Motor Vehicle SalesArizona Department of Revenue Form

What is the Motor Vehicle SalesArizona Department Of Revenue

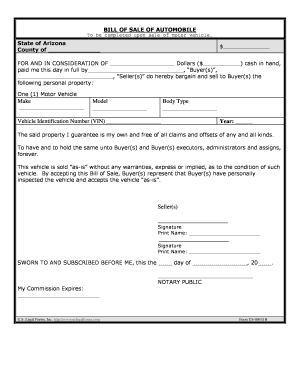

The Motor Vehicle SalesArizona Department Of Revenue form is a crucial document for individuals and businesses involved in the sale or transfer of motor vehicles in Arizona. This form serves as a record of the transaction, detailing the buyer, seller, vehicle information, and sale price. It is essential for ensuring compliance with state regulations and for the proper assessment of taxes related to vehicle sales. Understanding the purpose and requirements of this form is vital for anyone engaging in motor vehicle transactions within the state.

How to use the Motor Vehicle SalesArizona Department Of Revenue

Using the Motor Vehicle SalesArizona Department Of Revenue form involves several key steps. First, gather all necessary information, including the vehicle's make, model, year, VIN, and the details of both the buyer and seller. Next, accurately fill out the form, ensuring all fields are completed to avoid delays. Once completed, the form must be signed by both parties to validate the transaction. Finally, submit the form to the Arizona Department of Revenue or the appropriate local authority, either electronically or via mail, depending on the submission guidelines.

Steps to complete the Motor Vehicle SalesArizona Department Of Revenue

Completing the Motor Vehicle SalesArizona Department Of Revenue form requires careful attention to detail. Follow these steps:

- Collect all relevant vehicle information, including the VIN and title number.

- Provide accurate details for both the buyer and seller, including names, addresses, and contact information.

- Enter the sale price and date of the transaction.

- Ensure both parties sign the form to confirm the sale.

- Review the completed form for accuracy before submission.

Legal use of the Motor Vehicle SalesArizona Department Of Revenue

The legal use of the Motor Vehicle SalesArizona Department Of Revenue form is essential for validating vehicle transactions in Arizona. This form must be filled out correctly and submitted in accordance with state laws to be considered legally binding. It serves as proof of ownership transfer and is necessary for the buyer to register the vehicle in their name. Failure to complete and submit this form can result in legal complications, including issues with ownership verification and tax assessments.

Required Documents

To successfully complete the Motor Vehicle SalesArizona Department Of Revenue form, several documents are typically required. These include:

- The vehicle title, which must be signed by the seller.

- Proof of identity for both the buyer and seller, such as a driver’s license or state ID.

- Any existing lien release documents if applicable.

- Documentation of the sale price, which may include a bill of sale.

Form Submission Methods (Online / Mail / In-Person)

The Motor Vehicle SalesArizona Department Of Revenue form can be submitted through various methods. Individuals have the option to submit the form online via the Arizona Department of Revenue's official website, which may offer a streamlined process. Alternatively, the form can be mailed to the appropriate department or submitted in person at designated locations. It is important to check for specific submission guidelines and requirements, as these may vary based on the method chosen.

Quick guide on how to complete motor vehicle salesarizona department of revenue

Effortlessly Prepare Motor Vehicle SalesArizona Department Of Revenue on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Motor Vehicle SalesArizona Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Motor Vehicle SalesArizona Department Of Revenue with ease

- Locate Motor Vehicle SalesArizona Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Don't worry about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Motor Vehicle SalesArizona Department Of Revenue to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Motor Vehicle SalesArizona Department Of Revenue process?

The Motor Vehicle SalesArizona Department Of Revenue process involves the registration and taxation of vehicle sales within Arizona. Understanding this process is crucial for any business dealing with vehicle sales to ensure compliance with state regulations while facilitating smooth transactions.

-

How can airSlate SignNow simplify the Motor Vehicle SalesArizona Department Of Revenue process?

AirSlate SignNow streamlines the Motor Vehicle SalesArizona Department Of Revenue process by enabling businesses to electronically sign and send essential documents quickly. This not only saves time but also ensures that all necessary paperwork is correctly completed, aiding in compliance and reducing delays in processing.

-

What features does airSlate SignNow offer for Motor Vehicle SalesArizona Department Of Revenue?

AirSlate SignNow offers features like customizable templates, bulk sending, and secure cloud storage, specifically useful for the Motor Vehicle SalesArizona Department Of Revenue. These features allow for efficient document management and help businesses easily adapt to regulatory requirements.

-

Is airSlate SignNow a cost-effective solution for handling Motor Vehicle SalesArizona Department Of Revenue documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Motor Vehicle SalesArizona Department Of Revenue documents. With competitive pricing plans, businesses can streamline their operations without incurring high costs associated with traditional methods of document handling.

-

How does airSlate SignNow ensure compliance with Motor Vehicle SalesArizona Department Of Revenue regulations?

AirSlate SignNow helps ensure compliance with Motor Vehicle SalesArizona Department Of Revenue regulations by providing templates and workflows that are adaptable to all state requirements. This guarantees that businesses can effectively manage their vehicle sales documentation in accordance with the law.

-

What are the benefits of using airSlate SignNow for Motor Vehicle SalesArizona Department Of Revenue?

The benefits of using airSlate SignNow for Motor Vehicle SalesArizona Department Of Revenue include increased efficiency, reduced paperwork errors, and enhanced security. With easy-to-use electronic signatures and document tracking, businesses can focus on their core operations while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for Motor Vehicle SalesArizona Department Of Revenue?

Yes, airSlate SignNow offers seamless integrations with various software systems commonly used in the Motor Vehicle SalesArizona Department Of Revenue sector. This allows businesses to synchronize their data and improve operational workflows, enhancing overall efficiency.

Get more for Motor Vehicle SalesArizona Department Of Revenue

- Psychological checklist form

- Additional signature addendum form

- Sonyma form r7 12 14

- Example alphanumeric outline form

- Sc 8736 form

- Form i 601 instructions for application for waiver of

- Form i 918 supplement b u nonimmigrant status certification form i 918 supplement b u nonimmigrant status certification

- Form i 918 supplement a petition for qualifying family member of u 1 recipient form i 918 supplement a petition for qualifying

Find out other Motor Vehicle SalesArizona Department Of Revenue

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe