IL DoR Schedule 1299 D Instructions 2020

What is the IL DoR Schedule 1299 D Instructions

The IL DoR Schedule 1299 D Instructions is a specific form used for reporting certain tax-related information in the state of Illinois. This form is primarily utilized by individuals and businesses to report various types of income and deductions. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with state regulations. It provides guidance on how to properly fill out the form, ensuring that all necessary information is included to avoid potential issues with the Illinois Department of Revenue.

Steps to complete the IL DoR Schedule 1299 D Instructions

Completing the IL DoR Schedule 1299 D Instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements and deduction records. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form section by section, ensuring that all details are accurate and complete. After completing the form, review it for any errors or omissions before submission. Finally, retain a copy of the completed form for your records.

Legal use of the IL DoR Schedule 1299 D Instructions

The legal use of the IL DoR Schedule 1299 D Instructions is essential for ensuring that taxpayers comply with Illinois tax laws. This form must be filled out accurately and submitted by the designated deadlines to avoid penalties. It is important to understand that submitting incorrect or incomplete information can lead to legal repercussions, including fines or audits. Therefore, using the form in accordance with the provided instructions is vital for maintaining compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IL DoR Schedule 1299 D Instructions are critical for taxpayers to observe. Typically, the form must be submitted by the state tax filing deadline, which aligns with the federal tax deadline. It is essential to check for any updates or changes to these dates annually, as they may vary. Missing the deadline can result in penalties or interest on any unpaid taxes, making timely submission a priority for all filers.

Required Documents

To complete the IL DoR Schedule 1299 D Instructions, several documents are required. These typically include income statements such as W-2s or 1099s, records of any deductions you intend to claim, and prior year tax returns for reference. Having these documents on hand will facilitate a smoother completion process and help ensure that all necessary information is accurately reported on the form.

Form Submission Methods (Online / Mail / In-Person)

The IL DoR Schedule 1299 D Instructions can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online via the Illinois Department of Revenue's website, which is often the quickest option. Alternatively, taxpayers can choose to mail their completed forms to the designated address provided in the instructions. In-person submissions may also be possible at local tax offices, depending on current regulations and procedures. Each method has its own timeline for processing, so it is advisable to choose the one that best fits your needs.

Examples of using the IL DoR Schedule 1299 D Instructions

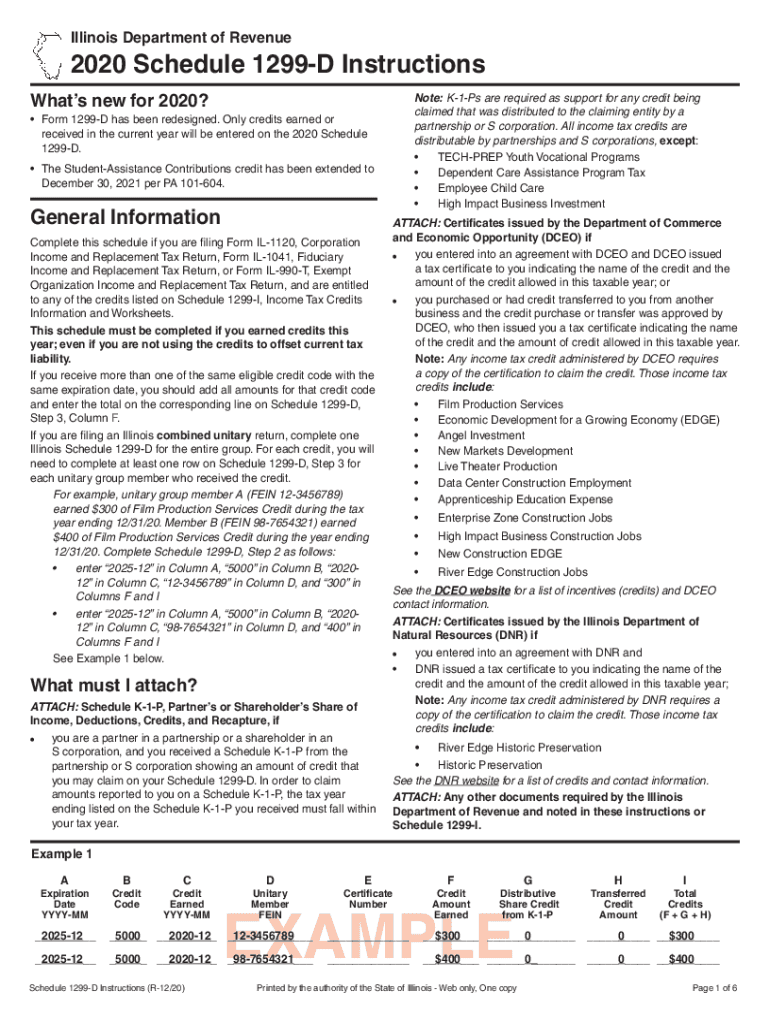

Examples of using the IL DoR Schedule 1299 D Instructions include scenarios such as reporting income from freelance work, claiming deductions for business expenses, or adjusting tax credits based on changes in financial status. Each example highlights the importance of accurately filling out the form to reflect the taxpayer's situation. Understanding these examples can help individuals and businesses better prepare their tax filings and ensure compliance with state requirements.

Quick guide on how to complete il dor schedule 1299 d instructions

Complete IL DoR Schedule 1299 D Instructions seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and safely archive it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage IL DoR Schedule 1299 D Instructions on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign IL DoR Schedule 1299 D Instructions effortlessly

- Obtain IL DoR Schedule 1299 D Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes a matter of seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to secure your changes.

- Select how you wish to submit your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign IL DoR Schedule 1299 D Instructions and guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il dor schedule 1299 d instructions

Create this form in 5 minutes!

People also ask

-

What are schedule 1299 d instructions?

Schedule 1299 D instructions refer to the guidelines for completing specific tax forms related to business deductions. This schedule is essential for accurately filing tax returns and understanding claims for deductions. For detailed instructions on how to fill out this schedule, it's crucial to refer to the official IRS directives.

-

How does airSlate SignNow assist with completing schedule 1299 d instructions?

airSlate SignNow simplifies the process of handling schedule 1299 d instructions by allowing users to gather necessary signatures and approvals on related documents electronically. With our platform, you can ensure that all your forms are completed and submitted efficiently. This saves time and reduces the risk of errors in your submissions.

-

What features does airSlate SignNow offer for businesses needing schedule 1299 d instructions?

airSlate SignNow offers various features such as customizable templates, document tracking, and real-time collaboration, which are beneficial when working with schedule 1299 d instructions. These tools help users tailor their documents to meet specific tax requirements. Additionally, the platform ensures that all documents are secure and compliant with legal standards.

-

Is airSlate SignNow a cost-effective solution for handling schedule 1299 d instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing schedule 1299 d instructions. With competitive pricing plans, users can access powerful eSign and document management tools without breaking the bank. This makes it easier for businesses of all sizes to stay compliant and efficient.

-

Can airSlate SignNow integrate with accounting software for schedule 1299 d instructions?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software platforms, improving the handling of schedule 1299 d instructions. This integration allows users to automatically sync their documents and streamline their workflow. Consequently, you can save time and reduce the complexity of managing multiple tools.

-

What benefits do users gain from using airSlate SignNow for schedule 1299 d instructions?

Using airSlate SignNow offers several benefits when dealing with schedule 1299 d instructions, including increased efficiency and enhanced accuracy. Electronic signing reduces turnaround times and the hassle of printing documents. Moreover, comprehensive document management features help organize and store important tax forms effectively.

-

How can I get started with airSlate SignNow for schedule 1299 d instructions?

Getting started with airSlate SignNow for schedule 1299 d instructions is easy! Simply visit our website to sign up for a trial or choose a plan that suits your needs. Once registered, you can start uploading your documents and utilize our tools to manage your schedule 1299 d instructions effectively.

Get more for IL DoR Schedule 1299 D Instructions

Find out other IL DoR Schedule 1299 D Instructions

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile