC1 Claim for Single Person Child Carer Credit Primary Claimant

The SPCC1 form is a specific document used in the United States for individuals applying for the Single Person Child Carer Credit. This credit is designed to provide financial support to single parents or guardians who are the primary caregivers for children. The form allows eligible claimants to report their caregiving responsibilities and claim the associated tax benefits. Understanding the purpose of the SPCC1 form is essential for anyone looking to take advantage of this tax credit.

Eligibility Criteria for the SPCC1 Claim

To qualify for the Single Person Child Carer Credit using the SPCC1 form, applicants must meet certain eligibility requirements. Generally, the claimant must be a single parent or guardian caring for a qualifying child. The child must meet age and residency requirements, and the claimant's income must fall within specified limits. It is important to review these criteria carefully to ensure that you meet all the necessary conditions before submitting the form.

Steps to Complete the SPCC1 Claim

Filling out the SPCC1 form involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all required documents, including proof of caregiving and income statements. Next, accurately fill out the form, providing detailed information about your caregiving situation and any relevant financial data. After completing the form, review it for any errors before submitting it either online or via mail. Following these steps can help streamline the application process and improve the chances of approval.

Required Documents for the SPCC1 Claim

When submitting the SPCC1 form, certain documents are necessary to support your claim. These may include:

- Proof of relationship to the child, such as a birth certificate or adoption papers.

- Documentation of caregiving expenses, if applicable.

- Income statements, including W-2 forms or 1099s.

- Any other relevant financial documents that demonstrate eligibility.

Having these documents prepared in advance can facilitate a smoother application process and help ensure that all necessary information is provided.

Form Submission Methods for the SPCC1 Claim

The SPCC1 form can be submitted through various methods to accommodate different preferences. Applicants have the option to file online through designated tax software that supports the SPCC1 form. Alternatively, the form can be printed and mailed to the appropriate tax authority. In some cases, in-person submission may also be available at local tax offices. Understanding these submission options can help you choose the most convenient method for your situation.

Legal Use of the SPCC1 Claim

The SPCC1 form is governed by specific legal guidelines that ensure its proper use in claiming the Single Person Child Carer Credit. Compliance with these regulations is crucial to avoid penalties or issues with the tax authority. It is advisable to familiarize yourself with the relevant tax laws and requirements surrounding the SPCC1 form to ensure that your claim is valid and legally sound.

Filing Deadlines for the SPCC1 Claim

Timely submission of the SPCC1 form is essential to ensure that you receive the benefits associated with the Single Person Child Carer Credit. Filing deadlines can vary based on the tax year and specific circumstances. Generally, the form must be submitted by the annual tax filing deadline, which is typically April 15. It is important to stay informed about any changes to these deadlines to avoid missing the opportunity to claim the credit.

Quick guide on how to complete spcc1 claim for single person child carer credit primary claimant

Complete SPCC1 Claim For Single Person Child Carer Credit Primary Claimant effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your papers quickly without delays. Manage SPCC1 Claim For Single Person Child Carer Credit Primary Claimant on any device with the airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and eSign SPCC1 Claim For Single Person Child Carer Credit Primary Claimant with ease

- Obtain SPCC1 Claim For Single Person Child Carer Credit Primary Claimant and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign SPCC1 Claim For Single Person Child Carer Credit Primary Claimant and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct spcc1 claim for single person child carer credit primary claimant

Create this form in 5 minutes!

How to create an eSignature for the spcc1 claim for single person child carer credit primary claimant

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an spcc1 form and why is it important for my business?

The spcc1 form is a crucial document that helps businesses comply with the Spill Prevention, Control, and Countermeasure regulations. By utilizing the spcc1 form, companies can ensure proper management of oil spills and protect the environment, potentially saving signNow costs related to fines and cleanup efforts.

-

How can airSlate SignNow help me with my spcc1 form?

AirSlate SignNow provides a user-friendly platform to easily create, manage, and eSign your spcc1 form. With our solution, you can expedite the approval process, ensuring compliance without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for my spcc1 form?

Yes, there is a cost associated with using airSlate SignNow, but we offer a range of pricing plans to cater to different business needs. Our cost-effective solution allows you to manage your spcc1 form efficiently while ensuring you stay compliant without overspending.

-

What features does airSlate SignNow offer for completing an spcc1 form?

AirSlate SignNow offers features such as electronic signatures, document templates, and secure storage for your spcc1 form. Additionally, our platform enables collaboration, allowing multiple users to work on the document simultaneously, streamlining the entire process.

-

Can I integrate airSlate SignNow with other software for my spcc1 form?

Yes, airSlate SignNow offers seamless integrations with numerous applications, making it easy to incorporate your spcc1 form into your existing workflows. This connectivity enhances productivity by reducing data entry errors and ensuring all pertinent information is readily available.

-

How secure is the information in my spcc1 form when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including your spcc1 form, by implementing industry-standard encryption and secure cloud storage. Your data remains confidential and safe from unauthorized access, giving you peace of mind.

-

Can I track the status of my spcc1 form with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track the status of your spcc1 form in real-time. You receive notifications at every step, ensuring you are always informed about who has signed and when the document is completed.

Get more for SPCC1 Claim For Single Person Child Carer Credit Primary Claimant

- Rent to own contract 100092996 form

- Trustmark claim forms

- Tx transportation trip log msb form

- Sym symphony st 200 manuale form

- Friend application form

- Fantasyworldreservations com form

- Nc 150 notice of hearing on petition form

- Cr 401 proof of service for petitionapplication under health and safety code section 11361 8adult crimes judicial council forms

Find out other SPCC1 Claim For Single Person Child Carer Credit Primary Claimant

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile