Instructions for Schedule D Form 1120S, Capital Gains and 2024-2026

Understanding the Instructions for Schedule D Form 1120S

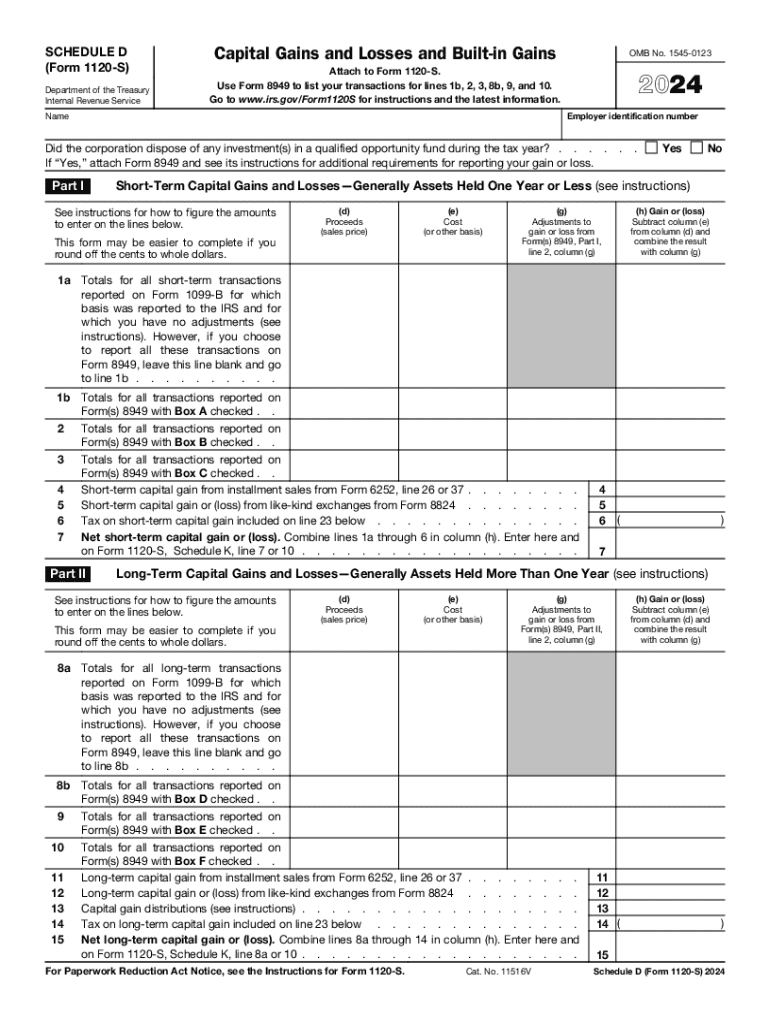

The Instructions for Schedule D Form 1120S provide essential guidance for S corporations to report capital gains and losses. This form is crucial for accurately reflecting the financial performance of the business. It outlines the necessary steps to report transactions involving stocks, bonds, and other capital assets. Understanding these instructions helps ensure compliance with IRS regulations and accurate tax reporting.

Steps to Complete the Instructions for Schedule D Form 1120S

Completing the Schedule D Form 1120S involves several key steps:

- Gather all relevant financial records, including details of capital gains and losses.

- Follow the instructions to determine the correct classification of each transaction.

- Fill out the form accurately, ensuring all figures are correct and properly categorized.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Schedule D Form 1120S. Typically, S corporations must file their tax returns by the fifteenth day of the third month following the end of their tax year. For those operating on a calendar year basis, this means the deadline is March 15. Failure to meet these deadlines may result in penalties and interest charges.

Required Documents for Schedule D Form 1120S

To complete the Schedule D Form 1120S, certain documents are required:

- Financial statements that detail capital transactions.

- Records of stock and bond transactions, including purchase and sale dates.

- Documentation of any capital losses carried over from previous years.

IRS Guidelines for Schedule D Form 1120S

The IRS provides specific guidelines for completing the Schedule D Form 1120S. These guidelines include instructions on how to report various types of capital gains and losses, as well as how to handle special situations such as inherited property or like-kind exchanges. Adhering to these guidelines is critical for ensuring compliance and minimizing the risk of audits.

Penalties for Non-Compliance with Schedule D Form 1120S

Non-compliance with the requirements for the Schedule D Form 1120S can lead to significant penalties. The IRS may impose fines for late filing, inaccurate reporting, or failure to report capital gains and losses. It is important for S corporations to understand these penalties and take steps to ensure timely and accurate submissions to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule d form 1120s capital gains and

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule d form 1120s capital gains and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 IRS Schedule D form?

The 2021 IRS Schedule D form is used to report capital gains and losses from the sale of securities and other assets. It helps taxpayers calculate their overall capital gain or loss for the year, which is essential for accurate tax filing. Understanding this form is crucial for anyone involved in trading or investing.

-

How can airSlate SignNow help with the 2021 IRS Schedule D form?

airSlate SignNow simplifies the process of preparing and signing the 2021 IRS Schedule D form. With our easy-to-use platform, you can quickly fill out, eSign, and send your tax documents securely. This streamlines your tax preparation and ensures compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the 2021 IRS Schedule D form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that facilitate the completion of the 2021 IRS Schedule D form and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your tax documents, including the 2021 IRS Schedule D form, efficiently. Our platform ensures that your documents are organized and accessible whenever you need them.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to streamline your workflow when preparing the 2021 IRS Schedule D form and other tax documents, enhancing productivity and reducing errors.

-

What are the benefits of using airSlate SignNow for eSigning tax forms?

Using airSlate SignNow for eSigning tax forms like the 2021 IRS Schedule D form offers numerous benefits, including speed, security, and convenience. You can sign documents from anywhere, reducing the time spent on paperwork. Additionally, our platform ensures that your signatures are legally binding and secure.

-

Is airSlate SignNow compliant with IRS regulations for tax documents?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures and document management. This compliance ensures that your 2021 IRS Schedule D form and other tax documents are handled according to legal standards. You can trust our platform to keep your information secure and compliant.

Get more for Instructions For Schedule D Form 1120S, Capital Gains And

- Montana office of public instruction re dissemination form

- Cbp 6043 form

- Cara mengisi borang permohonan lesen berniaga sabah form

- Schools first direct deposit form

- Zenox pump zps 800 manual form

- Israel visa online form

- Printable zumba waiver form

- Michigan department of state licensing unit medical examination report form

Find out other Instructions For Schedule D Form 1120S, Capital Gains And

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple