Form it 2104 Employee's Withholding Allowance Certificate Tax Year 2025-2026

Understanding the IT-2104 Employee's Withholding Allowance Certificate

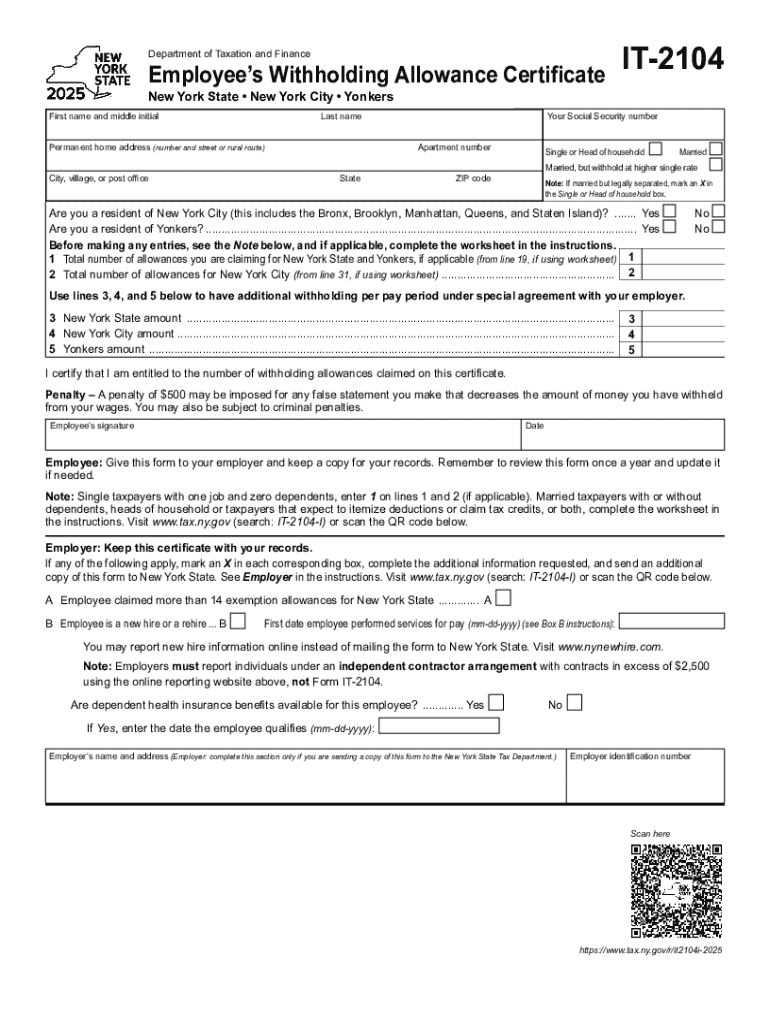

The IT-2104 form, officially known as the Employee's Withholding Allowance Certificate, is a crucial document for New York State employees. It allows individuals to claim withholding allowances that can reduce the amount of state tax withheld from their paychecks. This form is particularly important for ensuring that employees do not overpay their taxes throughout the year, which can lead to larger refunds or financial strain.

Steps to Complete the IT-2104 Form

Filling out the IT-2104 form involves several key steps:

- Personal Information: Start by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single or married, which affects your withholding allowances.

- Withholding Allowances: Calculate the number of allowances you are eligible to claim. This may depend on various factors, including dependents and other tax credits.

- Additional Withholding: If you wish to have an additional amount withheld from your paycheck, specify that amount in the appropriate section.

- Signature: Finally, sign and date the form to validate your information.

Obtaining the IT-2104 Form

The IT-2104 form can be easily obtained through various channels:

- Online: Download the form directly from the New York State Department of Taxation and Finance website.

- Employer: Request a copy from your employer's human resources or payroll department.

- Tax Offices: Visit local tax offices or libraries that may have physical copies available.

Legal Use of the IT-2104 Form

The IT-2104 form is legally binding and must be completed accurately to ensure compliance with New York State tax laws. Employees are responsible for providing truthful information regarding their withholding allowances. Misrepresentation can lead to penalties, including fines or additional taxes owed.

Key Elements of the IT-2104 Form

Several key elements are essential when filling out the IT-2104 form:

- Personal Information: Accurate identification details are necessary for proper processing.

- Withholding Allowances: The number of allowances claimed directly impacts the amount of tax withheld.

- Signature: A valid signature confirms the authenticity of the form.

Examples of Using the IT-2104 Form

Understanding how to use the IT-2104 form can be illustrated through various scenarios:

- A single individual with no dependents may claim one allowance to minimize withholding.

- A married couple with children may claim multiple allowances based on their family size.

- Individuals with additional income sources may choose to have extra withholding to avoid underpayment penalties.

Handy tips for filling out Form IT 2104 Employee's Withholding Allowance Certificate Tax Year online

Quick steps to complete and e-sign Form IT 2104 Employee's Withholding Allowance Certificate Tax Year online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant service for maximum simpleness. Use signNow to electronically sign and send Form IT 2104 Employee's Withholding Allowance Certificate Tax Year for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form it 2104 employees withholding allowance certificate tax year 772029811

Create this form in 5 minutes!

How to create an eSignature for the form it 2104 employees withholding allowance certificate tax year 772029811

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys application form 2025?

The nys application form 2025 is a document required for various applications within New York State. It is essential for individuals and businesses to complete this form accurately to ensure compliance with state regulations. Using airSlate SignNow, you can easily fill out and eSign the nys application form 2025, streamlining the submission process.

-

How can airSlate SignNow help with the nys application form 2025?

airSlate SignNow simplifies the process of completing the nys application form 2025 by providing an intuitive platform for document management. You can easily upload, edit, and eSign the form, ensuring that all necessary information is included. This efficiency helps reduce errors and speeds up the application process.

-

Is there a cost associated with using airSlate SignNow for the nys application form 2025?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when handling the nys application form 2025. The plans are designed to be cost-effective, providing businesses with the tools they need without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the nys application form 2025?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the nys application form 2025. These features enhance the user experience by making it easier to manage documents and ensuring that all signatures are collected promptly. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other applications for the nys application form 2025?

Absolutely! airSlate SignNow offers integrations with various applications that can assist in managing the nys application form 2025. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing you to streamline your workflow and keep all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for the nys application form 2025?

Using airSlate SignNow for the nys application form 2025 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and eSign documents quickly, which can save you time and resources. Additionally, your data is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for completing the nys application form 2025?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the nys application form 2025. The interface is intuitive, allowing users to navigate through the process without any technical expertise. This accessibility ensures that you can focus on completing your application efficiently.

Get more for Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

- Naacp complaint form 2

- Commercial lease contract triple net this lease is form

- Invoice template excel malaysia form

- Olympus in service training form

- Ga hmis consent to share form

- Mountlake terrace electrical permit form

- Microsoft word reimbursement form final docx

- Field trip permission slipformdatewednesday augu

Find out other Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney