SCHEDULE D Form 1120 Department of the 2023

What is the Schedule D Form 1120?

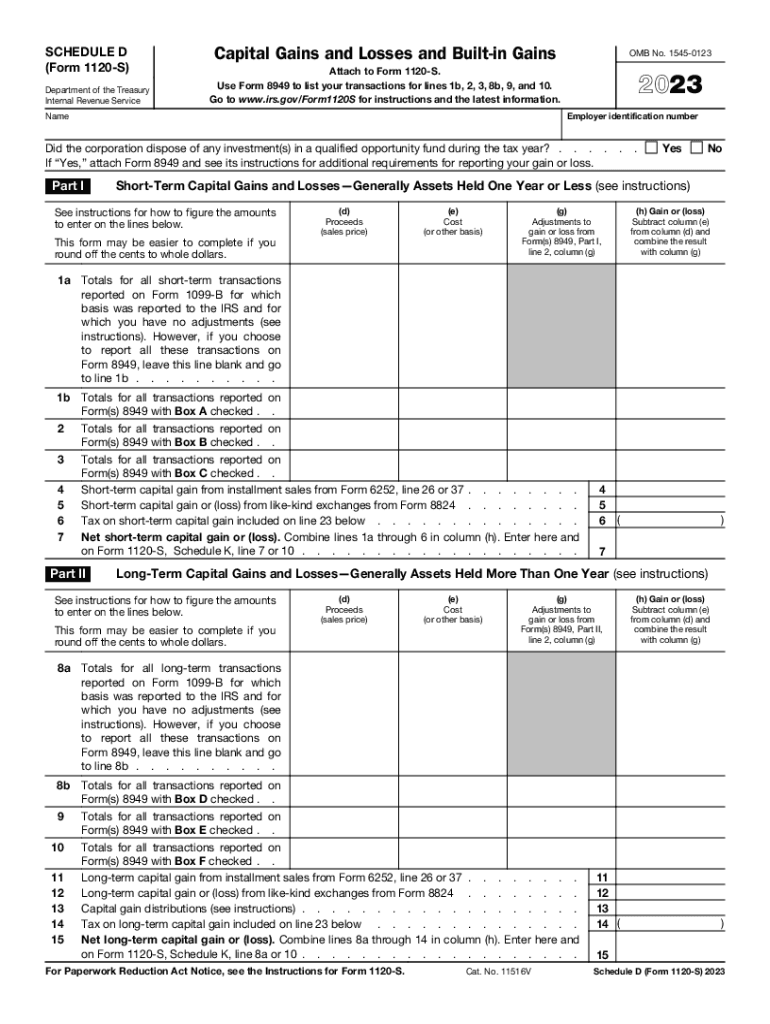

The Schedule D Form 1120 is a tax form used by corporations to report capital gains and losses. This form is essential for businesses that have sold assets or investments during the tax year. It allows corporations to calculate their net capital gain or loss, which is then reported on their corporate tax return. Understanding this form is crucial for compliance with IRS regulations and for accurate tax reporting.

How to Use the Schedule D Form 1120

Using the Schedule D Form 1120 involves several steps. First, businesses must gather all relevant information regarding their capital transactions, including sales of stocks, bonds, and other assets. Next, they will complete the form by detailing each transaction, including the date of sale, the amount received, and the cost basis of the asset sold. Finally, the total capital gains or losses calculated on this form will be transferred to the corporation's main tax return, ensuring that all income is accurately reported to the IRS.

Key Elements of the Schedule D Form 1120

The Schedule D Form 1120 contains several key elements that are important for accurate reporting. These include:

- Capital Gains and Losses: Detailed reporting of each transaction, including the type of asset, date acquired, date sold, and amounts.

- Net Capital Gain or Loss: A calculation that summarizes total gains and losses to determine the net result.

- Tax Rates: Information on applicable tax rates for different types of capital gains, which can vary based on the asset held and the duration of ownership.

Steps to Complete the Schedule D Form 1120

Completing the Schedule D Form 1120 requires careful attention to detail. The following steps outline the process:

- Gather all documentation related to capital transactions, including purchase and sale records.

- List each transaction on the form, ensuring accuracy in dates and amounts.

- Calculate the total capital gains and losses for the reporting period.

- Transfer the net capital gain or loss to the main corporate tax return.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Schedule D Form 1120

Filing deadlines for the Schedule D Form 1120 align with the corporate tax return deadlines. Typically, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. It is essential to be aware of these deadlines to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file the Schedule D Form 1120 accurately and on time can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, inaccuracies in reporting capital gains or losses can lead to audits and further scrutiny from the IRS. It is crucial for corporations to ensure compliance to avoid these potential issues.

Quick guide on how to complete schedule d form 1120 department of the

Effortlessly prepare SCHEDULE D Form 1120 Department Of The on any device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the correct template and safely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Handle SCHEDULE D Form 1120 Department Of The on any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-related workflow today.

How to modify and eSign SCHEDULE D Form 1120 Department Of The with ease

- Find SCHEDULE D Form 1120 Department Of The and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign SCHEDULE D Form 1120 Department Of The to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d form 1120 department of the

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1120 department of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the IRS Schedule D Capital?

The IRS Schedule D Capital is used to report capital gains and losses from the sale of securities and other assets. This form helps taxpayers calculate their net capital gain or loss for the year, ensuring they comply with tax regulations. Understanding how to properly fill out this schedule is crucial for accurate tax filings.

-

How can airSlate SignNow assist with IRS Schedule D Capital documents?

airSlate SignNow provides a streamlined platform for drafting, sending, and eSigning documents related to IRS Schedule D Capital. With its user-friendly interface, users can easily manage and store necessary tax documents securely. This helps ensure that all paperwork is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule D Capital documentation?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs and budgets. The cost-effective solution provides access to essential features for managing IRS Schedule D Capital documents without breaking the bank. You can choose a plan that best suits your volume and specific requirements.

-

What features does airSlate SignNow offer for handling IRS Schedule D Capital forms?

AirSlate SignNow includes features like customizable templates, eSignature capabilities, and secure storage for IRS Schedule D Capital forms. These tools streamline the document management process, allowing users to quickly create, send, and track the status of their tax documents. This enhances productivity and aids in compliance.

-

Are there integrations available with airSlate SignNow for IRS Schedule D Capital needs?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms that can help manage IRS Schedule D Capital documentation. Whether you are using accounting software or other business applications, these integrations facilitate smoother workflows and data management.

-

What benefits do I gain from using airSlate SignNow for IRS Schedule D Capital?

Using airSlate SignNow for IRS Schedule D Capital provides several benefits, including efficiency, accuracy, and convenience. The platform eliminates paperwork hassles, reduces errors with eSigning, and organizes your documents in one secure location. This ultimately saves time during the tax filing process.

-

Can airSlate SignNow help with IRS Schedule D Capital audits?

Yes, airSlate SignNow can play a vital role in helping you prepare for IRS Schedule D Capital audits. By organizing all your documents and keeping a robust record of transactions, you ensure that you have readily available information for auditors. This preparedness can streamline the audit process and reduce potential issues.

Get more for SCHEDULE D Form 1120 Department Of The

- Instructions to form llc 1014 1 guide for articles of

- Building permit application rapid permit service inc form

- Simsbury meadows performing arts centerperforming arts

- Kansas financial affidavit form

- Funeral arrangements worksheet irp cdn multiscreensite com form

- Job completion report 410750641 form

- Acknowledgment of paternity hawaii state judiciary formalu

- South carolina city history form

Find out other SCHEDULE D Form 1120 Department Of The

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple