Schedule 1299 D Instructions E Form RS Login 2023-2026

What is the Schedule 1299 D Instructions?

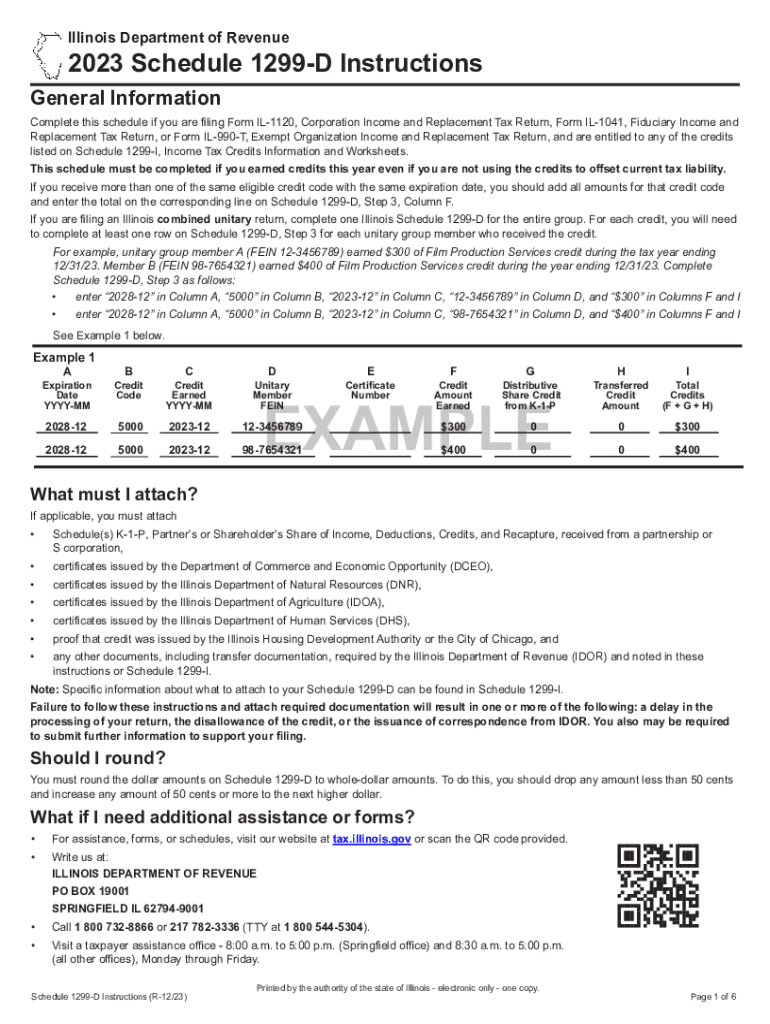

The Schedule 1299 D is a form used by taxpayers in the United States to report specific income and deductions related to their tax situation. This form is particularly relevant for individuals who are claiming certain tax credits or deductions that require detailed reporting. Understanding the Schedule 1299 D instructions is essential for accurate tax filing, as it outlines how to complete the form correctly and what information is necessary.

Steps to Complete the Schedule 1299 D Instructions

Completing the Schedule 1299 D involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the main steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Review the instructions carefully to understand what information is required.

- Fill out the form, ensuring that all sections are completed as per the guidelines.

- Double-check your entries for accuracy, particularly figures and personal information.

- Submit the form either electronically or by mail, based on your preference and requirements.

Required Documents for Schedule 1299 D

To complete the Schedule 1299 D, you will need several documents to support your claims. These typically include:

- W-2 forms from employers, which report your annual income.

- 1099 forms if you received income from freelance work or other sources.

- Receipts for any deductible expenses you plan to claim.

- Previous year’s tax return for reference and consistency.

Filing Deadlines for Schedule 1299 D

It is crucial to be aware of the filing deadlines associated with the Schedule 1299 D. Generally, the deadline for submitting your tax return, including this form, is April 15 of the following year. If you need additional time, you may file for an extension, but this does not extend the time to pay any taxes owed.

Legal Use of the Schedule 1299 D

The Schedule 1299 D is a legally recognized form that must be used in accordance with IRS regulations. Filing this form accurately is essential to avoid penalties and ensure compliance with tax laws. Misrepresentation or failure to file can result in legal consequences, including fines or audits.

IRS Guidelines for Schedule 1299 D

The IRS provides specific guidelines for completing the Schedule 1299 D. It is important to follow these guidelines closely to ensure that your submission is accepted. These guidelines cover everything from eligibility criteria to the specific information required for each section of the form.

Quick guide on how to complete schedule 1299 d instructions e form rs login

Easily Prepare Schedule 1299 D Instructions E Form RS Login on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Handle Schedule 1299 D Instructions E Form RS Login on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Simplest Method to Edit and Electronically Sign Schedule 1299 D Instructions E Form RS Login with Ease

- Find Schedule 1299 D Instructions E Form RS Login and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to retain your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Schedule 1299 D Instructions E Form RS Login to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 1299 d instructions e form rs login

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 d instructions e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the schedule 1299 d instructions?

The schedule 1299 d instructions provide essential guidelines for reporting tax credits and deductions on your tax returns. Utilizing these instructions correctly can maximize your eligible benefits and ensure compliance with tax laws. For detailed insights, it's advisable to refer directly to the official IRS documentation or consult a tax professional.

-

How does airSlate SignNow help with schedule 1299 d instructions?

AirSlate SignNow streamlines the process of eSigning documents related to your schedule 1299 d instructions. With our user-friendly interface, you can quickly prepare and send your tax documents securely. This efficient solution not only saves you time but also helps you stay organized throughout your tax filing process.

-

What features does airSlate SignNow offer for managing schedule 1299 d instructions?

AirSlate SignNow offers features like customizable templates, document tracking, and secure storage that cater to users managing schedule 1299 d instructions. These tools ensure that all your documents are easily accessible and securely shared with relevant parties. Plus, our integration capabilities with popular tax software further enhance your productivity.

-

What are the benefits of using airSlate SignNow for schedule 1299 d instructions?

Using airSlate SignNow for schedule 1299 d instructions provides signNow benefits, including faster document turnaround times and improved accuracy in submissions. Our solution minimizes errors by allowing users to review documents thoroughly before sending them out. Additionally, the electronic signing process is eco-friendly and reduces paperwork clutter.

-

How much does airSlate SignNow cost for eSigning schedule 1299 d instructions?

AirSlate SignNow offers competitive pricing plans that fit various business needs, starting with a free trial for new users. Pricing is designed to be cost-effective, especially for those regularly dealing with schedule 1299 d instructions. You can choose from multiple tiers based on features and volumes, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with my existing accounting software for schedule 1299 d instructions?

Absolutely! AirSlate SignNow integrates seamlessly with many popular accounting software systems. This functionality allows you to manage your schedule 1299 d instructions within the same platform, enhancing your workflow and reducing time spent on administrative tasks.

-

Is there customer support available for questions about schedule 1299 d instructions?

Yes, airSlate SignNow provides robust customer support to assist users with any queries about schedule 1299 d instructions. Our dedicated support team is available via chat, email, or phone to help you navigate the eSigning process or troubleshoot any issues you may face. We're committed to ensuring your experience is smooth and efficient.

Get more for Schedule 1299 D Instructions E Form RS Login

- Late enrollment form

- The liberty university school of divinity provides theological and graduate education for men and women preparing for ministry form

- Scholarship application henderson state university hsu form

- Instructions for completing new hire packets student assistants form

- Student information release ferpa

- 1 exculpatory clause in consideration for receiving form

- Walking with cavemen worksheet answers form

- Marketing project request form briarcliffedu

Find out other Schedule 1299 D Instructions E Form RS Login

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template