Promissory Note for Personal Loan Google Answers Form

What is the Promissory Note for Personal Loan Google Answers

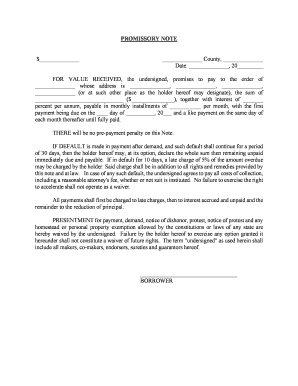

A promissory note for a personal loan is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This document serves as a written promise from the borrower to repay the borrowed amount, including any interest, within a specified timeframe. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and consequences of default. The promissory note is crucial in ensuring both parties understand their obligations and provides legal protection in case of disputes.

Key Elements of the Promissory Note for Personal Loan Google Answers

Several key elements must be included in a promissory note for it to be legally binding and effective. These elements typically include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount, which may be fixed or variable.

- Repayment Terms: The schedule for repayment, including due dates and payment amounts.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

- Default Conditions: Terms outlining what constitutes a default and the penalties for failing to meet obligations.

Steps to Complete the Promissory Note for Personal Loan Google Answers

Completing a promissory note for a personal loan involves several straightforward steps. Follow these guidelines to ensure accuracy and legality:

- Gather necessary information, including personal details of both the borrower and lender.

- Determine the loan amount and interest rate that both parties agree upon.

- Outline the repayment schedule, specifying when payments are due and how much will be paid each time.

- Clearly state the terms of default and any penalties associated with late payments or non-payment.

- Review the document for accuracy and completeness before signing.

- Both parties should sign the document in the presence of a witness or notary, if required.

Legal Use of the Promissory Note for Personal Loan Google Answers

The legal use of a promissory note for a personal loan is governed by state laws and regulations. For the note to be enforceable in a court of law, it must meet specific legal requirements, such as being in writing and signed by the borrower. The terms outlined in the note must also be clear and unambiguous to avoid disputes. Additionally, both parties should retain a copy of the signed document for their records, as it serves as proof of the loan agreement.

How to Use the Promissory Note for Personal Loan Google Answers

Using a promissory note effectively involves understanding its purpose and the obligations it creates. The borrower should ensure they can meet the repayment terms before signing the note. Once the note is signed, it becomes a binding contract, and the borrower must adhere to the agreed-upon terms. If any issues arise during the repayment period, both parties should communicate openly to resolve them amicably. In case of default, the lender may need to take legal action to enforce the terms of the note.

State-Specific Rules for the Promissory Note for Personal Loan Google Answers

Each state in the U.S. may have specific rules regarding promissory notes, including requirements for interest rates, maximum loan amounts, and the necessity of notarization. It is essential for both borrowers and lenders to familiarize themselves with their state's laws to ensure compliance. Some states may have additional regulations that impact the enforceability of the note, such as disclosure requirements or limits on fees. Consulting with a legal professional can provide clarity on these state-specific rules.

Quick guide on how to complete promissory note for personal loan google answers

Complete Promissory Note For Personal Loan Google Answers effortlessly across any device

Digital document management has gained immense popularity among businesses and individuals. It offers a top-notch eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without hold-ups. Manage Promissory Note For Personal Loan Google Answers on any device through airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Promissory Note For Personal Loan Google Answers seamlessly

- Find Promissory Note For Personal Loan Google Answers and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Revise and eSign Promissory Note For Personal Loan Google Answers to guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Promissory Note For Personal Loan?

A Promissory Note For Personal Loan is a written promise to pay a specified sum of money to a lender under agreed terms. It outlines the borrower's obligations regarding repayment, including interest rates and payment schedules. Understanding this document is essential for both borrowers and lenders to ensure clear financial agreements.

-

How can airSlate SignNow assist with creating a Promissory Note For Personal Loan?

airSlate SignNow simplifies the process of creating a Promissory Note For Personal Loan by providing easy-to-use templates and an intuitive interface. You can customize the note according to your specific needs and quickly include essential terms and conditions. This makes the documentation process efficient and hassle-free.

-

Are there any costs associated with using airSlate SignNow for a Promissory Note For Personal Loan?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget, providing access to features like custom templates and electronic signature capabilities. The cost-effective solutions ensure you can manage your Promissory Note For Personal Loan without breaking the bank.

-

What features does airSlate SignNow offer for managing Promissory Notes?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure electronic signatures. These features streamline the process of handling your Promissory Note For Personal Loan, allowing for faster transactions and better workflow. Additional tools like document tracking enhance the overall experience.

-

How does electronic signing enhance the Promissory Note For Personal Loan process?

Electronic signing makes the Promissory Note For Personal Loan process faster and more secure. It allows parties to sign documents from anywhere, removing the need for physical meetings or paperwork delays. This convenience not only saves time but also reduces the risk of document loss.

-

Can I integrate airSlate SignNow with other financial applications?

Yes, airSlate SignNow is designed to integrate seamlessly with various financial applications to enhance productivity. By integrating with tools like CRM and accounting software, you can manage your Promissory Note For Personal Loan efficiently. This connectivity facilitates better data management and workflow automation.

-

What are the benefits of using airSlate SignNow for personal loans?

Using airSlate SignNow for personal loans offers numerous benefits, such as improved efficiency and reduced paperwork. It allows you to easily create and sign a Promissory Note For Personal Loan, ensuring all parties are on the same page. The platform's user-friendly design helps streamline communication and paperwork management.

Get more for Promissory Note For Personal Loan Google Answers

Find out other Promissory Note For Personal Loan Google Answers

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast