Nys Form it 2104 2016

What is the Nys Form IT-2104

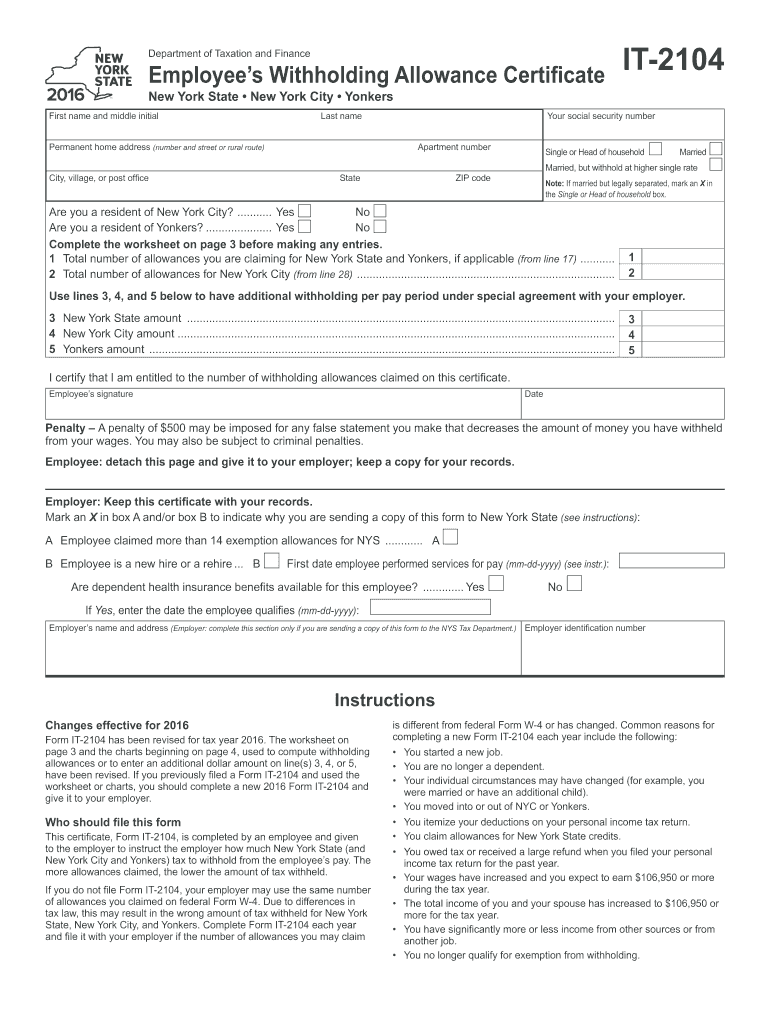

The Nys Form IT-2104 is a tax form used by New York State residents to determine the appropriate amount of state income tax withholding from their wages. This form is crucial for employees who want to adjust their withholding allowances based on their personal financial situation. By accurately completing the IT-2104, individuals can ensure they are not overpaying or underpaying their state taxes throughout the year.

How to use the Nys Form IT-2104

To use the Nys Form IT-2104, taxpayers must first download the form from the New York State Department of Taxation and Finance website or obtain a physical copy from their employer. Once the form is in hand, individuals should fill it out by providing their personal information, including name, address, and Social Security number. They will also indicate the number of allowances they wish to claim, which will affect their withholding amount. After completing the form, it should be submitted to the employer, who will use the information to adjust the withholding on future paychecks.

Steps to complete the Nys Form IT-2104

Completing the Nys Form IT-2104 involves several straightforward steps:

- Download or obtain the form from your employer.

- Fill in your personal details, such as your name, address, and Social Security number.

- Decide on the number of allowances you wish to claim based on your financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the Nys Form IT-2104

Several key elements are essential to understand when working with the Nys Form IT-2104:

- Personal Information: Accurate details such as name, address, and Social Security number are necessary.

- Allowances: The number of allowances claimed directly influences the amount of tax withheld.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

- Submission: The completed form must be submitted to the employer, not the state tax office.

Legal use of the Nys Form IT-2104

The Nys Form IT-2104 is legally recognized as a valid document for adjusting state income tax withholding. It complies with New York State tax regulations, allowing employees to manage their tax obligations effectively. Proper use of this form can prevent issues related to over-withholding or under-withholding, which can lead to penalties or unexpected tax bills at the end of the tax year.

Filing Deadlines / Important Dates

While the Nys Form IT-2104 does not have a specific filing deadline, it is important for employees to submit it to their employer as soon as they wish to change their withholding allowances. This ensures that the adjustments are reflected in their paychecks in a timely manner. Additionally, taxpayers should be aware of the overall tax filing deadlines for New York State to ensure compliance with all tax obligations.

Quick guide on how to complete nys form it 2104 2016

Your assistance manual on how to prepare your Nys Form It 2104

If you’re uncertain about how to create and dispatch your Nys Form It 2104, here are a few brief instructions on how to simplify tax filing.

To start, you just need to set up your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to update information where necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Nys Form It 2104 in moments:

- Create your account and begin handling PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Nys Form It 2104 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save adjustments, print your copy, forward it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return mistakes and delay refunds. Naturally, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nys form it 2104 2016

FAQs

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

I live in NJ and will work in NY, do I still have to fill out the NJ W4 or will the IT-2104 suffice?

The prior two commenters did not answer the question. If you work in New York but live in New Jersey, the IT-2104 should be all you need, because you have no earned income in New Jersey, so there should be no reason to complete an NJ-W4. There is one caveat however - if you are going to spend a signNow of WORKING days in New Jersey and your employer actually tracks this and withholds New Jersey income tax, then you should complete an NJ-W4 so not too much New Jersey tax is withheld. Otherwise there is no reason to complete an NJ-W4.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

Create this form in 5 minutes!

How to create an eSignature for the nys form it 2104 2016

How to generate an electronic signature for your Nys Form It 2104 2016 in the online mode

How to generate an electronic signature for your Nys Form It 2104 2016 in Chrome

How to generate an electronic signature for putting it on the Nys Form It 2104 2016 in Gmail

How to generate an eSignature for the Nys Form It 2104 2016 from your smartphone

How to make an electronic signature for the Nys Form It 2104 2016 on iOS devices

How to create an eSignature for the Nys Form It 2104 2016 on Android OS

People also ask

-

What is Nys Form It 2104 and why is it important?

Nys Form It 2104 is a tax form used in New York State for claiming a credit for taxes withheld on income. This form is crucial for accurate tax reporting and can help ensure you receive the maximum refund possible. Using airSlate SignNow to manage and eSign your Nys Form It 2104 simplifies the process, allowing you to focus on your finances.

-

How can airSlate SignNow help with Nys Form It 2104?

airSlate SignNow provides a streamlined solution for filling out and eSigning your Nys Form It 2104. With our intuitive interface, you can easily upload, edit, and send documents securely, reducing the time spent on paperwork. This efficiency helps you stay organized and ensures your tax submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for Nys Form It 2104?

Yes, airSlate SignNow offers a cost-effective solution for managing your Nys Form It 2104. Our pricing plans are designed to fit various budgets, providing excellent value for businesses needing efficient document management. Additionally, we offer a free trial so you can experience our features before committing.

-

What features does airSlate SignNow offer for Nys Form It 2104?

airSlate SignNow includes powerful features for handling Nys Form It 2104, such as customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are signed quickly and securely, while also allowing you to manage multiple forms effortlessly. Our platform is designed to enhance your workflow, especially during tax season.

-

Can I integrate airSlate SignNow with other software for Nys Form It 2104?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing your ability to manage Nys Form It 2104 efficiently. Whether you use accounting software, CRM systems, or other business applications, our integrations help streamline your processes. This connectivity ensures you can easily access and manage your documents from one central location.

-

How secure is airSlate SignNow when handling Nys Form It 2104?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Nys Form It 2104. We employ industry-standard encryption and secure cloud storage to protect your data. Additionally, our platform adheres to compliance regulations, ensuring that your documents are handled safely and confidentially.

-

What are the benefits of using airSlate SignNow for Nys Form It 2104?

Using airSlate SignNow for your Nys Form It 2104 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform simplifies the signing process, allowing you to complete and submit your forms quickly. This not only saves time but also helps minimize errors, ensuring your tax filings are precise.

Get more for Nys Form It 2104

- Limited liability company llc cancellation requirements instructions for completing the certificate of limited liability form

- Printable trademark application form in california

- Mlcc proof of financial responsibility form lc 95 michigan

- 45 qhr100 form

- Logan county lodging tax board funding request form please

- Logan county lodging tax board funding request form colorado

- Withdrawal of foreign registration statement fn 3 dcra dc form

- Application for employment creating workforce solutions form

Find out other Nys Form It 2104

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed