Form 13615Fill Out and Use This PDF 2024

What is the Form 13615

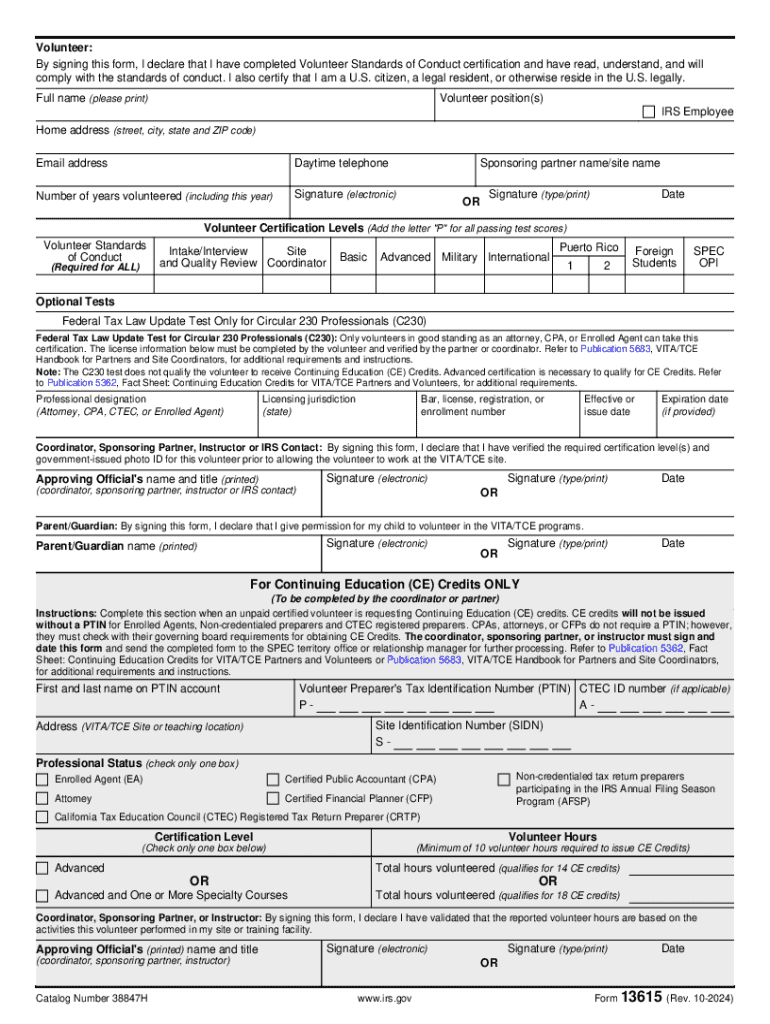

The Form 13615, officially known as the IRS Volunteer Standards of Conduct Agreement, is essential for volunteers participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. This form outlines the ethical standards and conduct expected from volunteers, ensuring that they provide accurate and confidential assistance to taxpayers. By signing this form, volunteers affirm their commitment to uphold the integrity of the tax assistance process.

Steps to Complete the Form 13615

Completing the Form 13615 involves several straightforward steps. First, volunteers should download the form in PDF format from the IRS website or obtain a physical copy. Next, they need to fill out their personal information, including name, address, and contact details. It is crucial to read the standards of conduct carefully before signing. After signing, the form must be submitted to the appropriate coordinator or supervisor within the VITA or TCE program. Ensuring that all sections are completed accurately is vital for compliance with IRS guidelines.

Legal Use of the Form 13615

The Form 13615 serves a legal purpose by establishing a formal agreement between volunteers and the IRS. This document ensures that volunteers are aware of their responsibilities regarding taxpayer confidentiality and ethical conduct. By signing the form, volunteers are legally bound to adhere to the standards set forth, which helps protect both the volunteers and the taxpayers they assist. Non-compliance with these standards can lead to deactivation from the program and potential legal consequences.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 13615, which are crucial for maintaining the integrity of volunteer programs. Volunteers must understand the importance of confidentiality and the ethical standards required in their roles. The IRS emphasizes the need for volunteers to avoid conflicts of interest and to provide unbiased assistance. These guidelines ensure that all volunteers operate within the legal framework established by the IRS, thereby fostering trust and reliability in the tax assistance process.

Required Documents

When filling out the Form 13615, volunteers should have certain documents on hand. This includes a valid form of identification, such as a driver's license or state ID, to confirm their identity. Additionally, any prior volunteer agreements or relevant training materials may be helpful to reference during the completion of the form. Having these documents ready ensures a smooth and efficient process for both the volunteer and the program coordinator.

Form Submission Methods

Volunteers can submit the Form 13615 through various methods, depending on the requirements of their specific VITA or TCE program. Typically, the completed form can be submitted in person to the program coordinator. Some programs may also allow electronic submission via email or a secure online portal. It is important for volunteers to confirm the preferred submission method with their program to ensure compliance with local procedures.

Eligibility Criteria

To be eligible to volunteer and complete the Form 13615, individuals must meet certain criteria established by the IRS. Volunteers typically need to be at least eighteen years old and possess a basic understanding of tax preparation. Additionally, they should demonstrate a commitment to providing quality service to taxpayers. Meeting these eligibility requirements is essential for maintaining the integrity and effectiveness of the VITA and TCE programs.

Handy tips for filling out Form 13615Fill Out And Use This PDF online

Quick steps to complete and e-sign Form 13615Fill Out And Use This PDF online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send out Form 13615Fill Out And Use This PDF for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 13615fill out and use this pdf

Create this form in 5 minutes!

How to create an eSignature for the form 13615fill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are standards conduct programs and how can airSlate SignNow help?

Standards conduct programs are essential frameworks that guide organizations in maintaining ethical practices. airSlate SignNow simplifies the implementation of these programs by providing a user-friendly platform for eSigning and document management, ensuring compliance and accountability.

-

How does airSlate SignNow support compliance with standards conduct programs?

airSlate SignNow offers features that enhance compliance with standards conduct programs, such as secure eSigning, audit trails, and customizable workflows. These tools help organizations ensure that all documents are signed and stored in accordance with regulatory requirements.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you are a small business or a large enterprise, you can choose a plan that aligns with your budget while effectively supporting your standards conduct programs.

-

Can airSlate SignNow integrate with other software for standards conduct programs?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your standards conduct programs. This integration allows for streamlined workflows and improved data management, making it easier to maintain compliance.

-

What are the key features of airSlate SignNow that benefit standards conduct programs?

Key features of airSlate SignNow include secure eSigning, document templates, and real-time tracking. These features are designed to support standards conduct programs by ensuring that all documentation is handled efficiently and securely.

-

How does airSlate SignNow enhance the efficiency of standards conduct programs?

By automating the document signing process, airSlate SignNow signNowly enhances the efficiency of standards conduct programs. This automation reduces the time spent on paperwork, allowing teams to focus on more strategic initiatives.

-

Is airSlate SignNow suitable for all types of businesses implementing standards conduct programs?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes and industries. Its versatility makes it an ideal solution for any organization looking to implement or enhance their standards conduct programs.

Get more for Form 13615Fill Out And Use This PDF

Find out other Form 13615Fill Out And Use This PDF

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now