Payroll Tax in Indiana What Employers Need to Know 2024-2026

Understanding the Payroll Tax in Indiana

The payroll tax in Indiana is a vital component of the state's tax system, affecting both employers and employees. This tax is levied on wages and salaries, contributing to various state and local services. Employers are responsible for withholding this tax from employee paychecks and remitting it to the appropriate authorities. Understanding the nuances of this tax is essential for compliance and effective financial planning.

Steps to Complete the Payroll Tax in Indiana

Completing the payroll tax process in Indiana involves several key steps:

- Determine the applicable tax rate: Employers should confirm the current payroll tax rate for their specific location, as rates can vary by county.

- Calculate employee withholdings: Accurately calculate the amount to be withheld from each employee's paycheck based on their earnings and the applicable tax rate.

- File the necessary forms: Complete and submit the required payroll tax forms to the Indiana Department of Revenue, ensuring all information is accurate and submitted on time.

- Remit payments: Pay the withheld amounts to the state, adhering to the deadlines to avoid penalties.

Legal Use of the Payroll Tax in Indiana

The payroll tax in Indiana is governed by state law, and employers must adhere to legal requirements to ensure compliance. This includes properly withholding the correct amounts from employee paychecks and submitting them to the state. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid amounts. Employers should stay informed about any changes in legislation that may affect payroll tax obligations.

Filing Deadlines and Important Dates

Timely filing and payment of payroll taxes are crucial for compliance. Employers in Indiana should be aware of the following key deadlines:

- Quarterly filings: Payroll taxes must be reported quarterly, with specific due dates for each quarter.

- Annual reconciliation: Employers must complete an annual reconciliation of payroll taxes, typically due by January 31 of the following year.

Required Documents for Payroll Tax Compliance

To ensure compliance with payroll tax regulations in Indiana, employers need to gather and maintain several key documents:

- Employee W-4 forms: These forms indicate the employee's withholding allowances and must be kept on file.

- Payroll records: Detailed records of all payroll transactions, including hours worked and wages paid, are essential for accurate reporting.

- Tax payment receipts: Keep copies of all payments made to the state for payroll taxes to verify compliance.

Penalties for Non-Compliance with Payroll Tax Regulations

Non-compliance with payroll tax regulations in Indiana can lead to significant penalties. Employers may face:

- Fines: Monetary penalties for late filings or payments can accumulate quickly.

- Interest charges: Unpaid amounts may accrue interest, increasing the total owed to the state.

- Legal action: In severe cases, continued non-compliance can result in legal action against the employer.

Examples of Payroll Tax Scenarios in Indiana

Understanding how payroll tax regulations apply to different situations can help employers navigate compliance effectively. Here are a few common scenarios:

- Seasonal employees: Employers hiring seasonal workers must ensure proper withholding and reporting during their employment period.

- Remote workers: Companies with employees working remotely in Indiana must comply with state tax laws, regardless of where the company is based.

- Employee classifications: Different classifications, such as full-time, part-time, or contract workers, may have varying payroll tax implications.

Create this form in 5 minutes or less

Find and fill out the correct payroll tax in indiana what employers need to know

Create this form in 5 minutes!

How to create an eSignature for the payroll tax in indiana what employers need to know

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

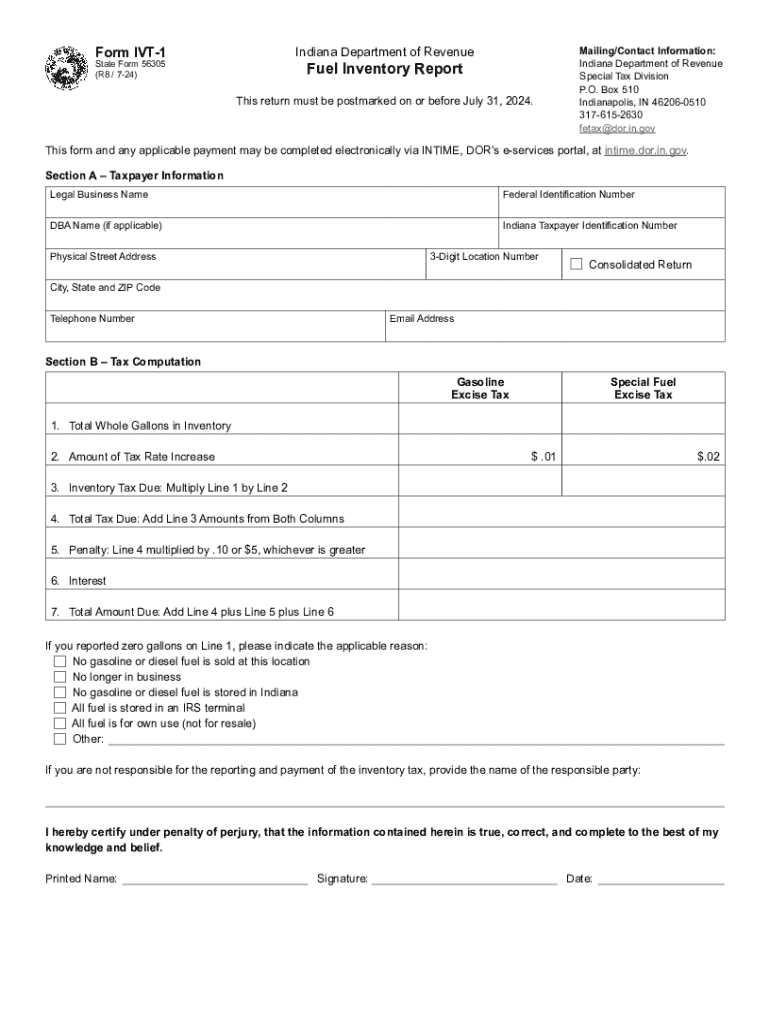

What is the Indiana form fuel and how can airSlate SignNow help?

The Indiana form fuel is a specific document required for fuel tax reporting in Indiana. airSlate SignNow simplifies the process by allowing users to easily fill out, sign, and send this form electronically, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for Indiana form fuel?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have access to features that streamline the completion of the Indiana form fuel.

-

What features does airSlate SignNow offer for managing the Indiana form fuel?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure document storage. These tools make it easy to manage the Indiana form fuel efficiently and ensure that all necessary information is accurately captured.

-

Can I integrate airSlate SignNow with other software for handling the Indiana form fuel?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can seamlessly connect your existing systems to manage the Indiana form fuel alongside other business processes.

-

Is airSlate SignNow secure for submitting the Indiana form fuel?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents. This ensures that your Indiana form fuel is submitted safely and confidentially.

-

How does airSlate SignNow improve the efficiency of completing the Indiana form fuel?

By using airSlate SignNow, businesses can eliminate the need for paper forms and manual signatures. This digital approach speeds up the process of completing the Indiana form fuel, allowing for quicker submissions and reduced turnaround times.

-

What are the benefits of using airSlate SignNow for the Indiana form fuel?

Using airSlate SignNow for the Indiana form fuel offers numerous benefits, including time savings, reduced errors, and improved compliance. The platform's user-friendly interface makes it accessible for all team members, enhancing overall productivity.

Get more for Payroll Tax In Indiana What Employers Need To Know

- We have many ways we can communicate with you govuk form

- T5018 statement contract payments etat form

- Chamber of commerce form

- Wwwscribdcomdocument388892855aarto form 14 20190130pdfregistered mailaffidavit

- Permit carry firearms residence ptcfor form

- Philippines office transportation cooperatives annual report form

- Nebraska cna reciprocity 621268266 form

- Form 5674 verification of rent paid

Find out other Payroll Tax In Indiana What Employers Need To Know

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage