201 D Form 2015

What is the 201 D Form

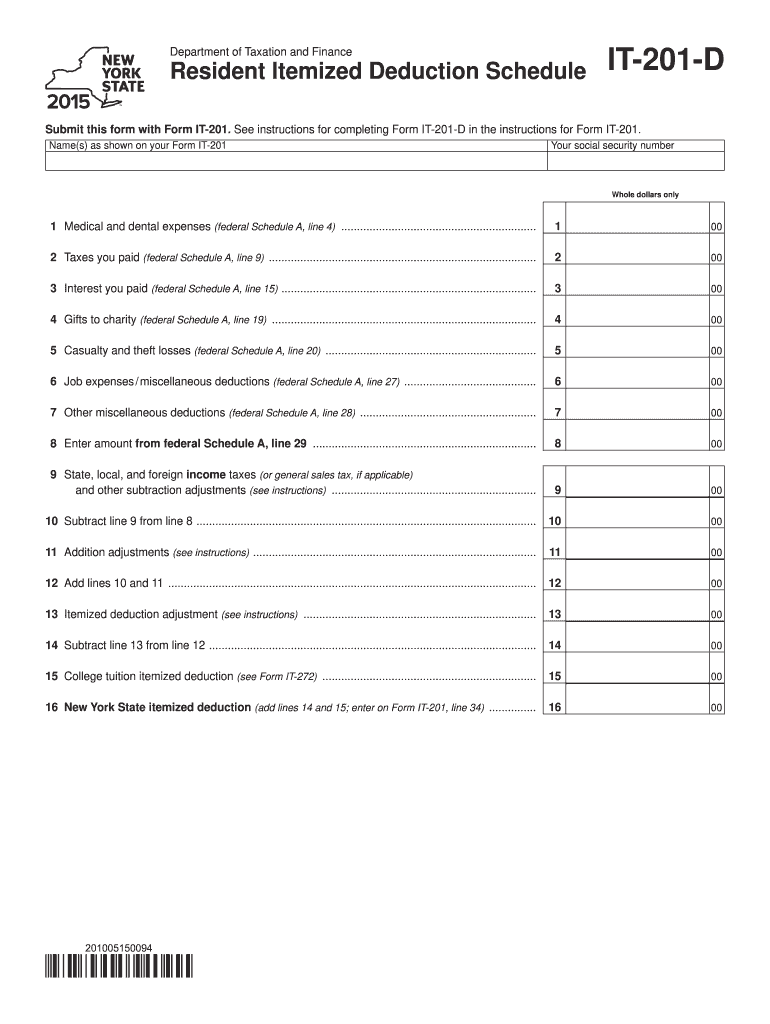

The 201 D Form is a specific tax document used primarily for reporting certain financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form typically includes sections for reporting income, deductions, and other relevant financial data. Understanding the purpose and requirements of the 201 D Form is crucial for effective tax management.

How to use the 201 D Form

Using the 201 D Form involves several key steps to ensure accurate and compliant reporting. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors or omissions. Finally, submit the form electronically or via mail as per IRS guidelines. Utilizing a reliable eSignature solution can simplify the signing process and enhance document security.

Steps to complete the 201 D Form

Completing the 201 D Form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, including income statements and expense records.

- Access the 201 D Form through the IRS website or a trusted eSignature platform.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the 201 D Form

The legal use of the 201 D Form is governed by IRS regulations. It is important to ensure that the form is filled out truthfully and accurately to avoid penalties. The IRS allows for electronic signatures on this form, which enhances the convenience of filing while maintaining legal validity. Adhering to the guidelines set forth by the IRS is crucial for ensuring that your submission is accepted and processed without issues.

Key elements of the 201 D Form

The 201 D Form contains several key elements that are essential for accurate reporting. These include:

- Identification Information: This section requires personal or business details, including name, address, and tax identification number.

- Income Reporting: Report all sources of income, including wages, interest, and dividends.

- Deductions: Include any eligible deductions that can reduce taxable income.

- Signature Section: A space for the taxpayer's signature, which can be completed electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 201 D Form are crucial for compliance. Generally, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific dates for estimated tax payments if applicable. Keeping track of these important dates helps avoid penalties and ensures timely filing.

Quick guide on how to complete 201 d form 2015

Your assistance manual on how to prepare your 201 D Form

If you are looking to understand how to generate and transmit your 201 D Form, below are several brief guidelines on simplifying tax submission.

To begin, you simply need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that allows you to modify, create, and finalize your income tax paperwork effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and return to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to finalize your 201 D Form in just a few moments:

- Create your account and start working with PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Select Get form to access your 201 D Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding electronic signature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to the recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper form can increase return mistakes and delay refunds. Importantly, before e-filing your taxes, check the IRS website for filing regulations relevant to your state.

Create this form in 5 minutes or less

Find and fill out the correct 201 d form 2015

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill up form for SNAP 2015?

Hey! Firstly I do hope that you know all about the SNAP as then you will be better prepared for the examination. The SNAP 2015 Application Form for the examination is completely online and is done in two stages namely the test registration and the registration to the individual colleges post the examination. In the linked article you will get the complee process of applying online. Good luck!

-

What is the link for filling out the CAT 2015 form?

CAT 2014

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

What is last date for filling out an application form for the MH MBA CET 2015?

Pramesh Shrivastava Does Glocal provide long distance MBA as well. Any update would be really appreciated.

-

How do you convert your CGPA into a percentage when doing graduation from Mumbai University and filling out the CAT 2015 form?

There was unfortunately no conversion formula as far I know (I passed out last year so not sure if they introduced it this year). Even I faced a lot of problems because of this. I just calculated the percentage from my marks. Maybe you could do the same and later if they ask you could explain this. As everyone with more than equal to 70% in all subjects gets an O irrespective of whether he/she scores 70% or 90%, there is no way out unless you contact the University, which I dont think will benefit much. Anyways, all the best.

-

I am 2015 batch passed out with computer science in B.E. so may I fill the AMCAT form?

Yes! You definitely can.I too wrote my AMCAT exam last year (August 2015). I'm graduated in 2015 as well.But my suggestion to you - write AMCAT; but don't expect companies which offer CTC above 6LPA. If at all such companies do appear, they usually expect you to have 2+ years of experience.If you can prepare well, then you can try eLitmus. It's much, much better than AMCAT.Good luck!

Create this form in 5 minutes!

How to create an eSignature for the 201 d form 2015

How to make an eSignature for your 201 D Form 2015 online

How to make an electronic signature for the 201 D Form 2015 in Google Chrome

How to generate an electronic signature for putting it on the 201 D Form 2015 in Gmail

How to generate an eSignature for the 201 D Form 2015 from your smartphone

How to make an electronic signature for the 201 D Form 2015 on iOS devices

How to create an eSignature for the 201 D Form 2015 on Android OS

People also ask

-

What is a 201 D Form and why is it important?

The 201 D Form is a specific document used for various regulatory and compliance purposes, particularly in business transactions. Understanding the 201 D Form is crucial for ensuring compliance and maintaining accurate records in your organization. With airSlate SignNow, you can easily create, send, and eSign the 201 D Form, streamlining your documentation process.

-

How can airSlate SignNow help with the 201 D Form?

airSlate SignNow provides a user-friendly platform to create and manage your 201 D Form efficiently. You can customize the form, automate workflows, and securely eSign documents, saving you time and effort. This ensures that your 201 D Form is handled with precision and meets all necessary compliance requirements.

-

Is there a cost to use airSlate SignNow for the 201 D Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you require basic features for the 201 D Form or advanced functionalities, our pricing is designed to be cost-effective. You can start with a free trial to see how airSlate SignNow can enhance your document management.

-

What features does airSlate SignNow offer for managing the 201 D Form?

airSlate SignNow includes features such as document templates, automated reminders, and secure cloud storage, specifically designed for handling the 201 D Form. Additionally, eSignature capabilities ensure that your form is signed quickly and legally, making it an all-in-one solution for your documentation needs.

-

Can I integrate airSlate SignNow with other software for the 201 D Form?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various software applications, allowing you to manage the 201 D Form alongside your existing tools. Popular integrations include CRM systems and project management software, which enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 201 D Form?

Using airSlate SignNow for the 201 D Form offers numerous benefits, including enhanced security, faster turnaround times, and improved collaboration. By digitizing your documentation process, you can reduce errors and ensure that all parties have access to the latest version of the 201 D Form.

-

Is airSlate SignNow compliant with legal standards for the 201 D Form?

Yes, airSlate SignNow complies with legal standards for electronic signatures and document management, ensuring that the 201 D Form is legally binding. Our platform adheres to industry regulations, giving you peace of mind that your documents are secure and valid.

Get more for 201 D Form

Find out other 201 D Form

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form