Fillable Michigan Department of Treasury 518 Rev 02 18 2021

Understanding the 2019 NYS IT-2104 Form

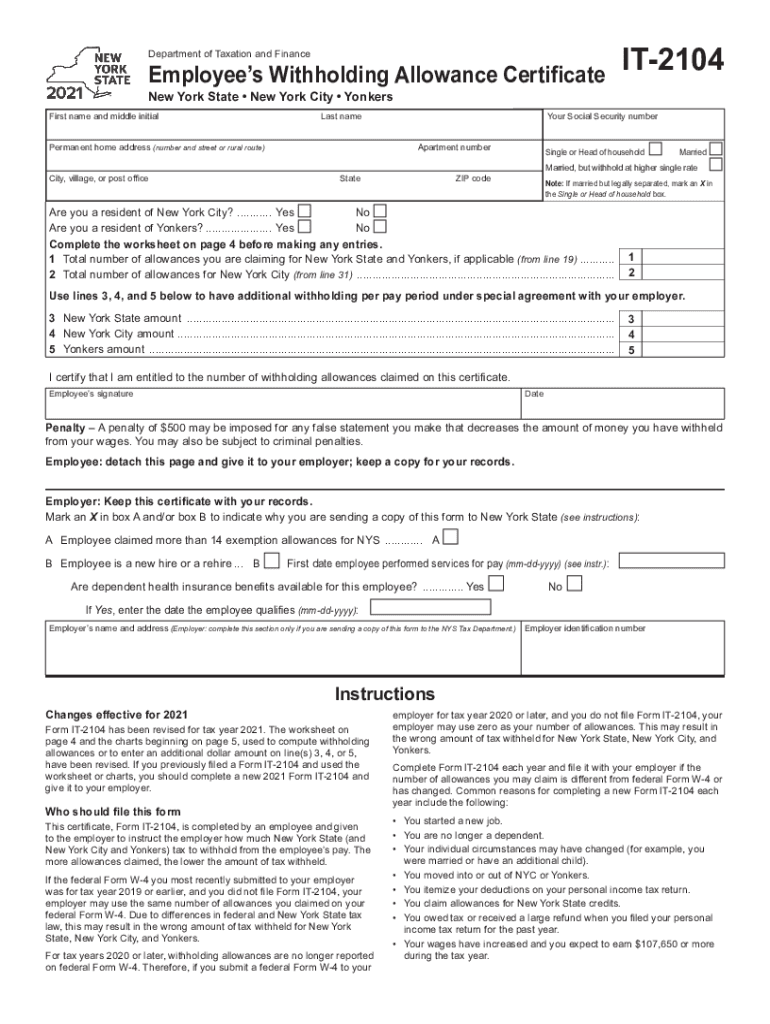

The 2019 NYS IT-2104 form is the New York State Employee's Withholding Allowance Certificate. This form is essential for employees to inform their employers about the number of allowances they are claiming for state income tax withholding purposes. The number of allowances directly affects the amount of tax withheld from an employee's paycheck, making it crucial for accurate tax planning and compliance.

Steps to Complete the 2019 NYS IT-2104 Form

Completing the 2019 NYS IT-2104 form involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate the number of allowances you are eligible for based on your personal situation, such as dependents or other tax credits.

- Additional Withholding: If you want additional amounts withheld, specify the dollar amount in the designated section.

- Signature: Sign and date the form to validate your information.

Legal Use of the 2019 NYS IT-2104 Form

The 2019 NYS IT-2104 form is legally binding once signed and submitted to your employer. It ensures that the correct amount of state income tax is withheld from your paychecks throughout the year. Employers are required to keep this form on file as part of their payroll records, ensuring compliance with New York State tax regulations.

Filing Deadlines for the 2019 NYS IT-2104 Form

While the 2019 NYS IT-2104 form does not have a specific filing deadline, it should be submitted to your employer as soon as you start a new job or experience a change in your tax situation. This ensures that the correct withholding amount is applied to your paychecks from the beginning of your employment or after the change.

Who Issues the 2019 NYS IT-2104 Form

The 2019 NYS IT-2104 form is issued by the New York State Department of Taxation and Finance. This department is responsible for administering state tax laws and ensuring compliance among taxpayers. The form is available online for download and can also be obtained from your employer's human resources department.

Required Documents for the 2019 NYS IT-2104 Form

To accurately complete the 2019 NYS IT-2104 form, you may need the following documents:

- Previous Year’s Tax Return: This can help determine your filing status and the number of allowances.

- Pay Stubs: Current pay stubs can provide insight into your current withholding and help you make adjustments.

- Dependent Information: If you have dependents, gather their Social Security numbers and other relevant details.

Taxpayer Scenarios for the 2019 NYS IT-2104 Form

Different taxpayer scenarios can affect how you fill out the 2019 NYS IT-2104 form. For example:

- Single Individuals: May claim fewer allowances compared to those with dependents.

- Married Couples: Often can claim more allowances, but should consider their combined income.

- Parents: May qualify for additional allowances based on the number of dependents.

Quick guide on how to complete fillable michigan department of treasury 518 rev 02 18

Complete Fillable Michigan Department Of Treasury 518 Rev 02 18 seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without delays. Handle Fillable Michigan Department Of Treasury 518 Rev 02 18 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Fillable Michigan Department Of Treasury 518 Rev 02 18 effortlessly

- Obtain Fillable Michigan Department Of Treasury 518 Rev 02 18 and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your papers or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searches, or mistakes that require reprinting new document versions. airSlate SignNow meets all your document management needs in just a few clicks from the device of your preference. Edit and eSign Fillable Michigan Department Of Treasury 518 Rev 02 18 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable michigan department of treasury 518 rev 02 18

Create this form in 5 minutes!

How to create an eSignature for the fillable michigan department of treasury 518 rev 02 18

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the importance of the 2019 nys regulations for eSignatures?

The 2019 nys regulations established a legal framework for electronic signatures in New York, ensuring their validity in legal matters. Understanding these regulations is crucial for businesses using eSignatures, like airSlate SignNow, to remain compliant. This makes it easier for organizations to adopt digital workflows without legal concerns.

-

How does airSlate SignNow comply with 2019 nys regulations?

airSlate SignNow adheres to the 2019 nys regulations by implementing secure and compliant eSignature solutions. Our platform ensures that all signed documents meet legal standards, giving users confidence in their digital transactions. This compliance is essential for businesses operating in New York to maintain trust and avoid legal issues.

-

What features does airSlate SignNow offer that are beneficial under the 2019 nys guidelines?

Under the 2019 nys guidelines, airSlate SignNow offers features like secure document storage, customizable workflows, and robust audit trails. These features help businesses manage and track their eSignatures efficiently while ensuring compliance. This not only streamlines operations but also protects against potential legal discrepancies.

-

Is airSlate SignNow a cost-effective solution for businesses following 2019 nys standards?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses navigating the 2019 nys standards. With various pricing plans, companies can choose a package that best fits their needs without compromising on security or compliance. Our affordable options make it easy for any organization to implement eSignatures.

-

Can airSlate SignNow integrate with other software under the 2019 nys requirements?

Absolutely! airSlate SignNow offers integration capabilities with various software under the 2019 nys requirements. This allows businesses to seamlessly incorporate our eSignature solution into their existing systems, enhancing overall efficiency. It ensures that all document processes comply with state regulations while optimizing workflow.

-

What benefits can businesses expect when using airSlate SignNow in compliance with 2019 nys?

Using airSlate SignNow in alignment with the 2019 nys compliance provides businesses with enhanced efficiency, security, and legal protection. With automated workflows and digital signatures, companies can reduce turnaround times for contracts and agreements. This ultimately leads to improved customer satisfaction and increased productivity.

-

How can I ensure that my organization follows 2019 nys eSignature guidelines with airSlate SignNow?

To ensure compliance with the 2019 nys eSignature guidelines using airSlate SignNow, familiarize yourself with the platform's security features and audit trails. Regularly train your team on best practices for using eSignatures and stay updated on any changes to state regulations. Our support team is also available to guide you through compliance best practices.

Get more for Fillable Michigan Department Of Treasury 518 Rev 02 18

- Libro completo como dios puede y va a restaurar su matrimonio pdf gratis form

- Inc 20a form download

- Samtrac books pdf form

- Bill nye the atmosphere answers form

- Victorian seniors card application form pdf

- Consent form for sports participation 251616257

- Justice is harmony in dash form

- Skybird credit card authorization form template

Find out other Fillable Michigan Department Of Treasury 518 Rev 02 18

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation