TruStone Financial Direct Deposit Information

What is the TruStone Financial Direct Deposit Information

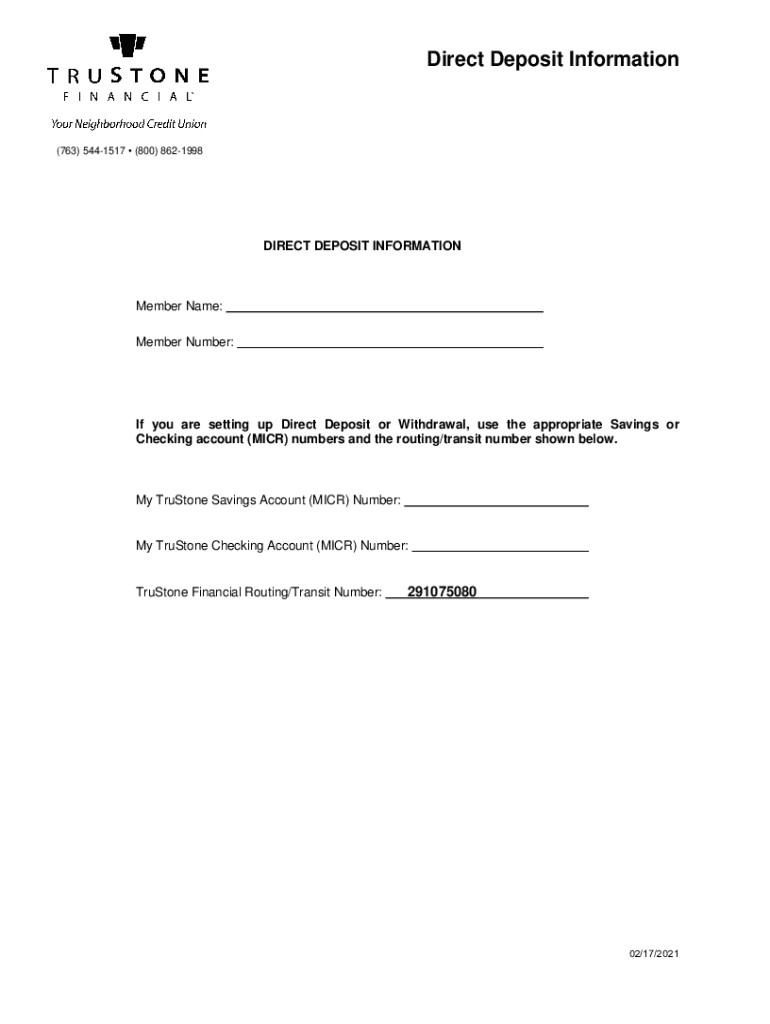

The TruStone Financial Direct Deposit information refers to the details required for setting up direct deposit services through TruStone Financial. This service allows members to receive their paychecks, government benefits, or other recurring payments directly into their bank accounts. By utilizing direct deposit, individuals can ensure timely access to their funds without the need for physical checks. The information typically includes account numbers, routing numbers, and personal identification details.

How to use the TruStone Financial Direct Deposit Information

To use the TruStone Financial Direct Deposit information, individuals need to provide their employer or the issuing agency with the necessary banking details. This process usually involves filling out a direct deposit authorization form, which includes the account number and routing number associated with the TruStone Financial account. Once submitted, the employer or agency will process the request, and future payments will be deposited directly into the specified account.

Steps to complete the TruStone Financial Direct Deposit Information

Completing the TruStone Financial Direct Deposit information involves several straightforward steps:

- Gather necessary information: Collect your TruStone Financial account number and routing number.

- Obtain the direct deposit authorization form: This form may be provided by your employer or can be obtained from TruStone Financial.

- Fill out the form: Accurately enter your personal information, including your name, address, and banking details.

- Submit the form: Return the completed form to your employer or the agency responsible for issuing payments.

- Verify the setup: After a pay period, check your account to confirm that the direct deposit is active and functioning correctly.

Legal use of the TruStone Financial Direct Deposit Information

The legal use of the TruStone Financial Direct Deposit information is governed by various federal and state regulations. Direct deposit agreements must comply with the Electronic Funds Transfer Act (EFTA), which outlines the rights of consumers regarding electronic payments. Additionally, employers must ensure that they have the proper authorization from employees before initiating direct deposits. This legal framework helps protect both parties and ensures secure transactions.

Key elements of the TruStone Financial Direct Deposit Information

Key elements of the TruStone Financial Direct Deposit information include:

- Account Number: A unique identifier for your TruStone Financial account.

- Routing Number: A nine-digit number that identifies the financial institution.

- Authorization Signature: A signature or electronic consent indicating that you permit direct deposits into your account.

- Personal Information: Your full name, address, and possibly your Social Security number for verification purposes.

Examples of using the TruStone Financial Direct Deposit Information

Examples of using the TruStone Financial Direct Deposit information include receiving salary payments from an employer, government benefits such as Social Security or unemployment compensation, and tax refunds from the IRS. Each of these scenarios requires the individual to provide their TruStone Financial account and routing numbers to ensure that funds are deposited accurately and promptly into their accounts.

Quick guide on how to complete trustone financial direct deposit information

Effortlessly Prepare TruStone Financial Direct Deposit Information on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and secure its storage online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage TruStone Financial Direct Deposit Information across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Alter and Electronically Sign TruStone Financial Direct Deposit Information with Ease

- Find TruStone Financial Direct Deposit Information and click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with specialized tools offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign TruStone Financial Direct Deposit Information to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trustone financial direct deposit information

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is Trustone Financial Direct Deposit?

Trustone Financial Direct Deposit is a secure and convenient way to have your paycheck deposited directly into your bank account. This service not only saves time but also provides immediate access to your funds, ensuring that you never miss a payday with Trustone Financial's seamless integration.

-

How does Trustone Financial Direct Deposit work?

Trustone Financial Direct Deposit works by allowing your employer to electronically transfer your salary or payments directly into your bank account. By providing your banking information to your employer, you can ensure that your funds are available faster and without the need for paper checks.

-

What are the benefits of using Trustone Financial Direct Deposit?

Using Trustone Financial Direct Deposit offers numerous benefits, including enhanced security, quicker access to funds, and reduced chances of lost or stolen checks. Additionally, it simplifies the payment process for businesses and employees alike, making it a preferred option in today’s digital age.

-

Are there any fees associated with Trustone Financial Direct Deposit?

Trustone Financial Direct Deposit typically does not incur any fees for employees or employers. However, it's advisable to check with your financial institution regarding any potential charges related to account maintenance or transaction services when using direct deposit.

-

How do I set up Trustone Financial Direct Deposit?

To set up Trustone Financial Direct Deposit, you will need to provide your employer with your bank account details, including your account number and routing number. Usually, your employer will supply a form to fill out, ensuring that your payments go directly into your account without delay.

-

Can I use Trustone Financial Direct Deposit with multiple accounts?

Yes, you can use Trustone Financial Direct Deposit with multiple bank accounts if your employer allows it. You can often allocate different percentages of your paycheck to different accounts, ensuring that your savings and spending are managed according to your preferences.

-

Is Trustone Financial Direct Deposit safe?

Yes, Trustone Financial Direct Deposit is considered a very safe method for receiving payments. The process uses encryption and secure methods to ensure that your financial information is protected during each electronic transaction.

Get more for TruStone Financial Direct Deposit Information

Find out other TruStone Financial Direct Deposit Information

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure