Instructions for Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions for Schedule D Form 1120 S 202 2022

Understanding the 2022 IRS Schedule D

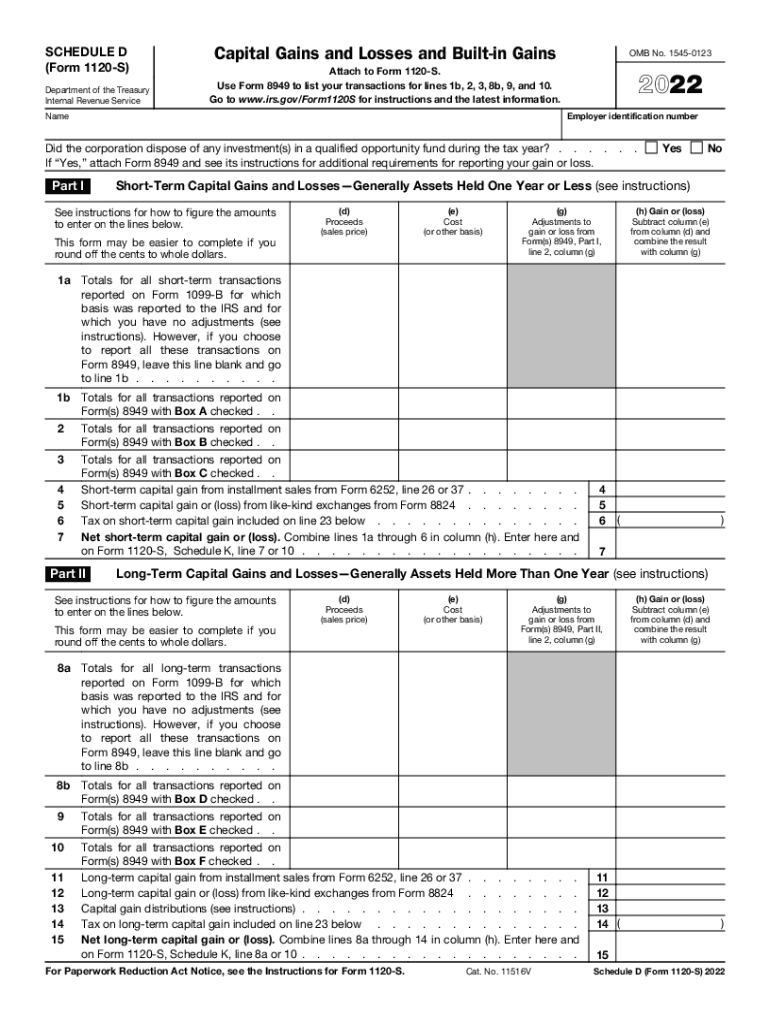

The 2022 IRS Schedule D is a crucial form for taxpayers who need to report capital gains and losses. This form is essential for individuals and businesses, including S corporations, to accurately report their investment income to the Internal Revenue Service. The Schedule D form allows taxpayers to summarize their capital gains and losses from the sale of assets, such as stocks or real estate, and helps determine the overall tax liability. Understanding the components of this form is vital for ensuring compliance with tax regulations.

Steps to Complete the 2022 IRS Schedule D

Filling out the 2022 IRS Schedule D involves several key steps. First, gather all necessary documentation related to the sales of assets, including purchase and sale records. Next, complete Part I of the form, which focuses on short-term capital gains and losses. This section requires listing each transaction, including the date acquired, date sold, proceeds, and cost basis. After completing Part I, move on to Part II, which addresses long-term capital gains and losses. Finally, ensure that all calculations are accurate before transferring the totals to your main tax return.

Legal Use of the 2022 IRS Schedule D

The 2022 IRS Schedule D serves as a legally binding document when filed with your tax return. It is important to ensure that all information provided is accurate and complete, as discrepancies can lead to audits or penalties. The IRS requires that taxpayers maintain supporting documentation for all reported transactions, which may be requested during an audit. Using a reliable eSignature platform can streamline the signing process and ensure that your Schedule D is submitted securely.

Filing Deadlines for the 2022 IRS Schedule D

Taxpayers must adhere to specific filing deadlines for the 2022 IRS Schedule D. Generally, the deadline for filing individual tax returns, including Schedule D, is April 15 of the following year. However, if you file for an extension, you may have until October 15 to submit your return. It is essential to stay informed about any changes to these deadlines to avoid late filing penalties.

Required Documents for the 2022 IRS Schedule D

To complete the 2022 IRS Schedule D accurately, several documents are required. These include transaction records for all capital asset sales, such as brokerage statements, purchase receipts, and any related documentation that supports the reported gains or losses. Keeping organized records will facilitate a smoother filing process and ensure compliance with IRS regulations.

IRS Guidelines for the 2022 Schedule D

The IRS provides specific guidelines for completing the Schedule D form. Taxpayers should refer to the IRS instructions for Schedule D to understand the requirements for reporting capital gains and losses. These guidelines outline the definitions of short-term and long-term gains, as well as the methods for calculating cost basis and proceeds. Following these guidelines is crucial for accurate reporting and avoiding potential issues with the IRS.

Quick guide on how to complete instructions for schedule d form 1120 s 20202020 schedule d form 1120 s irs tax formsinstructions for schedule d form 1120 s

Complete Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and electronically sign Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202 seamlessly

- Locate Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searching, and errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule d form 1120 s 20202020 schedule d form 1120 s irs tax formsinstructions for schedule d form 1120 s

Create this form in 5 minutes!

People also ask

-

What is the 2022 IRS Schedule D and why is it important?

The 2022 IRS Schedule D is a tax form used to report capital gains and losses. It's important for individuals and businesses to accurately report their investment transactions to ensure compliance with tax regulations. Proper use of the 2022 IRS Schedule D can help minimize tax liabilities.

-

How can airSlate SignNow help with the 2022 IRS Schedule D?

airSlate SignNow allows you to securely send and eSign documents related to your 2022 IRS Schedule D easily. This platform enables efficient document management, so you can focus on preparing your tax forms without the hassle of traditional paperwork. Our service streamlines the eSignature process, making tax filing smoother.

-

What features does airSlate SignNow offer that assist with tax documentation?

airSlate SignNow offers features like document templates, real-time collaboration, and secure eSigning, which are essential for managing documents related to the 2022 IRS Schedule D. These tools ensure that your documents are accurately completed and ready for submission. Additionally, the platform allows for easy integration with popular accounting software.

-

Is airSlate SignNow cost-effective for small businesses dealing with the 2022 IRS Schedule D?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage tax-related documents like the 2022 IRS Schedule D. Our competitive pricing plans cater to various business sizes, ensuring you have access to essential eSignature capabilities without breaking the bank. This helps you streamline tax processes affordably.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2022 IRS Schedule D?

Absolutely! airSlate SignNow easily integrates with numerous accounting software solutions, facilitating smooth handling of your 2022 IRS Schedule D. This integration allows you to keep your financial data organized and ensures that all necessary documents are readily available when filing your taxes.

-

What are the security measures in place for signing documents related to the 2022 IRS Schedule D?

airSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect documents related to your 2022 IRS Schedule D. Our platform ensures that all eSignatures are securely collected, and your sensitive information remains confidential. With airSlate SignNow, you can trust that your tax documentation is safe.

-

How does airSlate SignNow enhance the tax filing process for the 2022 IRS Schedule D?

By using airSlate SignNow, you can signNowly enhance the tax filing process for the 2022 IRS Schedule D. The platform allows for quick document preparation and efficient eSigning, minimizing the time spent on paperwork. This streamlined approach ultimately leads to a more organized and stress-free tax filing experience.

Get more for Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202

Find out other Instructions For Schedule D Form 1120 S 20202020 Schedule D Form 1120 S IRS Tax FormsInstructions For Schedule D Form 1120 S 202

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF