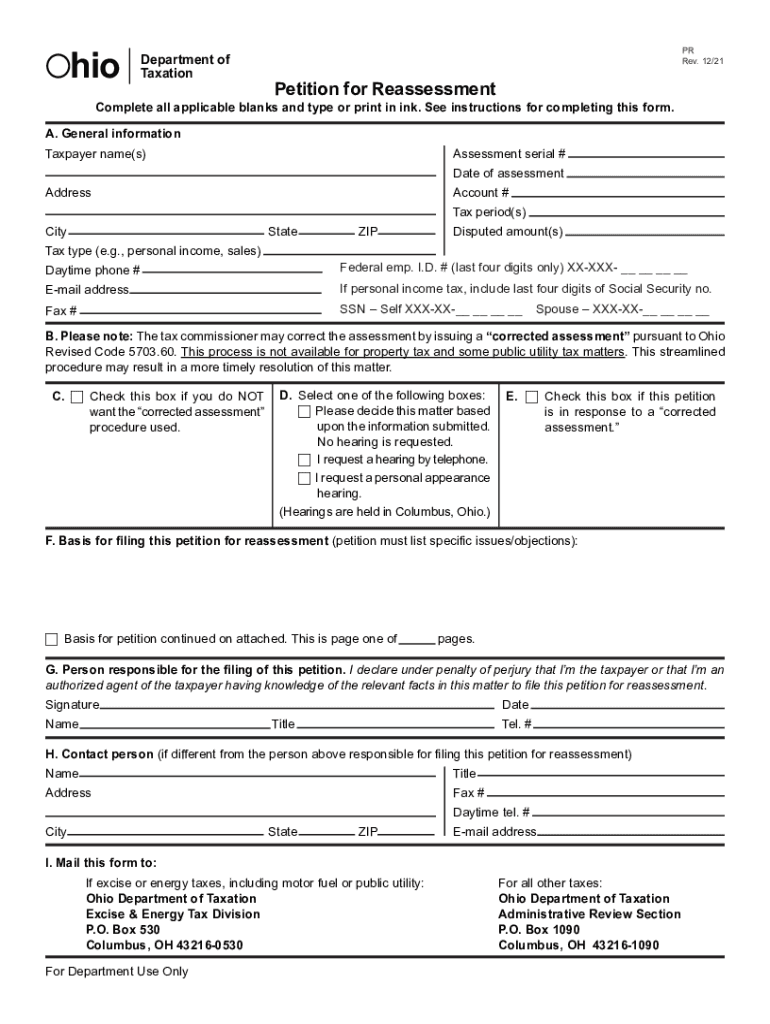

Petition for Reassessment Ohio Form

What is the Petition for Reassessment Ohio

The Petition for Reassessment Ohio is a formal request submitted to the Ohio Department of Taxation, allowing taxpayers to contest their property tax assessments. This process is essential for individuals or businesses who believe their property has been overvalued, leading to higher tax obligations. By filing this petition, taxpayers seek a reassessment that reflects the true market value of their property, ensuring they are not overpaying on taxes.

Steps to Complete the Petition for Reassessment Ohio

Completing the Petition for Reassessment Ohio involves several key steps to ensure accuracy and compliance with state regulations. Begin by obtaining the official form from the Ohio Department of Taxation. Next, gather all necessary documentation that supports your claim, such as recent property appraisals or comparable sales data. Fill out the form carefully, providing detailed information about your property and the reasons for the reassessment request. Finally, review the completed petition for any errors before submitting it to the appropriate local tax authority.

Legal Use of the Petition for Reassessment Ohio

The legal use of the Petition for Reassessment Ohio is governed by state laws that outline the rights of property owners to challenge their tax assessments. It is crucial that taxpayers understand the legal framework surrounding this process, including deadlines for filing and the required documentation. Submitting a petition that adheres to these legal standards ensures that the request is considered valid and can lead to a successful outcome.

Required Documents for the Petition for Reassessment Ohio

When filing the Petition for Reassessment Ohio, several documents are typically required to substantiate your claim. These may include:

- Proof of ownership, such as a deed or title.

- Recent property appraisals that reflect the current market value.

- Comparative sales data from similar properties in the area.

- Any previous tax assessments or notices received.

Gathering these documents in advance can streamline the filing process and strengthen your case.

Form Submission Methods for the Petition for Reassessment Ohio

Taxpayers have various options for submitting the Petition for Reassessment Ohio. The form can typically be submitted in several ways:

- Online through the Ohio Department of Taxation's official website.

- By mail, sending the completed form to the designated local tax authority.

- In-person at the local tax office, where you can receive assistance if needed.

Choosing the most convenient submission method can help ensure that your petition is processed in a timely manner.

Eligibility Criteria for the Petition for Reassessment Ohio

To be eligible to file the Petition for Reassessment Ohio, taxpayers must meet specific criteria. Generally, this includes being the legal owner of the property in question and having a valid reason for requesting a reassessment. Reasons may include significant changes in property value, errors in the initial assessment, or discrepancies in property characteristics. Understanding these eligibility requirements is essential for a successful petition.

Quick guide on how to complete petition for reassessment ohio

Effortlessly Prepare Petition For Reassessment Ohio on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools for quickly creating, modifying, and electronically signing your documents without delays. Handle Petition For Reassessment Ohio on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Easily Edit and eSign Petition For Reassessment Ohio with Minimal Effort

- Find Petition For Reassessment Ohio and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Petition For Reassessment Ohio to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Ohio Department of Taxation Petition for Reassessment?

The Ohio Department of Taxation Petition for Reassessment is a formal request submitted to contest the value assessment of property by the state. This process allows property owners to challenge their property taxes if they believe their assessment is inaccurate. airSlate SignNow simplifies this process by enabling users to create, send, and sign petitions electronically, ensuring a smooth submission.

-

How can airSlate SignNow assist with the Ohio Department of Taxation Petition for Reassessment?

airSlate SignNow provides an easy-to-use platform for preparing and submitting the Ohio Department of Taxation Petition for Reassessment. With its e-signature capabilities, users can securely sign documents online, eliminating the need for printing and mailing. This results in faster processing times and greater efficiency in handling tax reassessment petitions.

-

Is there a cost associated with using airSlate SignNow for tax petitions?

Yes, airSlate SignNow offers various pricing plans to suit different user needs, starting with affordable options for individuals and businesses. The cost is competitive compared to traditional methods of document handling when submitting an Ohio Department of Taxation Petition for Reassessment. The savings in time and resources make it a worthwhile investment for tax professionals and property owners alike.

-

What features does airSlate SignNow offer for handling reassessment petitions?

airSlate SignNow offers a range of features including customizable templates, e-signature integration, and secure storage capabilities. These features simplify the process of preparing an Ohio Department of Taxation Petition for Reassessment. Users can also track document statuses and receive notifications, which enhances communication and efficiency.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow supports integration with various applications commonly used in tax management, such as accounting software and document storage services. This flexibility allows users to streamline their processes when filing an Ohio Department of Taxation Petition for Reassessment, making it easier to manage all tax-related documents in one place.

-

How secure is the data when using airSlate SignNow for tax documents?

Data security is a top priority at airSlate SignNow. The platform uses industry-standard encryption to protect sensitive information, ensuring that your Ohio Department of Taxation Petition for Reassessment is secure during transmission and storage. With strict privacy controls, users can confidently manage their tax documents without worrying about unauthorized access.

-

What are the benefits of using airSlate SignNow for tax reassessment petitions?

Utilizing airSlate SignNow for your Ohio Department of Taxation Petition for Reassessment streamlines the entire process, saving time and reducing paperwork. The platform's intuitive interface ensures that users can easily navigate the petition process from start to finish. Additionally, the ability to track and manage submissions enhances overall organization and control.

Get more for Petition For Reassessment Ohio

Find out other Petition For Reassessment Ohio

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form