Www Tax Ny GovpitadsEnhanced Form it 213, Claim for Empire State Child Credit

What is the IT-213 Form for Empire State Child Credit?

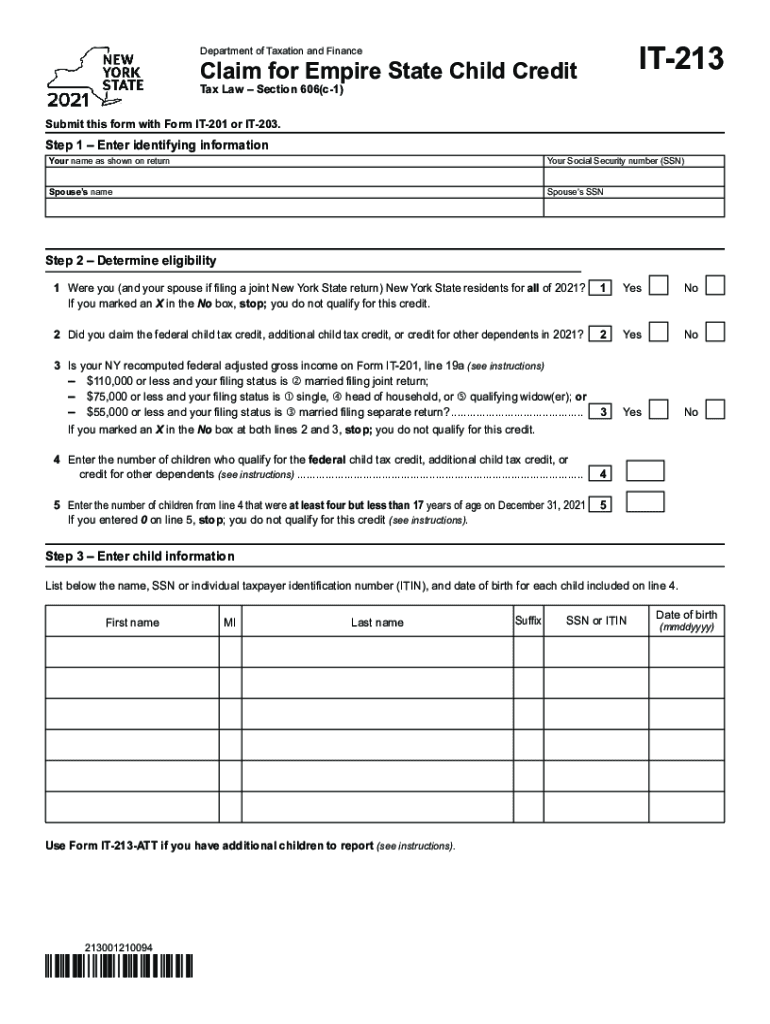

The IT-213 form, also known as the Claim for Empire State Child Credit, is a tax form used by eligible taxpayers in New York to claim a credit for qualifying children. This credit is designed to provide financial relief to families, reducing their overall tax liability. The form requires specific information about the taxpayer, their dependents, and their income to determine eligibility and the amount of credit available. Understanding the purpose and details of this form is essential for maximizing potential tax benefits.

Eligibility Criteria for the Empire State Child Credit

To qualify for the Empire State Child Credit, taxpayers must meet certain criteria. These include:

- Being a resident of New York State for the tax year.

- Having a qualifying child who is under the age of 17.

- Meeting specific income thresholds set by the New York State Department of Taxation and Finance.

Taxpayers should review the eligibility requirements carefully to ensure they qualify before submitting the IT-213 form.

Steps to Complete the IT-213 Form

Completing the IT-213 form involves several important steps:

- Gather necessary documents, including Social Security numbers for all dependents.

- Fill out personal information, including your name, address, and filing status.

- Provide details about your qualifying child or children, including their names and ages.

- Calculate the credit amount based on your income and the number of qualifying children.

- Review the form for accuracy before submission.

Following these steps carefully will help ensure that the form is completed accurately and efficiently.

How to Submit the IT-213 Form

The IT-213 form can be submitted in several ways:

- Online through the New York State Department of Taxation and Finance website.

- By mail, sending the completed form to the appropriate address provided by the department.

- In-person at designated tax offices, if applicable.

Choosing the right submission method can help expedite the processing of your claim.

Required Documents for the IT-213 Form

When completing the IT-213 form, certain documents are necessary to support your claim:

- Proof of residency in New York State.

- Social Security cards or numbers for all qualifying children.

- Income documentation, such as W-2 forms or tax returns.

Having these documents ready will streamline the process and help avoid delays in processing your claim.

Filing Deadlines for the IT-213 Form

It is important to be aware of the filing deadlines for the IT-213 form to ensure timely submission:

- The form must be filed by the tax return due date, typically April 15 of the following year.

- Extensions may be available, but they do not extend the deadline for paying any taxes owed.

Staying informed about deadlines helps prevent penalties and ensures eligibility for the credit.

Quick guide on how to complete wwwtaxnygovpitadsenhanced form it 213 claim for empire state child credit

Complete Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it on the web. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit with ease

- Locate Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose provided by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a state child credit form and why do I need it?

A state child credit form is a document used to claim tax credits for dependents on your state tax return. It's essential for maximizing your potential benefits, as it can signNowly reduce your tax liability. Properly filling out this form can help you secure funds that contribute to your family's financial well-being.

-

How can airSlate SignNow help me with the state child credit form?

airSlate SignNow offers a seamless electronic signing process that allows you to fill out and send your state child credit form quickly and securely. With our user-friendly interface, you can complete the form from anywhere, ensuring your documents are signed and submitted without hassle. This enhances your efficiency in managing tax-related paperwork.

-

Are there any costs associated with using airSlate SignNow for state child credit forms?

Yes, airSlate SignNow offers different pricing plans to fit various needs, including options for single users and businesses. While there may be a fee for advanced features, the basic plan allows you to create, sign, and manage your state child credit form at an affordable price. Investing in our service can save you time and resources.

-

What features does airSlate SignNow offer for managing state child credit forms?

airSlate SignNow provides a range of features for handling state child credit forms, including customizable templates, secure electronic signatures, and tracking capabilities. These features enable you to ensure that your documentation is complete and filed on time, helping you to avoid potential issues with the tax authorities. The platform makes it easy to manage multiple forms and documents in one place.

-

Can I integrate airSlate SignNow with other applications to manage state child credit forms?

Absolutely! airSlate SignNow integrates with various applications such as CRM systems, cloud storage services, and productivity tools. This allows you to streamline your workflow by directly linking your state child credit form processes with your existing software, ensuring a cohesive and efficient approach to document management.

-

Is airSlate SignNow secure for handling my state child credit form?

Yes, airSlate SignNow prioritizes the security of your documents, including state child credit forms. Our platform is compliant with strict industry standards, implementing features like data encryption and secure access controls to protect your sensitive information. You can trust us to safeguard your documents throughout the signing process.

-

What are the benefits of using airSlate SignNow for my state child credit form?

Using airSlate SignNow for your state child credit form greatly enhances your document management efficiency. You can complete the form quickly, send it for e-signature, and track its status in real-time. This leads to reduced paperwork and ensures that you meet deadlines while maximizing your potential tax benefits.

Get more for Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit

- Ohio prison commissary list form

- Statutory declaration of dom jak wypeni form

- Type printable document form

- Divorce papers in ms form

- Taxi driver medical form

- Attachment 6 b zero income verification checklist form

- North carolina child care form

- Site survey form ryterna garage doors ryternagaragedoors co

Find out other Www tax ny govpitadsEnhanced Form IT 213, Claim For Empire State Child Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors