Note Specific Information About What to Attach to Your 2021

What is the Schedule 1299 D?

The Schedule 1299 D is a form used by taxpayers in the United States to report specific deductions related to their tax obligations. This form is particularly relevant for individuals and businesses that are claiming certain credits or deductions that require detailed reporting. Understanding the purpose of this form is crucial for accurate tax filing and compliance with IRS regulations.

Key Elements of the Schedule 1299 D

When filling out the Schedule 1299 D, it is important to include several key elements to ensure that your submission is complete and accurate. These elements typically include:

- Taxpayer Information: Your name, address, and Social Security number or Employer Identification Number.

- Type of Deductions: A clear indication of the type of deductions you are claiming, such as those related to business expenses or specific credits.

- Supporting Documentation: Any necessary documentation that supports your claims, which may include receipts, invoices, or other relevant records.

- Signature: Your signature certifying that the information provided is accurate and complete.

Steps to Complete the Schedule 1299 D

Completing the Schedule 1299 D involves a series of steps to ensure that all required information is accurately reported. Here is a step-by-step guide:

- Gather all necessary documentation related to your deductions.

- Fill in your personal information at the top of the form.

- Clearly specify the deductions you are claiming in the designated sections.

- Attach any supporting documents that validate your claims.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines for the Schedule 1299 D

It is essential to be aware of the filing deadlines associated with the Schedule 1299 D to avoid penalties. Generally, this form must be submitted along with your tax return by the standard tax filing deadline, which is typically April fifteenth of each year. If you require an extension, ensure that you file the form by the extended deadline to maintain compliance.

IRS Guidelines for the Schedule 1299 D

The IRS provides specific guidelines for completing and submitting the Schedule 1299 D. These guidelines include instructions on what types of deductions can be claimed, how to calculate those deductions, and the importance of accurate reporting. Familiarizing yourself with these guidelines can help prevent errors and ensure that your tax return is processed smoothly.

Required Documents for the Schedule 1299 D

To successfully complete the Schedule 1299 D, you will need to gather several required documents. These may include:

- Receipts for expenses related to the deductions claimed.

- Tax forms from previous years if they are relevant to your current deductions.

- Any correspondence from the IRS regarding your tax status or previous filings.

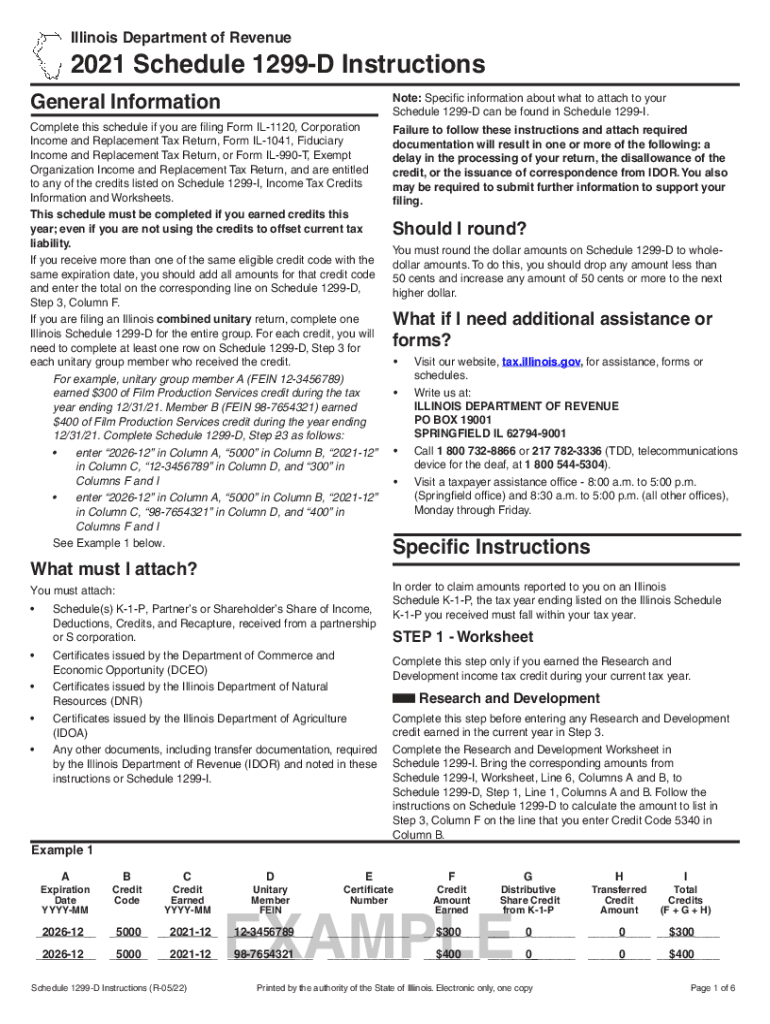

Quick guide on how to complete note specific information about what to attach to your

Effortlessly Prepare Note Specific Information About What To Attach To Your on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Note Specific Information About What To Attach To Your on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Note Specific Information About What To Attach To Your with Ease

- Find Note Specific Information About What To Attach To Your and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Note Specific Information About What To Attach To Your and guarantee exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct note specific information about what to attach to your

Create this form in 5 minutes!

People also ask

-

What are the schedule 1299 d instructions for eSigning documents with airSlate SignNow?

The schedule 1299 d instructions for eSigning documents with airSlate SignNow provide a straightforward guide to electronically sign and send forms. Users can follow the intuitive steps outlined in the platform to ensure compliance and accuracy. By leveraging these instructions, businesses can streamline their document management processes effectively.

-

How much does airSlate SignNow cost for using schedule 1299 d instructions?

airSlate SignNow offers a cost-effective solution with various pricing plans to accommodate different needs, including features for schedule 1299 d instructions. You can choose from monthly or annual subscriptions with a free trial available to test the features. This ensures businesses can select a plan that fits their budget while utilizing comprehensive eSigning solutions.

-

What features does airSlate SignNow offer related to schedule 1299 d instructions?

airSlate SignNow includes several features specifically designed for handling schedule 1299 d instructions, such as customizable templates and secure signing options. Users can create, send, and track documents effortlessly, ensuring that every transaction adheres to regulations. Additionally, integrations with popular apps enhance the overall functionality for users.

-

How can I integrate airSlate SignNow with other software while following schedule 1299 d instructions?

Integrating airSlate SignNow with other software is seamless, allowing users to utilize schedule 1299 d instructions within their existing systems. The platform offers integrations with CRM tools, cloud storage services, and more, enabling efficient workflows. This flexibility means you can maintain productivity while adhering to your specific document compliance needs.

-

What are the benefits of using airSlate SignNow for schedule 1299 d instructions?

Utilizing airSlate SignNow for schedule 1299 d instructions offers numerous benefits, such as time savings, enhanced security, and increased compliance. This platform simplifies the signing process and reduces the amount of paperwork involved. As a result, businesses can focus on their core operations rather than getting bogged down by administrative tasks.

-

Are there mobile features available for accessing schedule 1299 d instructions on airSlate SignNow?

Yes, airSlate SignNow provides mobile features that allow users to access schedule 1299 d instructions on the go. With a user-friendly mobile app, you can sign documents, send requests, and manage workflows directly from your device. This ensures you can keep up with your document needs regardless of your location.

-

Is customer support available for questions about schedule 1299 d instructions?

Absolutely! airSlate SignNow offers robust customer support for any inquiries regarding schedule 1299 d instructions. Users can access help through various channels, including live chat, email, and comprehensive online resources. This ensures that you can resolve any issues or questions promptly and efficiently.

Get more for Note Specific Information About What To Attach To Your

- Lead based paint disclosure for rental transaction hawaii form

- Notice of lease for recording hawaii form

- Sample cover letter for filing of llc articles or certificate with secretary of state hawaii form

- Supplemental residential lease forms package hawaii

- Hawaii tenant 497304600 form

- Name change instructions and forms package for an adult hawaii

- Hawaii name change instructions and forms package for a minor hawaii

- Name change instructions and forms package for a family father mother and minor children hawaii

Find out other Note Specific Information About What To Attach To Your

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile