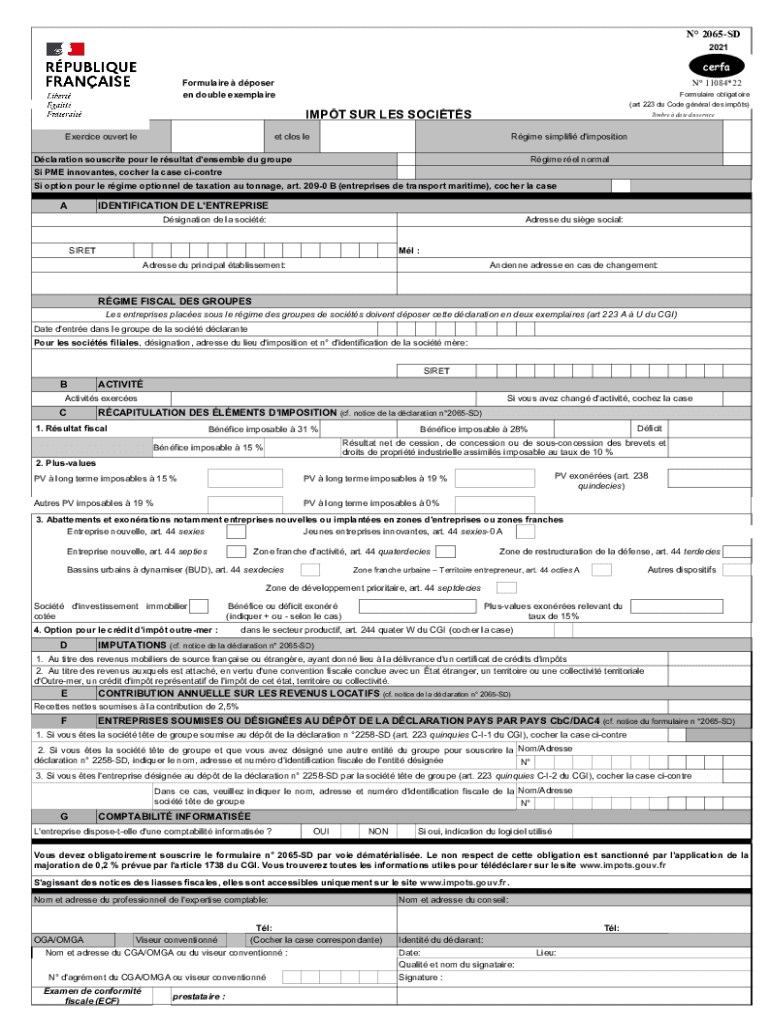

Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit

Understanding the Declaration 2065 SD

The Declaration 2065 SD is a crucial form used for corporate tax reporting in the United States. This form is specifically designed for businesses to report their income and expenses to the Internal Revenue Service (IRS). It provides a comprehensive overview of a company's financial status, ensuring compliance with federal tax regulations. The form includes various sections that require detailed information about the company's earnings, deductions, and tax liabilities.

Steps to Complete the Declaration 2065 SD

Completing the Declaration 2065 SD involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering the relevant financial data in the designated sections. Pay careful attention to detail, as errors can lead to penalties. Once completed, review the form thoroughly to ensure all information is correct before submission.

Legal Use of the Declaration 2065 SD

The Declaration 2065 SD is legally binding and must be filed accurately to avoid potential legal issues. It serves as an official record of a company's financial activities and tax obligations. Filing this form is essential for maintaining compliance with IRS regulations, and any discrepancies can result in audits or penalties. Therefore, it is vital to use reliable tools and resources to ensure that the form is completed correctly.

Filing Deadlines for the Declaration 2065 SD

Timely filing of the Declaration 2065 SD is critical for businesses. The IRS typically sets specific deadlines for submission, which can vary based on the business's fiscal year. Companies should be aware of these deadlines to avoid late fees and penalties. It is advisable to mark these dates on the calendar and prepare the necessary documents well in advance of the due date.

Required Documents for the Declaration 2065 SD

To complete the Declaration 2065 SD, certain documents are required. These typically include financial statements, receipts for deductible expenses, and any relevant tax documents from the previous year. Having these documents organized and readily available can streamline the process of filling out the form and ensure that all necessary information is included.

Penalties for Non-Compliance with the Declaration 2065 SD

Failure to comply with the requirements of the Declaration 2065 SD can lead to significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to file altogether. Additionally, non-compliance can trigger audits, which can be time-consuming and costly for businesses. It is essential to take the filing process seriously to avoid these potential consequences.

Quick guide on how to complete dclaration 2065 sd compta onlineformulaire de dclaration dimpt sur les socits 2065formulaire de dclaration dimpt sur les socits

Effortlessly Prepare Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit on Any Device

Managing documents online has gained traction among both companies and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit on any device with the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest method to amend and electronically sign Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit with ease

- Locate Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Don’t worry about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting copies. airSlate SignNow solves your document management requirements with just a few clicks from your chosen device. Edit and electronically sign Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a cerfa 2065 remplissable?

The cerfa 2065 remplissable is a French tax form used for income tax declarations. It provides a fillable format that simplifies the completion process for users, making it easier to submit to the tax authorities. By utilizing airSlate SignNow's features, you can easily manage and eSign your cerfa 2065 remplissable documents securely.

-

How does airSlate SignNow help with cerfa 2065 remplissable forms?

airSlate SignNow allows you to create, fill out, and send cerfa 2065 remplissable forms seamlessly. Our platform provides an intuitive interface where you can eSign documents and track their status throughout the process. This enhances efficiency and ensures that your tax forms are submitted on time.

-

Are there any costs associated with using airSlate SignNow for cerfa 2065 remplissable forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling cerfa 2065 remplissable forms. These plans are designed to be cost-effective, depending on the volume of documents you need to manage. Check our website for specific pricing details and to find the best plan for your requirements.

-

What features does airSlate SignNow provide for managing cerfa 2065 remplissable forms?

airSlate SignNow provides features like document sharing, eSigning, and template creation specifically for cerfa 2065 remplissable forms. You can automate workflows to save time and reduce errors as you fill out these forms. Additionally, our platform offers robust security measures to protect your sensitive information.

-

Can I integrate airSlate SignNow with other software for cerfa 2065 remplissable forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage cerfa 2065 remplissable forms. Whether you use CRM systems, email platforms, or project management tools, our integrations can streamline your document processes further, allowing for more efficient workflows.

-

What are the benefits of using airSlate SignNow for cerfa 2065 remplissable forms?

Using airSlate SignNow for your cerfa 2065 remplissable forms offers numerous benefits, including improved efficiency and reduced paperwork. The ease of eSigning enables quicker turnaround times for approvals and submissions. With our user-friendly platform, you can also easily access, manage, and track your documents from anywhere.

-

Is there a mobile app for handling cerfa 2065 remplissable forms?

Yes, airSlate SignNow offers a mobile app that allows you to manage cerfa 2065 remplissable forms on the go. With the app, you can fill out, sign, and send forms directly from your mobile device, making it convenient when you’re not at your desk. This ensures you can handle important documents anytime, anywhere.

Get more for Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit

- High risk pregnancy notification form miami dade county health department perinatal please send confidential fax to 305 470

- Ncysa medical waiver form

- Microscope parts and functions pdf form

- Cspire lifeline form

- Memorandum title form

- Julius caesar act 1 worksheet answers form

- North carolina individual estimated income tax instructions form

- International fuel tax agreement ifta renewal form

Find out other Dclaration 2065 SD Compta OnlineFormulaire De Dclaration D'impt Sur Les Socits 2065Formulaire De Dclaration D'impt Sur Les Socit

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement