Skipton Intermediaries Form

What is the Skipton Intermediaries

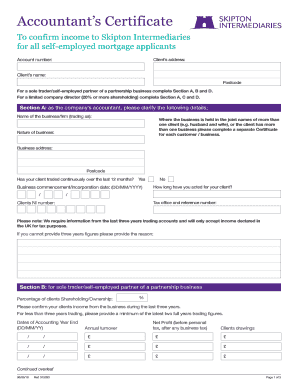

The Skipton Intermediaries form serves as a crucial document for financial transactions and agreements, particularly within the realm of mortgages and loans. This form is utilized by intermediaries to facilitate communication between lenders and borrowers. It ensures that all necessary information is collected and verified, allowing for a smoother application process. Understanding the purpose and function of this form is essential for anyone involved in intermediary services.

How to use the Skipton Intermediaries

Using the Skipton Intermediaries form involves several straightforward steps. First, intermediaries must gather all relevant information from clients, including personal details and financial status. Next, the form should be filled out accurately, ensuring that all required fields are completed. Once filled, the form can be submitted electronically, which streamlines the process and reduces the risk of errors. It is important for intermediaries to familiarize themselves with the specific requirements of the form to ensure compliance and efficiency.

Legal use of the Skipton Intermediaries

The legal use of the Skipton Intermediaries form is governed by various regulations that ensure its validity and enforceability. This includes adherence to eSignature laws, which recognize electronic signatures as legally binding under the ESIGN Act and UETA. Intermediaries must ensure that the form is filled out in compliance with these laws to avoid potential disputes. Additionally, maintaining accurate records and documentation is vital for legal protection and verification purposes.

Steps to complete the Skipton Intermediaries

Completing the Skipton Intermediaries form involves a series of methodical steps:

- Gather necessary information from clients, including identification and financial details.

- Access the digital form through a secure platform.

- Fill in all required fields accurately, ensuring no information is omitted.

- Review the completed form for accuracy and completeness.

- Submit the form electronically, ensuring a confirmation of submission is received.

Following these steps will help ensure that the form is completed correctly and efficiently.

Key elements of the Skipton Intermediaries

Several key elements are essential for the Skipton Intermediaries form to be effective:

- Accurate Information: All personal and financial details must be precise to avoid processing delays.

- Compliance: Adherence to legal standards and regulations is crucial for the form's validity.

- Signature: An electronic signature must be included to authenticate the document.

- Documentation: Supporting documents should be attached as required to substantiate the information provided.

Understanding these elements can enhance the effectiveness of the form and ensure a smoother process for all parties involved.

Examples of using the Skipton Intermediaries

The Skipton Intermediaries form can be applied in various scenarios, such as:

- Facilitating mortgage applications for first-time homebuyers.

- Assisting clients in refinancing existing loans to secure better rates.

- Helping businesses obtain financing for expansion or operational needs.

These examples illustrate the versatility of the form and its importance in different financial contexts.

Quick guide on how to complete skipton intermediaries

Complete Skipton Intermediaries effortlessly on any device

Online document administration has gained increased traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Skipton Intermediaries on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Skipton Intermediaries seamlessly

- Find Skipton Intermediaries and then click Get Form to initiate.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Skipton Intermediaries and guarantee excellent communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Skipton for intermediaries?

Skipton for intermediaries is a dedicated platform that provides brokers with the tools they need to manage loan applications efficiently. By utilizing Skipton for intermediaries, brokers can streamline their processes and offer clients a smoother experience.

-

How does airSlate SignNow integrate with Skipton for intermediaries?

airSlate SignNow seamlessly integrates with Skipton for intermediaries, allowing users to eSign and send documents directly through the platform. This integration enhances workflow efficiency and ensures that brokers can manage client documents without unnecessary delays.

-

What are the pricing options for using Skipton for intermediaries?

Pricing for utilizing Skipton for intermediaries varies based on the services needed; however, it is known for being cost-effective. With airSlate SignNow, you can expect competitive pricing that suits your business budget while ensuring you have access to top-notch eSigning features.

-

What features does airSlate SignNow offer for Skipton for intermediaries users?

AirSlate SignNow offers a variety of features tailored for Skipton for intermediaries users, including document templates, in-app collaboration, and secure storage. These features simplify the signing process and improve the user experience for brokers and their clients alike.

-

What are the benefits of using airSlate SignNow with Skipton for intermediaries?

Using airSlate SignNow in conjunction with Skipton for intermediaries provides numerous benefits such as increased efficiency, reduced turnaround times, and higher client satisfaction. This powerful combination enables brokers to focus more on closing deals rather than managing paperwork.

-

Can I access Skipton for intermediaries on mobile devices?

Yes, Skipton for intermediaries can be accessed on mobile devices, allowing brokers to work on the go. Coupled with airSlate SignNow’s mobile functionality, you can easily send and eSign documents anytime and anywhere.

-

How secure is airSlate SignNow when used with Skipton for intermediaries?

AirSlate SignNow takes security seriously, implementing robust encryption methods to ensure that all documents processed through Skipton for intermediaries are secure. Coupled with comprehensive compliance features, your client data remains protected at all times.

Get more for Skipton Intermediaries

Find out other Skipton Intermediaries

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT